Taxes increased, price increased by 400 million VND, pickup trucks 'out of business' to enter Vietnam

The information that the Ministry of Industry and Trade will impose a tax on imported pickup trucks, as recently proposed, has caused confusion among many car importing businesses. If approved by the Government and the National Assembly, the price of pickup trucks will certainly increase sharply, on par with other 9-seat passenger cars.

For example, a Ford Ranger, the lowest version 2.2L, manual transmission, has a selling price ranging from 580 - 600 million VND/car. The price of the highest-end version 3.2L cylinder capacity, automatic transmission, is around 880 million VND/car to nearly 900 million VND/car.

|

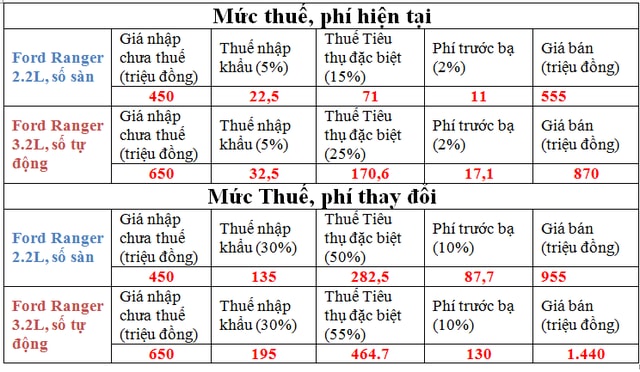

It is possible to do calculations to see clearly that the increase or decrease in tax will have a huge impact on the price of pickup trucks in Vietnam. Specifically, for a new 2.2L, manual transmission car, the declared import price fluctuates around 450 million VND, plus 5% import tax (22.5 million VND), 15% Special Consumption Tax (TTDB) (71 million VND), 2% registration fee (11 million VND), the selling price is around 560 million VND.

|

| Ford Ranger pickup truck prices are taken as an example before and after tax increase (Nguyen Tuyen) |

For the highest-end automatic pickup version, 3.2L cylinder capacity, the import price at the port is about 650 million VND, including 5% tax (32.5 million VND); 25% special consumption tax (170 million VND), 2% registration fee is 17 million VND, the lowest current selling price is 870 million VND, up to 880 million VND.

If the tax rate increases as proposed by the Ministry of Industry and Trade, pickup trucks could see their prices increase by hundreds of millions of dong.

Specifically, for the lowest version of the pickup truck with a capacity of 2.2L, manual transmission, the import price is 450 million VND, will have to add 30% import tax (135 million VND), plus 50% special consumption tax (292.5 million VND, plus 10% registration fee (87.7 million VND), the selling price will be around 960 million VND, an increase of more than 410 million VND compared to the old tax rate.

For the higher-end version 3.2L, automatic transmission, the import price at the port is 650 million VND, must add 30% import tax (195 million VND); 55% special consumption tax (464 million VND) 10% registration fee (130 million VND), the selling price can be up to 1.3 billion VND, an increase of more than 420 million VND compared to the current selling price.

|

In this case, the import tax on pickup trucks will be reduced to 0% starting from 2018 according to the regulation of eliminating common tariffs for exported vehicles originating from ASEAN countries to intra-bloc countries if the localization rate meets 40%.

Pickup trucks with a capacity of less than 2.5L and manual transmission will not be subject to the 30% import tax, only subject to the 50% special consumption tax and 10% registration fee, for the Ford Ranger, the price is over 740 million VND.

As for the high-end version from 3.0L and above, the import tax is also eliminated, but the special consumption tax will increase by 5% each year, starting from 2018 (60%). Thus, with the example of a Ford Ranger with a capacity of 3.2L, automatic transmission, the price is about 1.14 billion VND/car, a price increase of about 30% compared to the current price.

In addition to the Ford Ranger line, the product used in the tax problem that has been imported a lot to Vietnam recently, there are many other pickup truck brands imported to Vietnam, such as Misubishi Triton, Toyota Hilux, Izzu Dmax, Chevrolet Colorado... but they all have similar prices to Ford products.

According to Zing

| RELATED NEWS |

|---|