Mining enterprises 'complain about difficulties' if new tax and fee rates are applied

(Baonghean.vn)- From July 1, Circular No. 44apply new resource tax frameworkof the Ministry of Finance takes effect. Many mining enterprises in Nghe An and Yen Bai are worried and have petitioned the Prime Minister and relevant agencies.

The new tax bracket is too high.

The Association of Small and Medium Enterprises of Quy Hop District (Nghe An) operating in the field of mineral exploitation has just submitted a petition to the Prime Minister and competent authorities reflecting the difficulties in applying Circular No. 44/2017/TT-BTC dated May 12, 2017 of the Ministry of Finance on the new resource tax framework.

Enterprises believe that applying this circular will increase resource tax and mineral exploitation license fees by 3-4 times, causing many difficulties for businesses.

|

| Trung Hai Mineral and Trading Joint Stock Company (Chau Quang) invested in a modern superfine stone powder processing factory worth more than 6 million USD, and has just recruited more than 200 workers to serve the factory, but if the new tax framework is followed, the factory will easily stop production. Photo: Van Truong |

Mr. Nguyen Trung Hai - Chairman of the Board of Directors of Trung Hai Mineral and Trading Joint Stock Company - Nghe An said that the company has just invested in a large-scale, large-capacity superfine stone powder processing factory with the most modern technology today, with a total investment of over 6 million USD, and has just recruited more than 200 workers.

If the Company's mine reaches its licensed capacity, when applying the lowest price bracket according to Circular 44, the company's additional resource tax will be over 18 billion VND, the license fee will increase by about 3.6 billion VND, totaling 21.6 billion VND. With this tax rate, the company will certainly suffer a loss, and the company will have to stop production.

|

| Long Anh Private Enterprise invested in cutting stone with diamond saws from top to bottom at Tho Hop quarry, Quy Hop, but white stone is rare to find, and the poor quality of the quarry is also the reason why it is difficult to sell the product. Photo: Van Truong. |

A representative of An Loc Joint Stock Company in Tho Hop Commune - Quy Hop also shared: The company mainly uses white marble to produce carbonate powder to sell in the Chinese and Malaysian markets. The old tax rate for stone powder is 90,000 VND/m3, now applying the new tax rate from 280,000 - 400,000 VND/m3, we will have a lot of difficulty because we cannot increase the selling price with our partners.

|

| There are still a few stone paving workshops operating in Dong Hop commune, Quy Hop. Photo: Van Truong. |

Mr. Chu Duc Manh, Head of the representative office of Dat Viet Construction and Investment Cooperation Joint Stock Company in Nghe An, said: The company has a quarry in Thung Lo, Thung Diep, bordering Lien Hop and Chau Loc communes. The quarry has an area of 18.76 hectares, granted by the Ministry of Natural Resources and Environment in 2010, with a term of 29 years. The licensed output of cut stone is 2.8 million tons, and boulder stone is 7.2 million tons / 29 years, but in reality, the quarry does not meet the reserve and quality. Mainly boulder stone, only 5 - 10% of finished stone can be exploited. Meanwhile, businesses still have to pay tax for 100%, including unusable stone. Now the tax rate has increased, businesses are struggling.

A representative of Long Anh Private Enterprise, Tho Hop Commune, said: Our company invested in a diamond blade stone saw system that cuts from top to bottom, but it is very rare to find white stone, mainly colored stone, low value. Or if we find a white stone layer, when we cut it, we will know that the stone is not white enough, seamless, and it is cracked and broken, considered completely damaged. The quality of the stone is poor, so we have to turn to producing boulder stone. In recent years, the world market has been picky about consumption, so we have to limit production. The number of workers has gone from over 150 to only over 50. If the new tax rate is applied, we will definitely go bankrupt.

Mr. Nguyen Giang Hoai - Chairman of the Quy Hop Small and Medium Enterprises Association said: There are currently 70 licensed white marble mines nationwide, but only 40% of them are operating, the remaining 60% have to temporarily stop operations due to poor stone quality, too high taxes and fees, which businesses cannot afford. Currently, businesses in this field are trying to pay more than 10 types of taxes and fees. Businesses have reached their limits of endurance because they have to "carry" too many taxes and fees. Meanwhile, Vietnamese businesses have to try very hard to reduce prices to attract customers in the face of fierce competition with countries with the same products, especially China and Malaysia. If taxes and fees are increased according to Circular No. 44, 100% of businesses in this field will face difficulties. |

On the other hand, businesses in Nghe An said that the floor price and ceiling price established in Circular No. 44 are not consistent with the Law on Natural Resources Tax 2009, because the above price range is not the selling price of marble and white marble resources in Nghe An province.

Specifically, Nghe An is currently issuing a tax calculation price of 250,000 VND/m3For boulders. If applied according to Circular 44, the lowest level will be 700,000 VND/m3, 2.8 times higher than present.

Regarding stone powder, Nghe An currently issues a tax and fee rate of 50,000 VND/ton of reserves. If applied according to Circular 44, the lowest rate will be about 164,700 VND/ton, an increase of more than 3 times. "With the current fee rate, we are not collecting enough to cover expenses. If we apply the new rate, it is really unrealistic," Mr. Nguyen Giang Hoai affirmed.

|

| Many stone enterprises in Quy Hop have dissolved due to difficulties in selling their products. (One of the stone cutting workshops of an enterprise in Tho Hop is abandoned). Photo: Van Truong. |

Risk of bad debt of more than 7,000 billion, nearly 29,000 workers losing their jobs

Quy Hop is considered the country's stone export capital. In previous years, mineral activities in Quy Hop were very busy, but at this time, the mining areas in Chau Quang, Chau Hong, Tho Hop... are very gloomy, industrial clusters of machinery and equipment are lying in disarray, a series of businesses have to quit because their products cannot compete with the world.

In reality, the quality of stone in the mines is not high. The recovered output is only 7%, of which more than 2% is paving stone and 5% is stone powder, the rest is waste stone. Some businesses reflect: The licensed reserves are like that, but the amount of stone that must be discarded is dozens of times more than the small amount of finished stone that can be sold. That is not to mention other costs such as transportation costs, and the market fluctuations make operations very difficult.

Some businesses are trying to “hold on” and not daring to sign new contracts because if they have already signed them and fees and taxes increase, the business cannot increase prices for customers. The business will have to “bear” more costs.

|

| Unsold stone products at Thung Khuoc industrial park in Quy Hop town have been left exposed to the elements for many years. Photo: Van Truong. |

Mr. Hoang Van Hai - Director of Hoang Gia Joint Stock Company (Dong Hop Commune) explained: Although paying taxes is the responsibility and obligation of enterprises, if the authorities do not have a solution when applying Circular 44, enterprises can easily close down. The consequences are that many workers lose their jobs, every year they cannot maintain tax revenues for the State, and the company also becomes a bad debt of the bank...

Currently, many mineral workers in Quy Hop area are both working and anxiously following the latest situation of the circular's implementation. A worker of Hoang Gia Joint Stock Company confided: "I have been working in the stone processing industry with the company for more than 7 years, my family's livelihood depends on the worker's salary. Without a job, life will be difficult, because there is no rice field or forest land, I don't know what to do to make ends meet."

Mr. Nguyen Giang Hoai - Chairman of the Quy Hop Small and Medium Enterprises Association added: If the new tax rate is applied, there will be many consequences. Specifically, the total investment in the marble sector in Nghe An and Yen Bai is about 10,800 billion VND and will create 30,500 jobs. Of which, bank loans account for 70%, equivalent to 7,560 billion VND. If applied according to the regulations and price framework in Circular No. 44, it will lead to 95% of enterprises going bankrupt, leading to bad debts of about 7,182 billion VND that are difficult to recover. This will lead to 28,957 direct workers losing their jobs, indirectly affecting 86,925 people, equivalent to about 7,243 households. Unfinished mining areas leave behind environmental risks, labor safety risks and the risk of resource loss due to illegal activities.

Will submit to the Prime Minister for appropriate policies

Faced with that situation, the Quy Hop - Nghe An Small and Medium Enterprises Association and the Luc Yen - Yen Bai White Stone Association have submitted a document requesting the Prime Minister to consider and direct the Ministry of Finance, the General Department of Taxation and competent authorities to consider adjusting the price framework, list, collection level and appropriate calculation method.

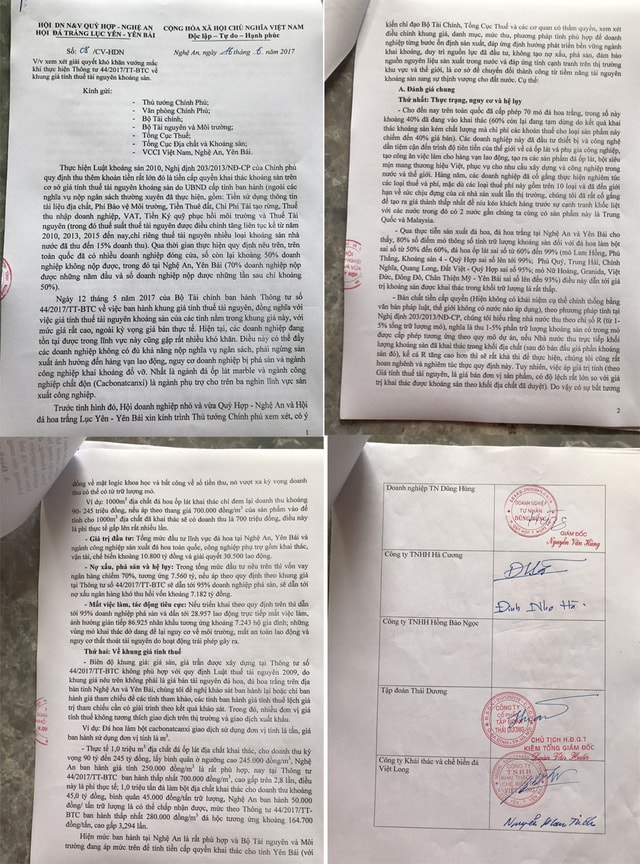

|

| Report to the Prime Minister of the Quy Hop Small and Medium Enterprises Association - Nghe An and the Luc Yen White Stone Association - Yen Bai |

According to the petition of the Association of Small and Medium Enterprises of Quy Hop district, implementing the 2010 Mineral Law, Decree 203/2013/ND-CP of the Government stipulates the collection of a very large additional amount of money, which is the fee for granting mineral exploitation rights based on the price for calculating mineral resource tax issued by the Provincial People's Committee. In addition, enterprises must also fulfill their regular budget payment obligations, including: Fees for using geological information documents, environmental protection fees, land rent, forest regeneration costs, infrastructure construction fees, corporate income tax, VAT, environmental restoration deposits, export tax rates and resource tax (in which the resource tax rate has been adjusted to increase continuously since 2010, 2013, 2015 to present, the state has collected up to 15% of revenue from resource tax on many types of minerals alone). During the implementation of the above regulations, many businesses have closed nationwide, the remaining about 50% of businesses do not pay taxes, including in Nghe An and Yen Bai (70% of businesses pay in the first years and the number of businesses that pay in the following years is only about 50%). |

Mr. Nguyen Dinh Tung - Chairman of Quy Hop District People's Committee said: At this time, mineral mining enterprises, especially white stone in the area, are facing many difficulties. Due to the economic recession, production and business of most enterprises have decreased. Up to now, Quy Hop (227/477 enterprises have stopped production or dissolved, more than 118 enterprises have tax arrears due to large inventories). If taxes are increased according to the new circular, it will be more difficult. The locality also hopes that superiors will have reasonable policies to create favorable conditions for enterprises to operate.

|

| If the new tax framework is implemented, many workers will lose their jobs. Photo taken at the superfine stone powder processing line of Trung Hai Mineral and Trading Joint Stock Company (Chau Quang). Photo: Van Truong. |

Currently, local businesses want the Ministry of Finance and relevant agencies to establish a working group with inter-ministerial, sectoral and local authorities to survey the actual value of the mine, investment rate, profit, employment and get opinions from local specialized agencies.

At the same time, consult with experts in mining economics, geology, finance, and tax to have a solution suitable to the quality characteristics of marble products and marble for producing calcium carbonate powder in Yen Bai, Nghe An and current budget collection regulations.

From there, re-issue the floor price, unit price, classification, group name, resource type for the tax calculation price frame for marble, white marble or apply for reference.

Mr. Le Ngoc Hoa - Vice Chairman of the Provincial People's Committee said: "The province has grasped the existing problems in the implementationCircular No. 44/2017/TT-BTC of the Ministry of Finance "regulating the price framework for calculating resource tax". After receiving the proposal from the Quy Hop Small and Medium Enterprises Association, in a recent business meeting, the Provincial People's Committee assigned the Department of Planning and Investment to summarize the proposed contents to report, the issues within the province's framework, the province will consider supporting. After reviewing the above content, the province will submit to the Prime Ministerhave reasonable policies on new tax frameworks to create favorable conditions for business operations". |

Hai An