Efforts to bring policy credit to the poor in Nghe An

(Baonghean) - With the goal of supporting policy beneficiaries to stabilize their lives, develop the economy, and ensure social security, the government's preferential policy credit capital has reached many beneficiaries with many diverse loan programs.

Overcoming circumstances thanks to policy loans

Her husband died early, leaving her to raise two children alone. The economy mainly depends on a few acres of contracted rice fields, so the life of the three mother and children of Ms. Nguyen Thi Duong in Phu Loc hamlet, Thuong Tan Loc commune, Nam Dan district faces many difficulties. In 2016, her family received a loan of 20 million VND from the bank's lending program for the poor.

With capital, Ms. Duong invested in fattening cattle. Thanks to her diligence in learning experiences and techniques in raising cattle, and knowing how to invest in the right direction, she was able to effectively utilize her capital and escape poverty. In 2017, the Nam Dan District People's Credit Fund lent her 25 million VND to repair her house, ensuring her family's living needs, and 50 million VND from the near-poor household program to raise cattle.

For the family of Mr. Tran Khac Nhuong - a member of the Veterans Association in Hamlet 3, Kim Lien Commune, in addition to receiving loans to develop the family economy, he also received loans from the student program to support his two children in university. Currently, his children have finished university and have jobs.

|

| War invalid Tran Khac Nhuong in Hoi 3 hamlet, Kim Lien escaped poverty and stabilized his life thanks to a loan from a policy bank. Photo: Thu Huyen |

“We were able to borrow money at low interest rates, and monthly interest payments were also very convenient. The capital from the Social Policy Bank is truly a hope, helping farming families like us to escape poverty and raise our children to go to school,” Mr. Nhuong shared.

Along with helping poor households and policy beneficiaries access preferential capital to develop production, create jobs, increase income, improve life and escape poverty, contribute to hunger eradication and poverty reduction, and ensure social security, the Nam Dan District People's Committee also implements a flexible savings and contribution program down to the Savings and Loan Groups (TTKVV) at the grassroots level.

Not only does it help customers use loans effectively and raise awareness of saving, but it also helps banks increase their capital capacity. For example, in the case of Ms. Nguyen Thi Duong, in the past 2 years, in addition to paying interest, she has saved from 400,000 to 600,000 VND per month through the loan group and savings. Thanks to that, her family has gradually been able to pay both principal and interest and have the conditions to raise and educate their children.

Every year, the Nam Dan District Social Policy Bank has advised the Board of Directors to direct the implementation of plans from villages and hamlets; and advised on the timely allocation of new capital sources.

|

| War invalid Phan Viet Hai in hamlet 6, Nam Giang commune, Nam Dan district borrowed preferential loans to invest in cattle farming. Photo: Thu Huyen |

Mr. Nguyen Sy Hai - Director of the Bank for Social Policies of Nam Dan district said: The development of the annual credit plan is carried out in accordance with regulations, especially the mobilization of resources from the local budget. In 2019, 1,900 million VND was mobilized (of which 200 million VND was from the district budget, 1.5 billion VND was from Bao Son Group, 200 million VND was from the District Youth Union), in the first 4 months of the year, the Transaction Office advised the District People's Committee to allocate 300 million VND from the district budget, completing 60% of the assigned plan. Up to now, the total budget has reached over 2.7 billion VND; the mobilized savings capital has reached 93 billion VND, completing 104% of the assigned plan.

Need solutions to increase capital sources

In the first 6 months of the year, the Covid-19 epidemic had a severe impact on the socio-economy, but the Provincial Social Policy Bank closely followed the direction of the Provincial People's Committee and the Board of Directors of the Social Policy Bank to focus on directing and implementing the set goals well in the conditions of both fighting the epidemic and performing socio-economic tasks.

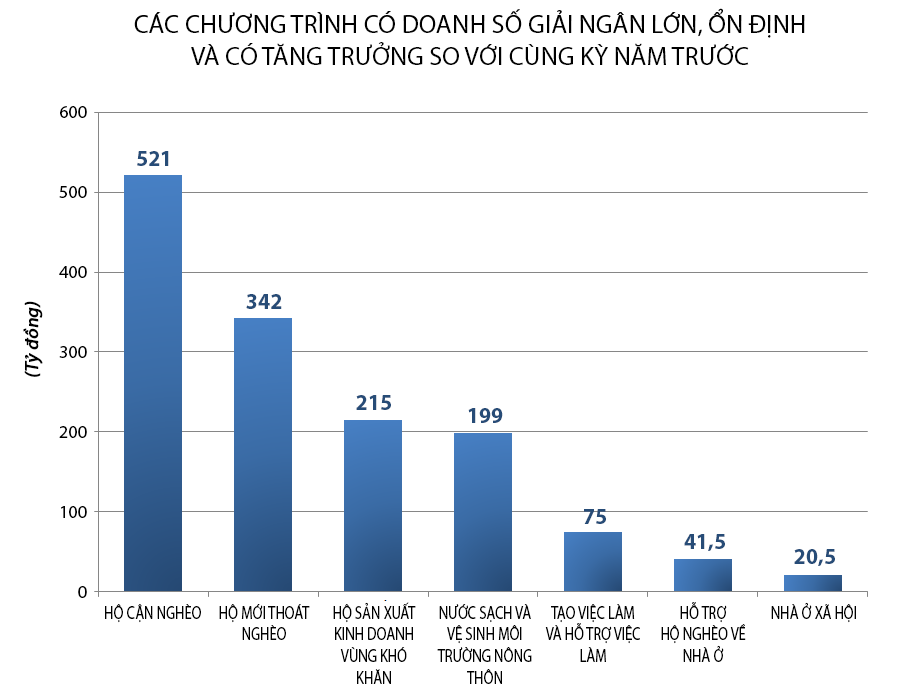

By June 30, 2020, total capital reached VND 8,882 billion, achieving a growth rate of over 6%; Loan turnover was VND 1,653 billion; Total outstanding debt reached VND 8,865 billion, achieving a growth rate of 6.03%. Some programs with good outstanding debt growth rates include: social housing loans increased by 65.31%; loans to support poor households with housing increased by 19.68%; loans to support employment/job creation increased by 15.95%; loans to newly escaped poverty households increased by 11.65%; loans to production and business households in difficult areas increased by 11.26%;...

|

| Graphics: Huu Quan |

The programs have large, stable disbursement turnover and have grown compared to the same period last year. Debt collection turnover reached 1,147 billion VND, accounting for 69.4% of loan turnover, contributing significantly to creating a stable and proactive revolving loan source at the local level, meeting the borrowing needs of poor households and policy beneficiaries in the context of difficulties in capital allocation from the central government.

The work of receiving savings deposits from poor households and policy beneficiaries through the Savings Savings Group continues to be well implemented by the entrusted associations at all levels in coordination with the Bank, and is increasingly becoming routine. Thanks to good propaganda work, most poor households and policy beneficiaries clearly understand the meaning of the monthly savings deposit program through the Group, thereby being aware of saving in spending, and practicing regular monthly deposits to the Vietnam Bank for Social Policies to create a source of debt repayment and interest payment. By June 30, 2020, the savings deposit balance of group members through the Savings Savings Group reached 493 billion VND, an increase of 43 billion VND compared to the beginning of the year, completing 64% of the central growth target for the whole year.

|

| Women in the savings and loan group of Lang Xieng village, Mon Son commune (Con Cuong) develop brocade weaving with loans from the Vietnam Bank for Social Policies. Photo: Thu Huyen |

Recently, at the regular meeting of the Board of Directors of the Vietnam Bank for Social Policies, the Standing Vice Chairman of the Provincial People's Committee, Head of the Board of Directors of the Vietnam Bank for Social Policies Le Hong Vinh suggested that in the coming time, it is necessary to take advantage of capital sources from the Central Government; actively and effectively mobilize deposit capital and revolving debt collection capital to focus on disbursement to meet the loan needs of poor households and other policy beneficiaries, especially lending to restore production after the pandemic.

The entrusted organizations direct and carry out well the work of evaluating loans to ensure publicity, democracy and accuracy; focus on directing the collection and handling of overdue debts; advise the Party Committee and the government on more drastic measures to deal with cases where they have the conditions to repay the debt but deliberately delay and delay, and those who use capital for the wrong purpose.

The Vice Chairman of the Provincial People's Committee also requested the Department of Labor, War Invalids and Social Affairs to properly implement Circular 17 in reviewing and updating poor and near-poor households as a basis for these subjects to have timely access to policy credit capital.

In the first 6 months of 2020, the Provincial Branch of the Vietnam Bank for Social Policies has provided preferential credit capital to 40,813 poor households and other policy beneficiaries, including: 5,801 poor households; 11,106 near-poor households received loans; 6,973 newly escaped poverty households and 4,553 production and business households in difficult areas received loans for production and business; 1,714 workers received loans to support job creation; 05 workers from families with revolutionary contributions received loans to work abroad; 9,881 other families in rural areas received loans to renovate/build new clean water tanks and sanitation facilities to improve the quality of life; 81 households received loans to build/buy social housing; 656 poor ethnic minority households benefited from policy credit (587 households borrowed capital to invest in production, 69 households borrowed capital to work abroad); 34 cooperative members received capital for production and 09 forest-growing households received capital to develop the forest economy.

Banking sector supports 21 billion VND to build 300 gratitude houses in Nghe An

(Baonghean.vn) - On the morning of July 5, in Vinh City, the State Bank of Vietnam held a ceremony to present social security programs of the banking sector to Nghe An province.