Prioritize preferential capital sources for poor households

(Baonghean) - By early April 2017, the outstanding loan balance at the Social Policy Bank, Nghe An Branch for 14 programs was 7,000 billion VND with tens of thousands of households having access to capital. Thanks to timely and correct disbursement of capital, many households have been able to invest in production and livestock farming, gradually improving their income and living standards.

Capital efficiency

Led by Mr. Ngo Xuan An - Head of the loan group in hamlet 1, Hung My commune, Hung Nguyen, we visited Mr. Ngo Xuan Suu's family - a poor household in the hamlet. In 2015, Mr. Suu was able to borrow 30 million VND to raise livestock and build barns. From this capital, his family bought buffaloes, raised chickens and pigs to develop the family economy. Mr. Suu said: Being able to borrow policy capital and receive advice and support from sectors and localities on livestock and crop knowledge has given my family more motivation to produce effectively, repaying the debt of 13 million VND. With this momentum, the family hopes to save up to pay off the debt and expand the flock of chickens and buffaloes, quickly escaping poverty.

Ms. Nguyen Thi Hanh's family in the same neighborhood was able to borrow 12 million VND (in 2016) to invest in a clean water system and toilet. Ms. Hanh said that before building a clean water tank, her family had to use unsanitary water. In 2016, with a loan from the district social policy bank, her family invested in pipes, built a tank, installed a filter, and built a toilet. Thanks to the clean water source, we feel secure using it, our health is better, and our house is cleaner...

|

| Poor households in Nam Dan district borrow capital from policy banks to raise cows. Photo: Thu Huyen |

Mr. Le Quang Hieu - Deputy Director of the Transaction Office of Hung Nguyen Social Policy Bank said: In 2016, Hung Nguyen Social Policy Bank had 2,792 poor households and other policy beneficiaries receiving loans to develop rural agriculture and reduce the financial burden for households with students studying at vocational schools. The number of households that improved their lives and escaped poverty in the area was 502. There were 78 families with conditions to develop farm economy to attract labor from the capital source to solve employment, creating new jobs for 78 workers. There were 1,363 households living in rural areas receiving loans to build clean water and environmental sanitation works that met standards. Policy credit capital supported 61 poor households to borrow capital to build houses, build 13 new houses, and repair and upgrade 48 houses.

With simple loan procedures, a wide network combined with instructions on how to use loans suitable to the borrower's ability and conditions, policy bank capital has changed the lives of many poor households and policy beneficiaries. In Dien Chau district, in 2016, 175 billion VND was provided to 6,170 poor households and policy beneficiaries. In the first 4 months of the year, 2,621 policy beneficiaries received loans with a total amount of more than 82 billion VND. Some programs have large outstanding loans such as preferential loans for poor households according to Decree 78/2002 of more than 139 billion VND; loans for near-poor households of more than 159 billion VND; loans for households that have just escaped poverty of nearly 55 billion VND; loans for clean water and rural environmental sanitation of nearly 62 billion VND...

Mr. Lam Quan - Director of the Transaction Office of Dien Chau district said: Policy beneficiaries in the area mainly borrow capital to raise cattle, agricultural production; some coastal areas such as Dien Hung, Dien Van, Dien Hai, Dien Kim, Dien Trung buy fishing gear to catch seafood. According to data from Dien Chau district, the rate of poor households in the district has decreased from 5.3% in 2016 to 3.6% in the first quarter of 2017. Thus, poor households are increasingly narrowing, but thanks to flexible capital sources, transferred in programs, it creates favorable conditions for other policy beneficiaries to meet their needs for loans to develop household economy and stabilize their lives.

Actively disburse capital

Thanks to taking advantage of capital allocated from the Central Government and at the same time promoting capital mobilization at the local level, exceeding the assigned plan target, in recent times, the Nghe An branch of the Social Policy Bank has basically met the demand for loans to develop production and business and serve the essential needs of the lives of poor households and other policy beneficiaries in the area.

|

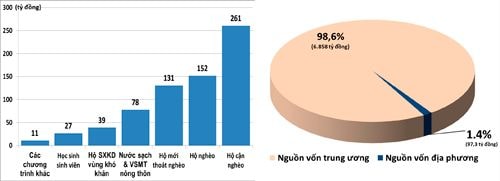

| Some programs with large loan sales in the first quarter of 2017 and capital allocation ratio up to early April 2017. Graphics: Tran Hai |

Mr. Tran Khac Hung - Director of the Provincial Social Policy Bank said: Recently, the bank has advised the provincial Board of Directors to promptly allocate capital transferred by the Central Government to the grassroots level. Thanks to that, the organization of credit program disbursement has been accelerated, avoiding backlogs that cause capital waste. In the first quarter of 2017 alone, the newly transferred growth capital was 310 billion VND and we have completed loan disbursement for the growth target of outstanding debt assigned by the Central Government before March 31, bringing the first quarter loan turnover to 699 billion VND, equal to 136% compared to the same period last year.

In the credit programs, we prioritize capital for poor households. Currently, some programs with large loan turnover are: loans for near-poor households 261 billion VND, poor households 152 billion VND, newly escaped poverty households 131 billion VND, clean water and environmental sanitation in rural areas 78 billion VND, production and business households in difficult areas 39 billion VND, students 27 billion VND. Up to now, the total outstanding debt has reached nearly 7,000 billion VND, an increase of 214 billion VND compared to the beginning of the year, an increase of 3.2%, completing 100% of the plan assigned to the present time.

Along with loan disbursement and credit growth, the Provincial Social Policy Bank has paid attention to improving credit quality, internal audit and inspection as well as transaction activities at the commune level. Up to now, 100% of commune transaction points across the province have been completed and renovated; machinery and equipment have been fully arranged to meet work requirements; the compliance with professional procedures of transaction team staff continues to be closely monitored and supervised.

In addition, the organizations and unions receiving the trust actively directed and implemented the loan evaluation work well to ensure timeliness, publicity, democracy, and correct subjects. At the same time, they guided the documents and procedures for borrowers to receive loans in a thoughtful, convenient, and timely manner. In the first quarter, the disbursement turnover of entrusted capital was 697.3 billion VND, equal to 137% compared to the same period in 2016. In which, the loan turnover of the organizations: Women's Union was 250.9 billion VND, Farmers' Association was 218 billion VND, Veterans Association was 131.5 billion VND and Youth Union was 96.8 billion VND. Through inspection, the associations at all levels assessed and evaluated that the policy credit capital continued to be strictly managed; the evaluation and disbursement of capital were correct for the subjects, borrowers used it for the right purpose, and capital efficiency was promoted.

However, in order for policy loans to continue to play an important role as a resource to help the poor and policy beneficiaries develop production, improve their lives and gradually escape poverty, it is necessary to continue to strengthen the inspection and supervision of entrusted activities for grassroots units; pay attention to inspecting the use of loans to require borrowers to use them for the right purposes and effectively. At the same time, resolutely handle cases of association officials and management board officials of Savings and Credit Groups who embezzle, borrow money, and collect fees. Regularly pay attention to the work of perfecting, rectifying and improving the quality of activities of Savings and Credit Groups; direct commune-level associations to seriously participate in the activities of Savings and Credit Groups to direct and supervise the loan evaluation.

Thu Huyen

| RELATED NEWS |

|---|