Gold buyers lost more than 2 million VND after one week

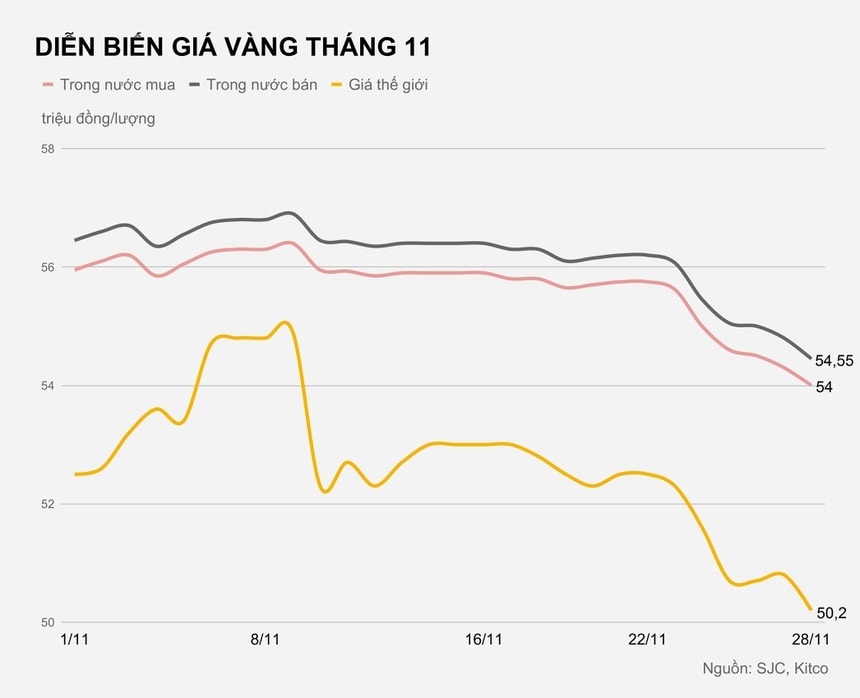

Affected by world prices, domestic gold bar prices dropped sharply below 55 million VND/tael, causing gold buyers this week to suffer large losses.

The world gold market last night (Vietnam time) continued to witness a sell-off by investors, causing the price to fall below the $1,790/ounce range.

Closing session this week,gold priceOn the New York Stock Exchange, it closed at $1,787.7/ounce, down $20.4 compared to the previous session. Compared to the end of last week, the price of precious metals here is now $85/ounce lower, equivalent to a decrease of nearly 4.5% in a week.

Similarly, the spot gold price on Kitco continued to fall sharply last night, also closing the week at $1,787.7/ounce. Compared to the end of last week, the spot gold price here is now more than 4% lower in market price. On Comex, the December gold futures price last night fell nearly 1.3% in value, last trading at $1,782.7/ounce.

Buying domestic gold loses 2.2 million VND/week

The sharp drop in world precious metal prices has also caused domestic gold bars to fall continuously this week. Currently, the price of gold bars has decreased for the 6th consecutive session and is commonly sold at 54.5 million VND/tael.

|

Also this morning, the selling price of SJC gold at stores in Hanoi area decreased to 54.57 million VND/tael, this is the 6th consecutive decrease of SJC gold bars. During this whole week (November 23-28), the gold price only maintained a downward trend.

The sharp decline in precious metals in both the world and domestic markets is causing the price of this commodity to fall to a four-month low.Gold falls for third consecutive week

Closing at a low price range has caused domestic and world gold prices to have a third consecutive week of decline. This week, world gold prices started with many expectations as they still maintained the important mark from the end of last week.

However, positive news related to Covid-19 vaccines and a strong stock market have put pressure on the precious metal. In particular, data shows that the cash flow withdrawn from the gold market by investors to pour into stocks is the main reason for the sharp price drop.

Gold's drop below $1,790 an ounce last night also marked the third decline of this commodity in the past week.

|

| Gold buyers this week are suffering a loss of more than 2 million VND/tael. Photo: Chi Hung. |

According to Alain Corbani, portfolio manager at Finance SA, gold has broken through key support levels this week (1,850 USD, 1,800 USD) but there is not much negative left. He predicts that gold prices will rise back to the 2,500 USD/ounce mark from the current price range.

“The next leg of the bull cycle will be based on a lower US dollar and that is the key factor to drive gold higher from here,” said Mr. Corbani.

Some other experts say the macro environment is still supportive for gold prices to rise, but expectations of record high prices have been delayed until next year.

“Gold prices are not rising because of the pandemic, but because of the policy response to the pandemic. Economic stimulus packages, a weak US dollar, low interest rates are the reasons why gold has risen to record levels. These reasons will not go away and gold will rise strongly next year,” said Mr. Kevin Grady, President of Phoenix Futures & Options LLC.

However, Mr. Grady does not expect gold to reach $2,000/ounce by the end of this year, but the precious metal will close this year below $1,900/ounce.