Nghe An province has developed a strong transportation sector with thousands of vehicles in operation. Despite regulations, many vehicle owners have not declared and paid taxes, making it difficult to control transportation tax revenue.

In recent years, transportation business activities in Nghe An have been increasingly developed, helping the circulation and transportation of goods and passengers to be carried out quickly and conveniently. Sugar, tea, cement, milk, construction material factories, and commercial activities in particular... want to bring goods to consumers and need transportation. However, tax management for this activity is facing many difficulties, especially for the management of automobile transportation business households. Some transportation business households do not declare and pay taxes in accordance with the provisions of the Law on Tax Management, leading to increasing tax debts. Coordination between levels and sectors in managing transportation business activities is not very effective and lacks synchronization.

In Quynh Luu district - Nghe An, there are currently thousands of private transport vehicles. Recently, the local government and related forces have propagated and required vehicle owners to pay taxes in full. However, there is still a situation of intentional tax evasion, causing loss of transport tax revenue.

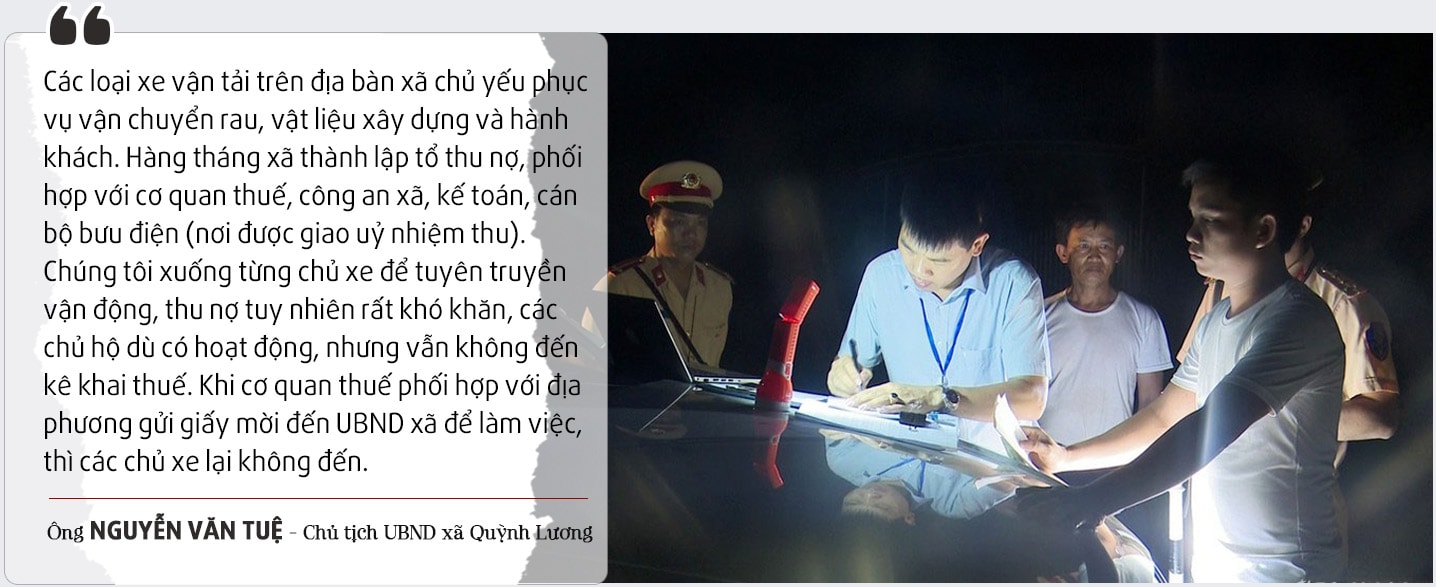

Typically, in Quynh Luong commune, the whole commune has over 60 means of transport, of which 40 vehicles are in debt to transport business tax. As of the end of March 2022, transport business households in Quynh Luong commune still owe over 1 billion VND in tax, of which the amount of tax that is difficult to collect is over 400 million VND.

According to a report from the Bac Nghe I Tax Department (which manages tax collection in Quynh Luu district and Hoang Mai town), the total tax arrears in the transport business sector in the whole district are more than 7 billion VND, of which about 2 billion VND are difficult to collect. Some localities have a large total tax arrears in transport business such as Quynh Chau, Tan Son, Quynh Nghia, Quynh Van communes...

The representative of the Bac Nghe I Tax Department said: The reason why transport tax is difficult to collect is because of taking advantage of the special nature of the transport business which is mobile, many private households do not register their business so they do not have fixed routes and avoid paying taxes. Vehicles have been bought and sold but have not changed their names or registered for tax... The recent difficulties in transport business activities have made the collection of transport tax debts ineffective.

Also in the same situation, the areas of Dien Chau and Yen Thanh districts managed by Bac Nghe II Tax Department have quite vibrant transportation business activities, the whole district has thousands of cars for transportation business, the problem of collecting this tax is very difficult. For example, in Lien Thanh commune, Yen Thanh, there are currently 30 bus companies, the total transportation tax debt is over 800 million VND, the Phuong Dung sleeper bus company alone still owes over 400 million VND in transportation tax...

Mr. Cao Van Thanh - Deputy Head of Bac Nghe II Tax Department said: The Department currently manages over 1,000 transport vehicles in the two districts of Dien Chau and Yen Thanh. Tax collection in this area is very difficult, currently the two localities still owe over 5 billion VND. The reason for the difficulty in collection is due to the lack of compliance of some transport vehicle owners, such as when the tax authority comes to collect the debt, they deliberately avoid it. Enforcing cases of tax debt in transport business is very difficult. When sending documents to collect and verify information, these cases do not have accounts or have accounts but do not transact at commercial banks. Regarding the measure of notifying that invoices are no longer valid, very few transport business households use invoices or buy invoices from tax authorities.

The areas of Do Luong and Thanh Chuong districts managed by Song Lam 1 Tax Department are also in the same situation. These two districts have nearly 1,000 trucks of all kinds, Do Luong district is in arrears of over 300 million VND. Among them, many sleeper bus companies in Do Luong town, Dang Son commune, Giang Son Dong are deliberately evading transportation tax.

Another reason is that since 2005, with the permission of the province, the Tax Department has established a team to inspect the compliance with tax obligations at the Inspection Centers, according to which, when carrying out vehicle inspection procedures before being granted a registration certificate, vehicle owners must be confirmed to have registered and declared to pay taxes. However, since August 30, 2013, the team to inspect the compliance with tax obligations at the Inspection Centers has not been maintained to reduce administrative procedures, the Tax Department no longer has a team to inspect the compliance with tax obligations at the Inspection Centers, so the phenomenon of tax arrears from transportation business activities tends to increase.

In recent years, Nghe An Tax Department has directed and guided the Tax Branch to take steps to enforce tax debt collection against transport business households violating tax laws, but the effectiveness is not high. The reason is that for tax debt enforcement by means of withdrawing money from accounts; by deducting a portion of salary and income; enforcement by means of collecting money and other assets of the subject of enforcement held by other organizations and individuals: When sending documents to collect and verify information, these cases do not have accounts or have accounts but do not transact at commercial banks.

Regarding the measure of notifying that invoices are no longer valid: very few cases of transport business households using invoices or purchasing invoices from tax authorities. With the measure of seizing assets and auctioning seized assets: Determining the type of assets, current address of assets, initial value of assets, current value of assets, determining seized assets and building legal documents to implement this measure encounter many difficulties.

When enforcing by means of property seizure, it causes negative reactions from business households. Regarding the enforcement measure of revoking business registration certificates, business registration certificates or establishment and operation licenses, and practice licenses, due to inconsistent regulations between legal documents on tax and business registration.

Recently, the tax authorities have advised the People's Committees of districts, towns and cities to establish an interdisciplinary team to combat revenue loss and collect transportation tax debts, to propagate, inspect and handle unregistered business households, declare taxes, and have long-term tax debts, but the effectiveness has not been high, because the sanctions to handle these cases are not deterrent enough and lack consistency.

(To be continued)