Nghe An: Budget revenue target for the 2020 - 2022 period reaches nearly 50,000 billion VND

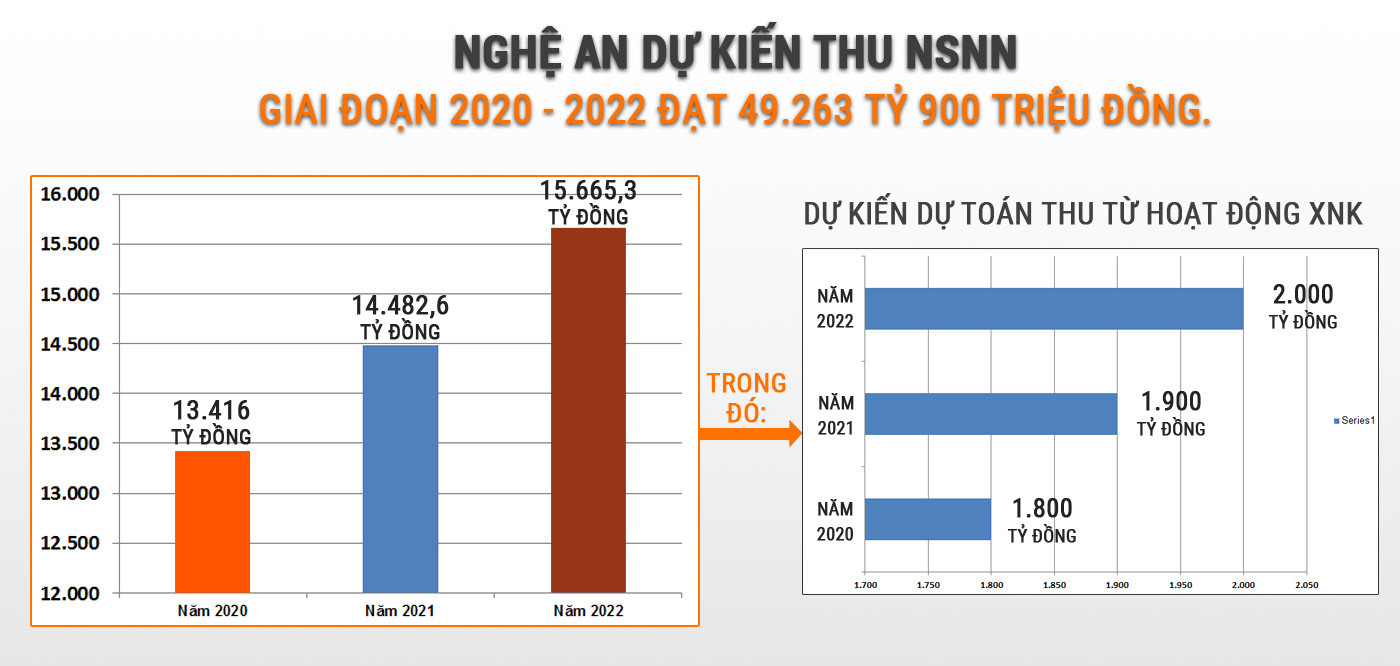

(Baonghean) - Based on the implementation and results of State budget collection in the period 2016 - 2019, Nghe An expects to collect State budget in the period 2020 - 2022 to reach 49,263 billion 900 million VND.

Identifying difficulties

On that basis, domestic revenue is expected to reach 13,416 billion VND in 2020, 14,482.6 billion VND in 2021 and 15,665.3 billion VND in 2022. Land use fee collection includes revenue from auctioned residential land planning, excluding land use fee collection and infrastructure construction expenditure. Land use fee collection for industrial park infrastructure projects, BT projects, etc. will be recorded, land use fee collection, infrastructure construction expenditure (exchanging land for works), compensation for site clearance of projects will be recorded according to the province's commitment progress.

Regarding revenue from import-export activities: Estimated revenue from import-export activities is 5,700 billion VND, of which: 1,800 billion VND in 2020; 1,900 billion VND in 2021 and 2,000 billion VND in 2022.

Assessing the advantages and disadvantages of revenue from import-export activities, Mr. Chu Quang Hai - Director of Nghe An Customs Department said: White limestone (in block form) has increased tax rates according to the provisions of Decree No. 125/2017/ND-CP dated November 16, 2017 of the Government. Accordingly, it is forecasted that budget revenue from mineral products in the coming period will increase significantly. At the same time, imported cold-rolled steel products are a major source of revenue.

|

| Loading and unloading goods at Cua Lo Port. Photo: Thu Huyen |

In general assessment of state budget revenue, Mr. Trinh Thanh Hai - Director of Nghe An Tax Department said: It is expected that in 2020, the budget revenue in the province will be 15,216 billion VND, this revenue level will not reach the target of the Resolution of the 18th Provincial Party Congress (25,000 - 30,000 billion VND). The main reason is: The growth rate of GRDP of the province is not as expected (according to the congress' target for the whole period of 2016-2020 is 11-12%, it is expected that in 2020 it will reach the highest level of 10%). The production and business situation still faces many difficulties, the rate of enterprises generating corporate income tax payable is below 35%,...

|

| Graphics: Lam Tung |

On the other hand, in the area, many projects are expected to bring large revenues to the budget but have not yet come into operation. Changes in policy mechanisms have had an impact on reducing revenue in the area such as reducing average retail electricity prices, businesses with long-term negative tax are not entitled to tax refunds; Resolution on tax debt relief, cancellation of late payment fines, late payment fees for taxpayers who are no longer able to pay the State budget...

Efforts to increase revenue and save costs

Based on the implementation and results of the state budget collection in the period of 2016 - 2019, Nghe An expects the state budget collection in the period of 2020 - 2022 to reach 49,263 billion 900 million VND. To ensure the budget collection plan, the People's Committee of Nghe An province will deploy solutions, exploit the province's potential and advantages to the fullest, seek support from the Central Government; strongly improve the investment environment, remove difficulties and obstacles and create favorable conditions for businesses; promptly complete and put into use key works and projects to implement the Resolution of the 18th Provincial Party Congress and the Resolution of the 12th National Party Congress.

|

| Instructions for businesses to declare taxes at Nghe An Tax Department. Photo: Lam Tung |

At the same time, focus on effectively implementing solutions to improve the business environment, enhance national competitiveness in 2019 and orientation to 2021, support and develop enterprises until 2020;... Resolve difficulties in disbursing public investment capital, accelerate progress and speed of implementation of construction investment volume, soon put works and projects into operation. Focus on strongly developing industry, focusing on processing and manufacturing industries; supporting industries, industries serving agriculture associated with advantages in developing agricultural, forestry and fishery raw materials. At the same time, work with investors to speed up the progress of investment projects to soon come into operation. Functional sectors will review revenue sources, prevent tax evasion, loss and tax debt.

|

| Production activities of enterprises in the Southeast Economic Zone. Photo: Lam Tung |

Because the budget revenue is difficult to reach the target of the Resolution of the 18th Provincial Party Congress, while the spending demand is very large, so in order to effectively manage the local budget balance, the province requests all sectors and levels to thoroughly implement savings in regular spending; requires sectors and localities to streamline staffing, use resources reasonably; not issue policies, regimes, and spending tasks when the sources are not balanced. Proactively adjust the balance of the 2016-2020 medium-term public investment plan, tighten fiscal discipline, budget, public debt, etc.

Total state budget expenditure for the years 2020 - 2022 is determined based on the budget revenue plan, surplus level and debt repayment each year. Accordingly, total state budget expenditure for 3 years (2020 - 2022) in Nghe An is expected to be about 84,358 billion 829 million VND.