Information that another enterprise operating in the mineral sector in Quy Hop district was charged with billions of dong in resource tax and environmental fees came to Nghe An Newspaper before the Lunar New Year of Nham Dan 2022.

At this time, the informant said that the enterprise that was charged with additional natural resource tax and environmental protection fees was Trung Nguyen Nghe An Minerals Company Limited. The act of "inflating" the declaration of natural resource tax and environmental protection fees of this enterprise was discovered by an interdisciplinary inspection team established under Decision No. 3892/QD-UBND of the Provincial People's Committee (Interdisciplinary Team 3892 - PV). "After Dong Tien Joint Stock Company, this is the second enterprise to be charged with additional taxes and fees..." - the informant said. Contacting Trung Nguyen Nghe An Minerals Company Limited, the leader of this enterprise confirmed, but did not announce the amount of money to be charged. Asked about the reason for the additional tax, the general exchange was: "Because the enterprise did not fully understand the tax law, it declared incorrectly". However, the leader "revealed" that in 2020, the company was "inspected" by the Tax authority for its compliance with tax obligations...

According to the above information, it is known that through the inspection of the Interdisciplinary Team 3892, Trung Nguyen Nghe An Minerals Company Limited was charged a total of more than 1 billion 273 million VND. Of which, the resource tax was charged more than 1 billion 46 million VND (in 2020, it was charged more than 776.9 million VND; in the first 9 months of 2021, it was charged 270 million VND); environmental protection fee was charged more than 87 million VND (in 2020, it was charged 11 million VND; in the first 9 months of 2021, it was charged more than 76 million VND); corporate income tax in 2020 was charged more than 139 million VND. In addition, Trung Nguyen Nghe An Minerals Company Limited was also recorded as an administrative violation and transferred to a competent person to handle administrative violations for the violation of not classifying workers according to the provisions of Article 22 of the Law on Labor Safety and Hygiene 2015.

Regarding the reason for the collection of resource tax, it was clarified that Trung Nguyen Nghe An Minerals Company Limited under-declared the taxable output (converted from tons to m).3not in accordance with regulations); also leads to the collection of environmental fees, due to not declaring the feeable output of excavated soil and rock and under-declaring the feeable output of minerals!

Is it true that in 2020, Trung Nguyen Nghe An Minerals Company Limited was "inspected" by the tax authority for its compliance with tax obligations? Upon investigation, it was found that the "revelation" of this company's leader before the 2022 Lunar New Year was true. Specifically, in 2020, Trung Nguyen Nghe An Minerals Company Limited was inspected by the Tax Department for its compliance with tax laws according to Decision No. 670/QD-CT dated April 28, 2020. After that, the Tax Department handled the collection, administrative fines and late payment fees with a total amount of VND 239,711,981.

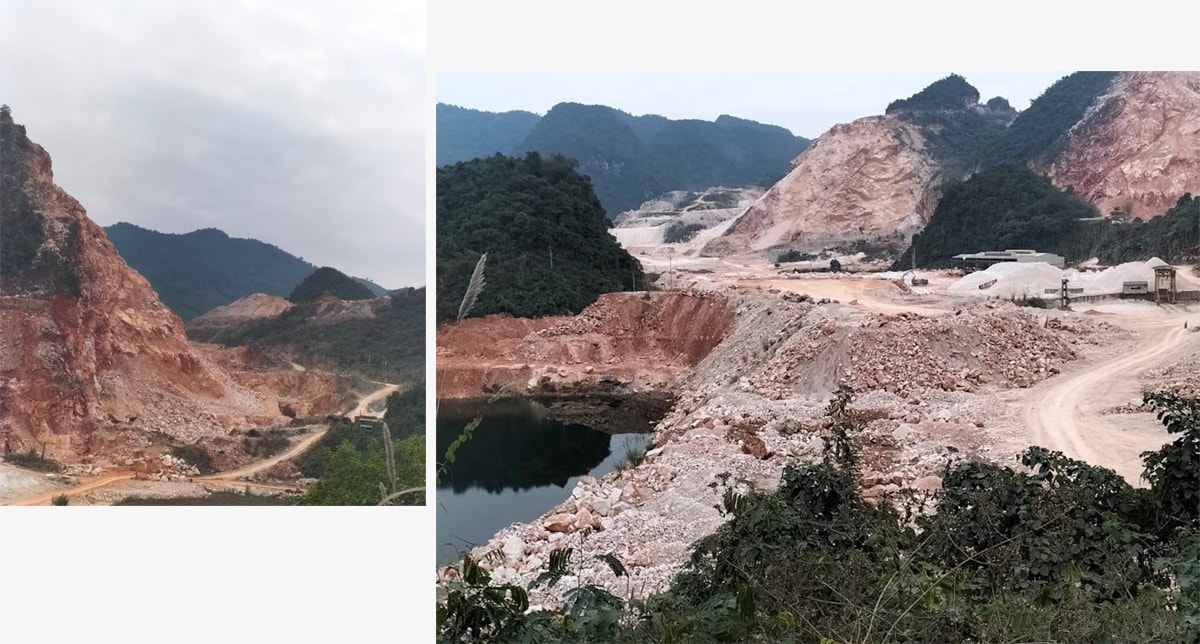

According to Decision No. 3892/QD-UBND of the Provincial People's Committee, the inspection period for compliance with the law of mineral enterprises in the province is from January 2018 to September 2021. Why did the Interdisciplinary Team 3892 only inspect Trung Nguyen Nghe An Minerals Company Limited from January 1, 2020 to September 2021? The answer is: Trung Nguyen Nghe An Minerals Company Limited was granted Mineral Exploitation License No. 3045/GP-BTNMT by the Ministry of Natural Resources and Environment on October 5, 2018; the mine location is in Thung Nam and Thung Heo, Chau Cuong commune, Quy Hop district. In 2019, this enterprise exploited 73,724 tons of marble to make calcium carbonate powder. However, because in 2020, Trung Nguyen Nghe An Minerals Company Limited was inspected by the Tax Department, the Interdisciplinary Team 3892 only conducted the inspection during the period from January 1, 2020 to September 2021!

Also near the Lunar New Year of Nham Dan 2022, Nghe An Newspaper received information that in 2021, a provincial agency inspected tax data implemented at Invecom Quy Hop Company Limited, fiscal year 2020. It was then discovered that this enterprise used the conversion coefficient of exploited white marble output from tons to m3to calculate resource tax incorrectly.

Verifying the source, in 2021, the Provincial Inspectorate, a "provincial agency", inspected and compared tax data implemented at Invecom Quy Hop Company Limited, fiscal year 2020. This content was conveyed by the Provincial Inspectorate in Conclusion No. 19/KL-TTr dated November 29, 2021 "Conclusion of the inspection of budget management and operation in Quy Hop district in 2020". Accordingly, in 2020, the volume of raw stone exploited by Invecom Quy Hop Company Limited to process boulders to produce carbonate powder was 247,440.42 tons. The volume of boulders sold during the period was 281,023.46 tons (of which 34,354.29 tons were goods sent for sale without recorded revenue, the remaining 246,669.17 tons had recorded revenue). The volume of white marble used to produce carbonate powder declared for resource tax is 91,466.6m33.

Through checking and comparing, it was found that Invecom Quy Hop Company Limited is using the conversion coefficient from ton unit to m unit.3is 2.7 (2.7 tons = 1m3) for the exploited stone output to calculate the resource tax payable, applied from the start of exploitation until the end of 2020. However, according to Decision No. 39/2017/QD-UBND dated April 1, 2017 of the Provincial People's Committee, the conversion rate of raw stone to calculate environmental protection fees is 1.7 tons = 1 m3(effective from April 10, 2017); according to Decision No. 22/2020/QD-UBND dated August 24, 2020 of the Provincial People's Committee, the conversion rate of white marble to calculate resource tax when converting from tons to m3is 1.6 (1.6 tons = 1m3), effective from September 7, 2020.

The provincial inspectorate assessed that Invecom Quy Hop Company Limited used the conversion coefficient of 2.7 tons of white marble (rutilated stone) equal to 1m3The conversion ratio used to calculate resource tax using white marble is not consistent with the specific gravity of the actual carbonate powder used for white marble and is not consistent with the conversion ratio used to calculate resource tax as prescribed by the competent authority, the Provincial People's Committee. From here, in Conclusion No. 19/KL-TTr dated November 29, 2021, the Provincial Inspectorate concluded that the use of the above conversion coefficient by Invecom Quy Hop Company Limited to calculate resource tax is "at risk of resource tax loss in the exploitation of white marble minerals".

Invecom Quy Hop Company Limited was granted a Mineral Exploitation License by the Ministry of Natural Resources and Environment on June 30, 2011. Therefore, when asked a Provincial Inspector (participating in the inspection of budget management and administration in Quy Hop district), it was discovered that Invecom Quy Hop Company Limited used the mineral output conversion coefficient to calculate resource tax incorrectly in 2020. Why didn't the Provincial Inspectorate check the tax data implemented at this company in previous years? The answer received was: The mission of the delegation is to check the budget management and administration in Quy Hop district, the inspection year is 2020. Moreover, it must be said frankly that it is very difficult to approach mineral enterprises to check their compliance with tax laws. With what was inspected and discovered, in Conclusion No. 19/KL-TTr dated November 29, 2021, the Provincial Inspectorate fully reported for the Provincial People's Committee to consider and direct handling...