A series of banks increased deposit interest rates to 'follow' U23 Vietnam

A series of banks have increased deposit interest rates to "follow" the heat of U23 Vietnam in the context of a sudden increase in liquidity at the end of the year and the approaching Lunar New Year.

A series of banks increased deposit interest rates.

The “heat” of U23 Vietnam was blown up more than ever when the team excellently overcame the heavyweight opponent Qatar to win the right to play in the final match of the U23 Asian Championship. This is also the first time in history that the Vietnamese team has reached this round.

Immediately after the victory, the name U23 Vietnam was praised in all newspapers, and was a hot topic of discussion in all forums. And many banks also took this opportunity to increase deposit interest rates, attracting deposits in the context of quite tight liquidity in the run-up to Lunar New Year.

|

| A series of banks increased deposit interest rates (Illustration photo: KT) |

Vietnam Prosperity Joint Stock Commercial Bank (VPBank) is the most agile bank in the race to increase interest rates. As soon as U23 Vietnam won on the evening of January 23, this bank immediately announced that it would add 0.23% to the savings interest rate for all customers named Quang Hai and Tien Dung when depositing money at VPBank and all other customers would receive an additional 0.1% to their savings interest rate on January 24.

National Citizen Commercial Joint Stock Bank (NCB) also announced that it would give a maximum of 0.15% on deposit interest rates to all customers who deposit money from January 24, 2018 to January 31, 2018.

Meanwhile, Orient Commercial Bank (OCB) announced a 0.5% interest rate increase for all Korean customers and customers named Hai, Dung, Thanh when making savings deposits from January 24 to January 27.

According to bank representatives, the decision to increase interest rates will ensure that it does not exceed the State Bank's interest rate ceiling of 5.5%/year for terms under 6 months.

Notably, Southeast Asia Commercial Joint Stock Bank (SeABank) announced that it will add an interest rate margin of up to 2.3%/year for the coaching staff, U23 players and relatives when depositing money at SeABank with a term of over 6 months.

At the same time, SeABank added 0.23% to the savings interest rate for all customers named Quang Hai and Tien Dung and customers with the same name as the best U23 Vietnam player in the Final. Notably, this program will last from January 25 until… July 31, 2018.

Kill two birds with one stone!

It is undeniable that the fact that banks "follow" the hot event of U23 Vietnam to increase deposit interest rates for a certain period of time, for certain customer groups, is a rather clever PR trick, demonstrating the banks' agility and keeping up with trends, helping to bring the bank's image closer to the public.

Besides, this also seems to be one of the quite reasonable reasons for banks to launch deposit mobilization programs, in the context of sudden increase in liquidity at the end of the year and the approaching Lunar New Year.

Previously, since the end of November 2017, some banks have also been preparing to increase deposit interest rates.

BIDV is an example. According to the latest interest rate schedule of this bank, VND deposits with terms of 1 month and 2 months will be applied with an interest rate of 4.8%/year, an increase of 0.5% compared to the old interest rate. The interest rate applied to 3-month deposits will be raised from 4.8% to 5.2%/year - equivalent to the previous 6-month term. For deposits with terms of 364 days or more, BIDV bank applies an interest rate of 6.9%/year.

Or at Vietinbank, although the interest rate for terms under 6 months remains the same, the interest rate applied to deposits with terms from 6 to under 9 months has increased from 5.5-5.7% to 5.8%/year; the interest rate applied to deposits with terms from 12 months to under 13 months has increased from 6.5% to 6.8%/year.

Most recently, Sacombank adjusted the interest rate for 2-month and 6-month terms up by 0.2%, to 5.3%/year and 6.2%/year, respectively. The 9-month term increased by 0.4% to 6.4%/year; the 12-month term also increased slightly by 0.1%, to 6.9%/year.

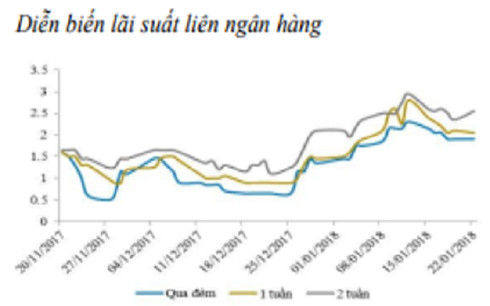

According to a recent report by Bao Viet Securities Corporation (BVSC), the average interbank interest rate last week continued to increase slightly for overnight, 1-week and 2-week terms with an increase range of 0.08% - 0.12%.

|

Specifically, the average overnight interest rate increased by 0.08% to 2.09%/year, the average 1-week interest rate increased by 0.08% to 2.35%/year, and the average 2-week interest rate increased by 0.12% to 2.64%/year.

This is the third consecutive week that interbank interest rates have tended to increase. Previously, in the first week of the new year, interbank interest rates had begun to increase sharply for overnight, 1-week and 2-week terms with an increase range of 0.36% - 0.6%.

In the second week, interest rates for overnight, 1-week and 2-week terms continued to increase with an increase range of 0.43% - 0.64%.