Quy Hop direct dialogue with taxpayers

(Baonghean.vn) - On November 14, Quy Hop Tax Department organized the 2nd Tax Policy Training Conference and Dialogue with Taxpayers in 2017.

250 people, including directors, cooperative managers and accountants of local and foreign enterprises with registered tax codes in Quy Hop, participated in the training.

|

| Quy Hop Tax Department staff give guidance on some tax policy contents. Photo: Thu Huong |

During the 1-day course, the trainees were guided by the Quy Hop Tax Department on some contents of implementing Circular No. 06 amending Circular 156 on tax management law; Circular No. 93/2017 amending and supplementing Article 12 of Circular 219; Decision No. 39 on converting environmental protection fees; Circular No. 44 guiding Decree No. 50 on the price framework for calculating resource tax; Circular No. 333/2016 amending and supplementing Circular 77/2014 on collecting land rent, water surface rent... Some contents warn of risks for taxpayers.

The conference spent most of its time on direct dialogue with taxpayers; the tax authority received many questions related to issues such as: tax administrative procedures, tax code registration, receiving tax declarations; purchasing invoices, registering to use self-printed invoices; tax incentives for investment projects, reasonable deductible expenses; settlement procedures for enterprises when splitting, merging, consolidating, dissolving; how to calculate taxes according to newly implemented circulars.

|

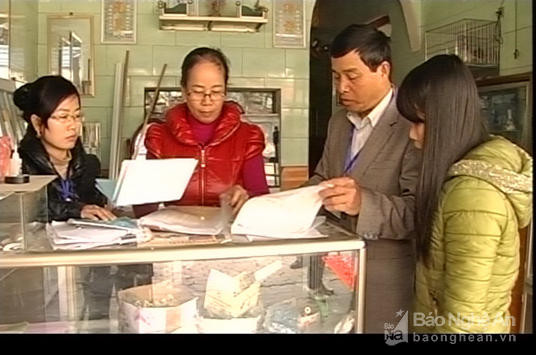

| Quy Hop Tax Branch implements tax collection at business households. Photo: Thu Huong |

On this occasion, 5 enterprises were awarded Certificates of Merit by Nghe An Tax Department for their many achievements in tax payment in 2016.

In 2017, Quy Hop district was assigned to collect 129 billion 400 million VND from the state budget. As of October 31, the district had implemented drastic measures but the total state budget revenue only reached more than 105 billion VND, reaching 81.2% of the ordinance estimate, equal to 95% compared to the same period. It is expected that by the end of 2017, the revenue shortfall will be about 11.4 billion VND compared to the estimate, in which the shortfall will be from resource tax, VAT, other budget revenues, and registration fees. |

Thu Huong