Gold jewelry export tax will be reduced to 1%

The Ministry of Finance also plans to reduce export tax on some other gold products by 1-2% regardless of gold content. The Ministry of Finance has just announced a draft Circular amending regulations on export tax on gold products.

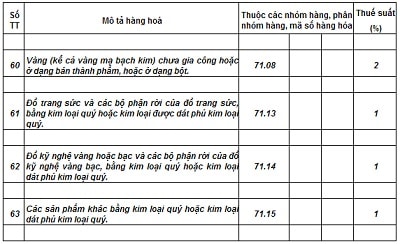

Accordingly, export tax for some gold products will change compared to the current level. Notably, export tax will be applied to a group of products regardless of gold content as before.

Specifically, gold products (including platinum-plated gold) that are unprocessed or in semi-finished form, or in powder form will be subject to an export tax of 2%. According to current regulations, the export tax on gold with a content of less than 99.99% is 10%; other types are 0%.

Other products including jewelry and parts thereof, of precious metal or metal clad with precious metal, are also expected to be reduced to 1%. The current rate for this item with a gold content of 80% or more is 10%; for other types, 0%.

Similarly, the following items include: gold or silver industry articles and separate parts of gold or silver industry articles, made of precious metal or metal clad with precious metal and other products made of precious metal will only be subject to an export tax of 1%. The export tax rate currently applied to this group of items with a gold content of 80% or more is 10%; other types are 0%.

The new draft circular of the Ministry of Finance also removes the regulation that in addition to the general customs dossier, there must be a gold content appraisal certificate for some goods in the above groups that are subject to a 0% export tax rate.

New tax schedule announced according to the draft of the Ministry of Finance.

According to many opinions previously given, the old tax rate applied in 2011 is no longer suitable because now there are no more businesses exporting gold in the form of raw jewelry.

Previously, businesses in the Gold Business Association repeatedly proposed reducing the export tax on gold jewelry to 0%, compared to the current rate of 10% due to economic difficulties and very low domestic demand for gold jewelry.

In addition, other countries in the region have reduced export tax rates on gold jewelry and fine arts to 0%, so their gold jewelry industry always achieves high export turnover values, such as in Thailand, where gold jewelry export turnover reaches an average of about 3 billion USD per year.

According to Dan Viet - TH