Pha Danh (Ky Son) is a poor commune, the people's lives still face many difficulties, so policy credit activities at the grassroots level are also very difficult. In that general context, previously, the activities of the Savings and Loan Group in Pieng Pho village faced many difficulties, the compliance awareness of the group members was still low, often overdue debts, high interest, 100% of the group members did not participate in saving. The change started in 2009, when Ms. Xa Thi Vien - a Thai ethnic group took over as the head of the Savings and Loan Group of the village. With the trust and compliance of the group members, the Savings and Loan Group in Pieng Pho village changed rapidly, the quality of management was increasingly improved, by the end of 2010 there were no overdue debts, 100% of the borrowing households paid off all outstanding interest and strictly complied with monthly interest payments, 100% of the households participated in monthly savings. Up to now, the total outstanding loan balance of the group has reached over 2 billion VND, the total savings of the group has reached over 150 million VND. The capital from the Social Policy Bank has helped 16 poor households in the village escape poverty sustainably; some particularly poor households have risen up, have a prosperous life, and become typical households with effective loans for the villagers to learn and follow.

For example, Ms. Luong Thi Huong has a small child, her husband died early from illness, her family is very poor, she borrowed 5 million VND from the program for ethnic minorities with special difficulties to buy a cow, in 2010, she borrowed an additional 30 million VND to increase her herd, up to now, she has a total herd of over 20 cows, built a new spacious house, becoming a household with good economic conditions in the village. Or the case of Ms. Lo Thi Lan, one of the poorest households in the village, borrowed capital from the program for poor households, then the program for production and business households in difficult areas, she has now escaped poverty, is investing in raising livestock, providing broilers and breeding chickens effectively.

Going to Chau Binh commune, Quy Chau district - a commune in a particularly difficult situation, here are mainly people from the lowlands migrating to build a new economic zone. Recalling the first days of "starting a business", Ms. To Thi Huong in Quynh 2 village, Chau Binh commune said: My family is a poor household in the village with 5 members; 2 husband and wife are the main laborers and 3 children are of school age. In early 2016, while difficulties were piling up, the family's meals were sometimes hungry, sometimes full, fortunately I was admitted to the Savings and Loan Group and was considered to borrow capital from the District Social Policy Bank with an amount of 25 million VND from the housing loan program for the poor. Thanks to that, my family repaired the temporary house to have a place to settle down. After that, her family continued to borrow capital to raise buffaloes and cows, dig ponds to raise fish and plant forests.

Up to now, Ms. Huong's family has escaped poverty and become a well-off household in the commune and district. The development of livestock farming and production and business activities has helped her family have enough conditions to take care of their children's education. In particular, the eldest daughter is an excellent student of the province and is currently continuing to study at Quy Chau High School. "To have what I have today is truly a dream, a dream that I never dreamed of before. Among them, the Social Policy Bank of Quy Chau district, the women's union officials of Chau Binh commune and the savings and loan group in the village where I live are the people who have made great contributions - accompanying and supporting my family's dream to become a reality" - Ms. Huong shared.

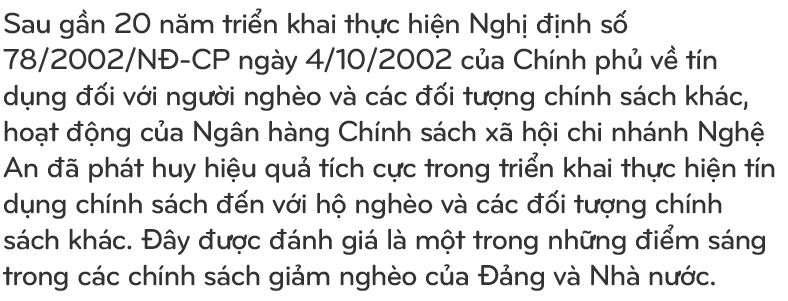

Up to now, it is difficult to count how many examples of overcoming difficulties to rise up, how many students have money to pursue their studies, how many warm houses have been built from policy credit capital... That result is thanks to the support capital, a suitable organizational model, along with a network of transaction points spread throughout the province down to the communes and the system of Savings and Loan Groups in villages and hamlets is considered as the "extended arm" of the Social Policy Bank in implementing policy credit. With a creative method of operation through entrusting some work stages to 04 socio-political organizations, connecting with the network of savings and loan groups up to 100% of villages and hamlets and organizing transactions at the commune level; social policy credit activities in Nghe An have been actively participated by the entire political system, ensuring publicity and democracy.

For example, in Do Luong district, socio-political organizations entrusted with lending in the area have done a good job of entrusting and managing policy credit capital, thereby helping thousands of subjects in need of loans to access preferential capital as quickly as possible. The Youth Union of Giang Son Tay commune is considered the unit that best performs the task of entrusting loans. Currently, the total outstanding debt under management is 4.5 billion VND with 85 borrowers still having outstanding debt at 2 loan groups. Thanks to preferential capital, after 15 years of operation since the separation of Giang Son commune into 2 communes Giang Son Dong and Giang Son Tay, the commune-level entrusting units have helped over 400 households escape poverty, of which over 150 households managed by the Youth Union have escaped poverty. To help poor households use capital effectively, the Youth Union attaches great importance to guiding loan households on livestock breeding techniques, production, and business knowledge. Every year, the Commune Youth Union coordinates with the Department of Agriculture to organize the transfer of science and technology according to the season or each type of crop, livestock, production and business type to help poor households and policy beneficiaries understand scientific and technical advances to apply in practice. After 15 years of implementing the entrusted lending activities from the loan capital of the Social Policy Bank since the separation of the commune, the Commune Youth Union has helped hundreds of households escape poverty, contributing positively to the socio-economic development, the commune was recognized by the Provincial People's Committee as meeting the new rural standards in 2021.

The capital of policy credit programs has had great power, affecting many aspects of social life. Mr. Tran Khac Hung - Director of the Provincial Social Policy Bank said: "The journey of the past 20 years in Nghe An has affirmed the suitability and timeliness in implementing policy credit programs, which has increased the efficiency of capital sources; the responsibility and determination of those participating in the policy credit flow have turned small capital into a driving force for the poor and policy beneficiaries to rise up and take control of their lives. Policy credit has made an important contribution to the achievements of economic development, the goal of sustainable poverty reduction, ensuring social security and building new rural areas of the province".

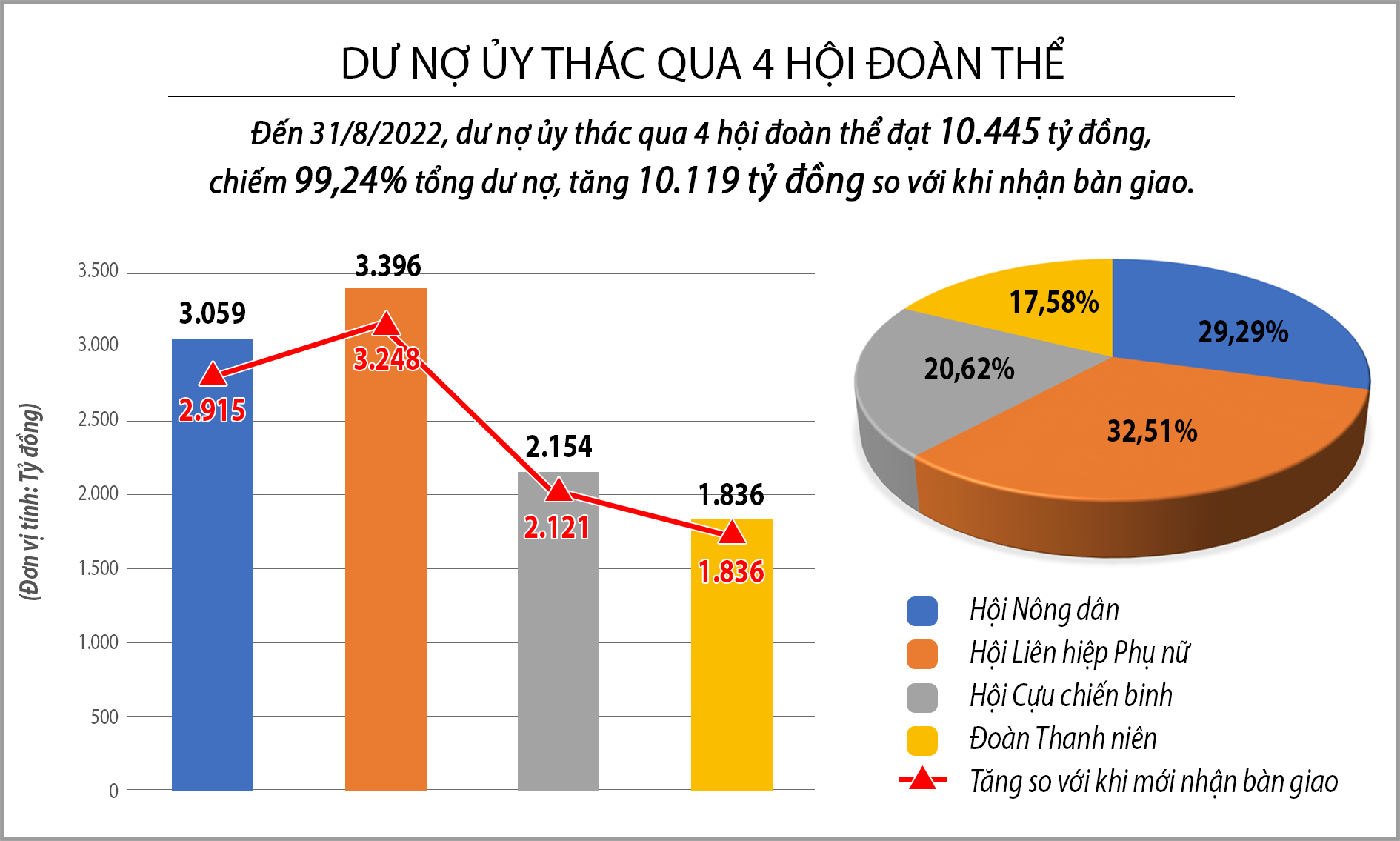

From the first three credit programs, Nghe An Bank for Social Policies has so far deployed 22 credit programs. The 20-year loan turnover reached VND 32,451 billion with 1,280,000 poor households and policy beneficiaries receiving loans. The total outstanding debt as of August 31, 2022 reached VND 10,524 billion, an increase of VND 10,217 billion compared to the time of establishment (an increase of 34.31 times), with 277,800 customers still having outstanding loans. Of which, the poor household loan program has the highest 20-year loan turnover, reaching VND 8,284 billion, with over 294,400 poor households borrowing capital. This is followed by the near-poor household loan and poverty reduction loan programs. Nghe An is also the locality with the largest outstanding debt of the Student Loan Program in the country: over the past 20 years, the loan turnover has been 4,475 billion VND with more than 250,000 households borrowing capital for 625,000 students to go to school. The outstanding debt as of August 31, 2022 is 285 billion VND, accounting for 2.71% of the total outstanding debt, with 8,040 households borrowing capital.

Comrade Le Hong Vinh - Member of the Provincial Party Standing Committee, Permanent Vice Chairman of the Provincial People's Committee, Head of the Board of Directors of the Provincial Social Policy Bank assessed that the 20-year journey of implementing credit for the poor and other policy subjects according to Decree No. 78/2002/ND-CP is not long but has achieved great results and significance. Along with the integration of national target programs, the poverty rate of Nghe An from 2002 was 14.79% to now has decreased to 2.74% (according to the old standard). The province has resolutely implemented credit programs, with ways to achieve the highest efficiency. The province also took advantage of large capital sources from the Central Government combined with assigning specific targets to districts, cities and towns for implementation. By June 30, 2022, local budget capital transferred to the Social Policy Bank for loans to poor households and other policy beneficiaries was VND 235.2 billion.

“Promoting the achieved results, in the coming time, the Provincial People's Committee will continue to direct all levels and sectors to coordinate with the Provincial Social Policy Bank to effectively implement preferential credit programs; closely manage and monitor this capital source; better implement the contents of Directive 40 and Conclusion 06 of the Party Central Committee Secretariat on strengthening the Party's leadership on policy credit; at the same time, focus on mobilizing maximum resources to meet the capital needs of poor households and policy beneficiaries. The province will also study and gradually increase capital sources from the local budget to implement projects on poverty reduction and job creation for workers, in order to accelerate the pace of poverty reduction and ensure social security in the area" - Comrade Le Hong Vinh emphasized.