Will monetary easing continue to boost growth in 2021?

In 2020, Vietnam successfully contained the Covid-19 pandemic while maintaining positive economic growth. However, in 2021, what will be the main driving force for economic growth?

OUTLOOK AND MOTIVATION FOR 2021

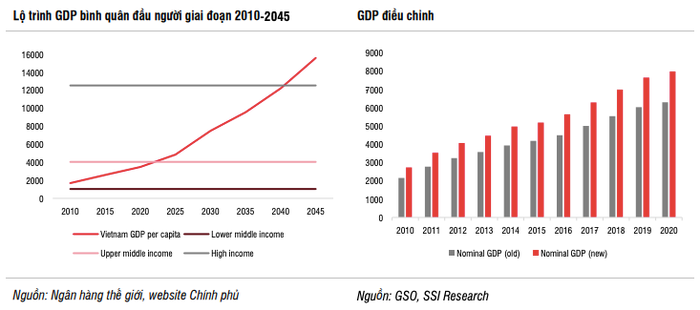

In the recently released summary report on Vietnam's macro and market outlook for 2021, SSI Securities Company forecasts thatGDP growthVietnam's GDP in 2021 will stabilize at around 6.5% compared to the previous year. Growth will begin to accelerate from the second quarter of 2021 and maintain momentum until 2022, with an increase of around more than 7%.

Much attention is being directed to the most important events taking place in 2021, which are the 13th National Party Congress taking place in January, followed by the election of the new National Assembly in May. This is also the first year of the new 5-year plan for the period 2021-2025. In the next 5-year plan, the Government sets an average growth target of 6.5-7%.

|

| Will monetary easing continue to boost growth in 2021? |

"The five-year plan will have two phases: 2021-2022 (recovery phase) and 2023-2025 (acceleration phase). Therefore, for 2021, the Government will continue to loosen monetary policy and implement expansionary fiscal policy. The budget deficit will continue to be high, even in absolute terms, due to the upward adjustment of GDP at current prices," said an expert from SSI.

Vietnam's economic growth in 2021 will be supported by the recovery of the global economy, especially in the context of Vietnam becoming a more important center in the manufacturing and processing industry ecosystem.

Specifically, in the fourth quarter of 2020, the industrial production index (IPP) increased by 6.3% year-on-year (December alone increased by 9.5% year-on-year), while the manufacturing sector achieved significant growth of 9% year-on-year. This confirms that the recovery in production has returned to pre-Covid levels.

In addition, although many companies said their clients postponed their investment plans in Vietnam this year due to travel restrictions, registered FDI inflows in 2020 only decreased by 8.7% year-on-year (total registered FDI capital of about USD 21 billion in absolute value). Therefore, this makes the outlook for 2021 promising for FDI inflows as public investment growth returns to normal growth rates.

Free trade agreements such as CPTPP, EVFTA or RCEP will have a stronger impact and domestic consumption will recover from 2021, which is also expected to be a growth driver for Vietnam's economy next year.

MONETARY EASY CONTINUE?

Notably, the research team highly appreciated the role of the State Bank as well asmonetary policyin economic growth in 2021.

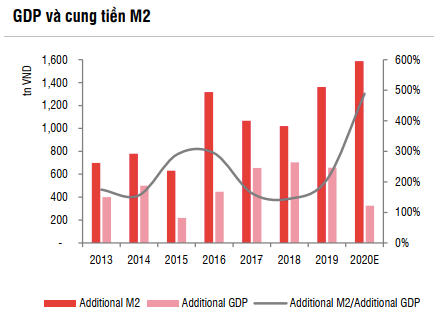

According to the report, it is estimated that nominal GDP growth in 2020 could reach about 4.24% and M2 money supply growth is 15%. While in 2019 GDP increased by 9.4% and M2 increased by 14.8%.

The widening gap between nominal GDP growth and M2 money supply is due to the Covid-19 pandemic and its severe impacts on the sustainable development of businesses.

Source SSI.

In the first 9 months of 2020, M2 increased by 8.63%. The Government estimated that foreign exchange reserves at the end of 2020 reached 100 billion VND, meaning that the State Bank bought an additional 22 billion USD in 2020, similar to 2019.

On the other hand, the net mobilization value from the OMO market was almost zero for the whole year of 2020. Overall, the net money injection value from the State Bank could increase by 13% over the same period in 2020.

However, due to weak credit growth in the first 11 months of the year, liquidity became abundant.

Amid falling private consumption and investment, bank deposits have shifted to corporate bonds (issued volume in the first nine months of the year increased by 79% year-on-year) and possibly the stock market (daily trading value increased by 41% in the first eleven months of 2020 compared to the average in 2019, while foreign investors sold a net $704 million).

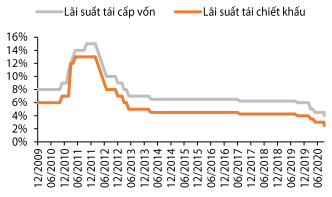

“In 2021, the State Bank will continue its easing policy in the context of other central banks implementing similar strategies and the USD may continue to depreciate,” the research team at SSI forecast.

However, foreign exchange policy in 2021 may change after the US Treasury Department determined that Vietnam is a currency manipulator. This may be the main catalyst for the State Bank to emphasize "not to create unfair international trade competitive advantages" in its policy orientation.

"Therefore, we expect the VND to appreciate in line with positive changes in macroeconomic factors in 2021. Meanwhile, interest rates may bottom out in mid-2021 due to stronger credit growth and economic recovery," SSI's report stated.

Policy interest rates hit record lows in 2020.

Sharing the same view, Dragon Capital Securities Company (VDSC) also believes that the monetary policy easing stance will continue in 2021 to support businesses and households facing prolonged difficulties due to the pandemic.

At the same time, credit growth will increase to 12% to 13% along with improvement in business confidence and economic activities.

“We see a low likelihood of further interest rate cuts. In addition, the dong will remain stable against the USD in 2021 due to expectations of further USD weakness,” VDSC said.