Businesses "bear" three major impacts from minimum wage increase

The Department of Enterprise Development (Ministry of Planning and Investment) has just issued notes on rebuilding payrolls, wages, and insurance types for businesses from 2018.

|

| Raising the minimum wage has three major impacts on businesses. |

According to Decree No. 141 regulating the regional minimum wage for employees working under labor contracts, from 2018, the regional minimum wage applied to employees working at enterprises has been adjusted to increase from 180,000 - 230,000 VND/month depending on the region compared to 2017.

|

In case the enterprise has built a salary scale and payroll lower than the regional minimum wage, it will have to revise the salary scale and payroll; increase the insurance premiums; increase union fees as well as overtime pay for employees.

Accordingly, the Department of Enterprise Development believes that there are three things that businesses need to do:

The first,Rebuild salary scale and payroll: Enterprises must base on the current regional minimum wage to prescribe salary levels for each position, job, and job group in accordance with the principles prescribed by law.

Therefore, when the Government adjusts the regional minimum wage, enterprises are responsible for reviewing, amending and supplementing their salary scales and payrolls accordingly. These amendments and supplements must be consulted with the organization representing the collective of employees at the enterprise and publicly announced at the workplace of the employees before implementation.

After rebuilding the new salary scale and payroll, the enterprise submits it to the Department of Labor, War Invalids and Social Affairs where the headquarters is located.

Monday,increase monthly salary for insurance contributions:The monthly salary stated in the labor contract is the basis for the enterprise to pay insurance, including: social insurance, health insurance, unemployment insurance.

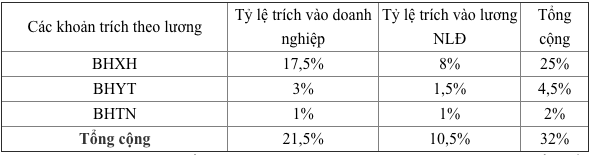

Currently, every month, businesses must pay for employees and deduct from employees' monthly salaries to simultaneously pay into the Social Insurance Fund, health insurance, unemployment insurance..., with a contribution rate of 32%.

|

Therefore, when businesses have to readjust their salary scales and payrolls due to increased regional minimum wages, the insurance premiums also increase accordingly.

Tuesday,Increase union fee payment: Every month, businesses must deduct union fee payment according to regulations at 2% of the salary fund used as the basis for social insurance payment for employees.

The grassroots union must pay this amount to the grassroots union at the higher level and then the higher level union will deduct 68% of the operating costs for the grassroots union and retain 32%.

Thus, when the regional minimum wage increases, of course the 2% union fee payment of enterprises also increases.