What deductions do I have to make when I receive my monthly salary?

(Baonghean.vn) - Every month, what amounts do employees need to contribute when receiving their salary?

1. Social insurance:Contribution level = 8% of monthly salary (Based on Article 85 of the Law on Social Insurance 2014)

2. Health insurance:Contribution level = 1.5% of monthly salary (Based on Article 2 of Decree 105/2014/ND-CP, Clause 1, Article 18 of Decision 959/QD-BHXH in 2015)

3. Unemployment insurance:Contribution level = 1% of monthly salary (Based on Clause 1, Article 57 of the 2013 Law on Employment)

4. Union dues(Employees working at non-state enterprises, agencies and organizations - meaning your salary is paid by the enterprise)

Contribution level = 1% of salary (Based on Clause 1, Article 37 of the 2013 Vietnam Trade Union Charter)

|

| Workers at Trung Do Granite Factory pack ceramic tile products. Photo courtesy of Nghe An Newspaper |

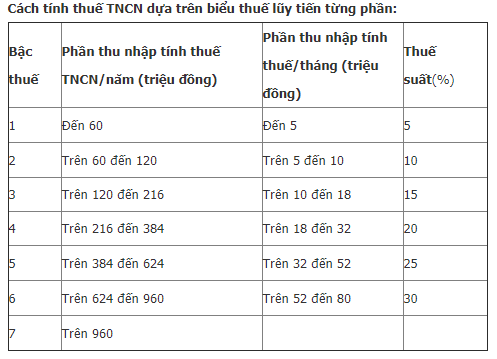

5. Personal income tax

Depending on the salary and wages, whether or not it is necessary to pay personal income tax? Because the income subject to personal income tax is the amount after deducting social insurance, health insurance, unemployment insurance, deductions... and then calculated according to the progressive tax table.

» Nghe An: Collected 229 billion VND from personal income tax

|

In addition, employees must also contribute to the Disaster Prevention Fund every year:

Contribution level = 1 day's salary calculated according to the regional minimum wage.

Employees who are Vietnamese citizens are subject to compulsory social insurance, including: 1.1. Persons working under indefinite-term labor contracts, fixed-term labor contracts, seasonal labor contracts or labor contracts for a specific job with a term of 3 months to less than 12 months, including labor contracts signed between the unit and the legal representative of a person under 15 years old according to the provisions of the law on labor; 1.2. Employees working under a fixed-term labor contract from 01 month to less than 03 months (effective from 01/01/2018); 1.3. Cadres, civil servants and public employees as prescribed by law on cadres, civil servants and public employees; 1.4. Defense workers, police workers, and people working in other key organizations (in cases where the Ministry of Defense Social Insurance and the People's Public Security Social Insurance hand over to provincial Social Insurance); 1.5. Business managers and cooperative executives receive salaries; 1.6. Part-time workers in communes, wards and towns participating in compulsory social insurance into the pension and death fund (implemented from January 1, 2016); 1.7. People working abroad under contracts as prescribed in the Law on Vietnamese workers working abroad under contracts; 1.8. Persons receiving spouse or husband benefits at Vietnamese representative agencies abroad as prescribed in Clause 4, Article 123 of the Law on Social Insurance. 2. Foreign employees working in Vietnam with a work permit or practice certificate or practice license issued by a competent authority of Vietnam (effective from January 1, 2018). 3. Employers participating in compulsory social insurance include: state agencies, public service units, people's armed forces units; political organizations, socio-political organizations, socio-political-professional organizations, socio-professional organizations, other social organizations; foreign agencies, organizations, international organizations operating in Vietnam; enterprises, cooperatives, individual business households, cooperative groups, other organizations and individuals that hire and use labor under labor contracts. |

PV(synthetic)

| RELATED NEWS |

|---|