Important resources for social security in Nghe An

(Baonghean) - In the first 11 months of 2019, 58,075 poor households and other policy beneficiaries in Nghe An received preferential credit. Policy credit continues to make important contributions to the implementation of poverty reduction goals, new rural construction, and security and political stability in the locality.

Important results

Nghi Loc district is a border area of Vinh city, so there are certain difficulties in mobilizing and lending due to competition with Vinh city and Cua Lo town. Mr. Nguyen Viet Ha - Director of Nghi Loc District Social Policy Bank Transaction Office said: We are currently implementing 14 policy credit programs with a total number of households with outstanding debt in the area of 13,278 households. On average, each household can borrow 29 million VND. The whole district has 462 savings and loan groups, of which 91% are classified as excellent. Regarding the balance of local budget sources, Nghi Loc is among the units with high balances in the province. Implementing the direction of the Provincial People's Committee on assigning budget targets for 2020, the unit has also advised the District People's Committee to assign targets to communes.

|

| Capital disbursement at the transaction point of Nghi Long commune, Nghi Loc. Photo: Viet Phuong |

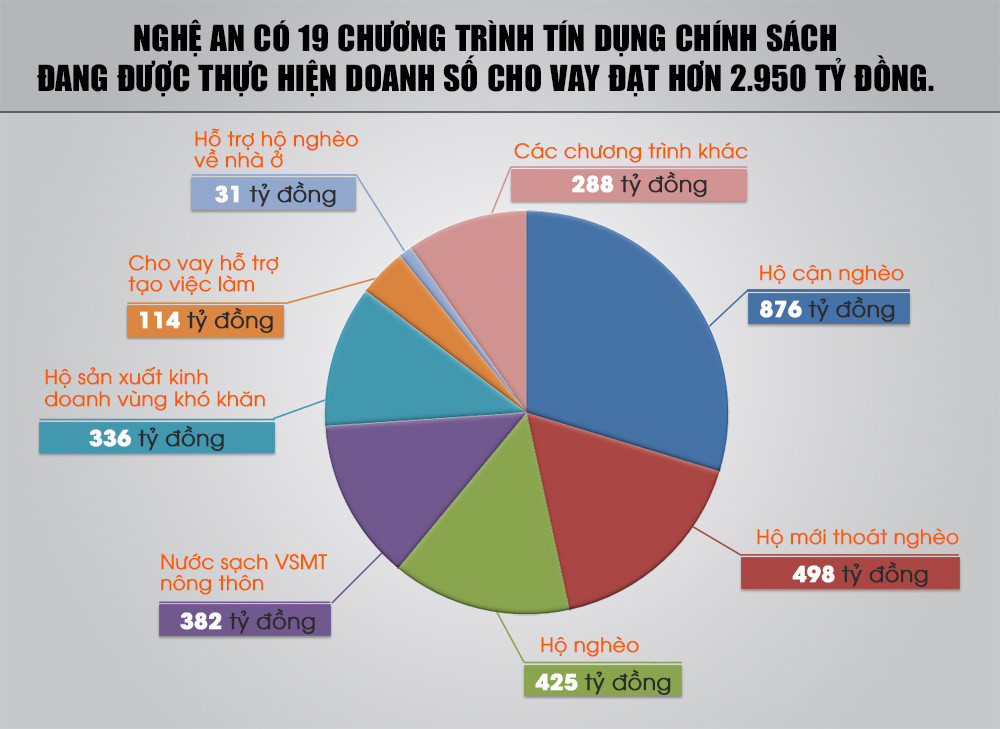

Currently, Nghe An has 19 policy credit programs being implemented in the province with a total capital of over VND 8,280 billion, a growth rate of 6.84%. Loan turnover reached over VND 2,600 billion, mainly focusing on key programs, prioritizing poor, near-poor, newly escaped poverty households, rural and disadvantaged areas. Specifically: Loans to near-poor households VND 876 billion, newly escaped poverty households VND 498 billion, poor households VND 425 billion, clean water and environmental sanitation in rural areas VND 382 billion, production and business households in disadvantaged areas VND 336 billion, loans to support job creation VND 114 billion, housing support for poor households VND 31 billion,...

|

| Graphics: Lam Tung |

At the same time, the policy of lending to increase the maximum loan limit and term for production for poor households, near-poor households, newly escaped-poverty households and ethnic minority households according to Decision No. 12 of the Board of Directors was implemented promptly. The implementation was carried out closely, publicly and transparently. By September 30, the whole province had disbursed VND 4,498 billion to 64 customers who needed to borrow more, had effective production and business plans, and met the lending conditions. Debt collection turnover to date has reached VND 2,070 billion. Good debt collection turnover creates a stable revolving loan source (accounting for 76% of loan turnover), helping the unit proactively source investment capital on the spot, promptly meeting the capital needs of poor households and policy beneficiaries to invest in production and serve essential needs of life.

|

| Loan programs play an important role as a resource to help the poor and policy beneficiaries develop production, improve their lives, and gradually escape poverty. Photo: Viet Phuong |

Continue to improve credit quality

Along with credit growth, the branch pays special attention to improving credit quality, indicators reflecting credit quality are regularly paid attention to and closely monitored. Actively directs grassroots associations and TKVV groups to evaluate loans to ensure transparency and correct subjects; guides the preparation of procedural documents, coordinates with the Bank to organize timely disbursement to each household.

The outstanding loan balance entrusted through socio-political organizations has reached VND8,245 billion so far, accounting for 99.73% of the total outstanding loan balance of the entire branch. The organizations and unions receiving the trust at all levels regularly pay attention to propaganda and mobilization work to help poor households and policy beneficiaries borrow capital to understand the purpose, meaning and methods of saving, thereby actively accumulating to participate in monthly savings deposits through the TKVV group.

Thanks to that, the savings deposit activity has been maintained very stable and increased gradually over time. By September 30, 2019, the accumulated savings deposit balance of poor households and policy beneficiaries was 421.5 billion VND. There are 239,076 poor households and policy beneficiaries participating in savings deposits at 7,506 TKVV groups, with an average savings balance of 1.76 million VND per household.

|

| Anh Son residents use policy loans for economic development. Photo: Viet Phuong |

In recent times, the Board of Directors, together with the internal control system of the Social Policy Bank at all levels and the entrusted associations from the provincial to the district/commune levels, have all stepped up inspection and supervision work to promptly correct existing problems as well as prevent and avoid risks in the process of implementing policy credit at the grassroots level.

Through inspection, the association at all levels assessed and evaluated that policy credit capital sources continued to be strictly managed; the work of evaluating and disbursing capital sources to the right subjects, borrowers used them for the right purposes, and capital efficiency was promoted. Loan capital continued to play an important role as a resource to help the poor and policy subjects develop production, improve their lives and gradually escape poverty.

In the coming time, the Provincial Social Policy Bank will continue to direct the good implementation of Directive No. 29-CT/TU of the Provincial Party Committee and the province's plan in advising local Party committees and authorities to pay attention to allocating resources entrusted to the Social Policy Bank in 2019 to complete the Centrally assigned plan targets. At the same time, direct the District-level Board of Directors' Representative Board to advise the People's Committee to submit to the People's Council of the same level to approve the entrusted budget capital source in 2020; Maximize the exploitation of capital sources from the Central to the local level, continue to submit to the Central Government to supplement capital sources for lending to programs that have completed the plan targets to complete the target of capital growth and outstanding debt in 2019 of at least 7%... Thereby, contributing significantly to the effective implementation of the National Target Program on sustainable poverty reduction, new rural construction, and ensuring social security.

Motivation from credit policy for ethnic minority areas

(Baonghean) - Along with the implementation of mechanisms and policies of the Central and the province, mountainous districts in Nghe An have had many positive changes in socio-economic development.

Nghe An Social Policy Bank mobilizes many resources for effective lending

(Baonghean) - The capital transferred by Nghe An Social Policy Bank to the poor and policy beneficiaries creates an important "push" for them to escape poverty sustainably and become rich legitimately.