'Fast car loan - Get instant incentives' at BAC A BANK

(Baonghean.vn) - The program "Fast car loan - Receive incentives immediately" is implemented by Bac A Commercial Joint Stock Bank (BAC A BANK) with the aim of helping business customers improve their competitiveness and be ready to seize opportunities for growth and development.

Be careful with the cost-benefit equation

Despite being affected to some extent by the Covid-19 pandemic, in the last months of 2020, Vietnam recorded a relatively positive economic growth rate, which means that business activities have recovered and flourished. To meet development needs, businesses have been more bold in investing and consolidating resources; andcaris one of the indispensable "categories".

Unlike cars used for personal use, this vehicle can be used by businesses for a variety of purposes, from commuting, transport rental to business services. “In the context of the economy still facing many difficulties, businesses need to carefully consider the cost-benefit equation when buying a car,” an economic expert advised.

In addition to direct promotional programs from car manufacturers such as increasing discount rates on selling prices and giving away accessories, banks are also actively looking for solutions so that businesses can soon own cars as expected, meeting the needs of transportation businesses, serving production, business, rental activities as well as serving the travel needs of businesses.

|

| "Fast car loan - receive immediate incentives" from BAC A BANK. Photo: PV |

“From a business perspective, purchasing vehicles will partly affect the allocation of business resources to suit the operating plan. If you want to ensure financial stability, instead of “losing opportunity costs” for other investments serving production and business, businesses can refer toloan package"Buy cars with preferential prices from reputable banks" - Mr. Tran Thanh Hai - Director of Wholesale Banking, Bac A Commercial Joint Stock Bank (BAC A BANK) shared.

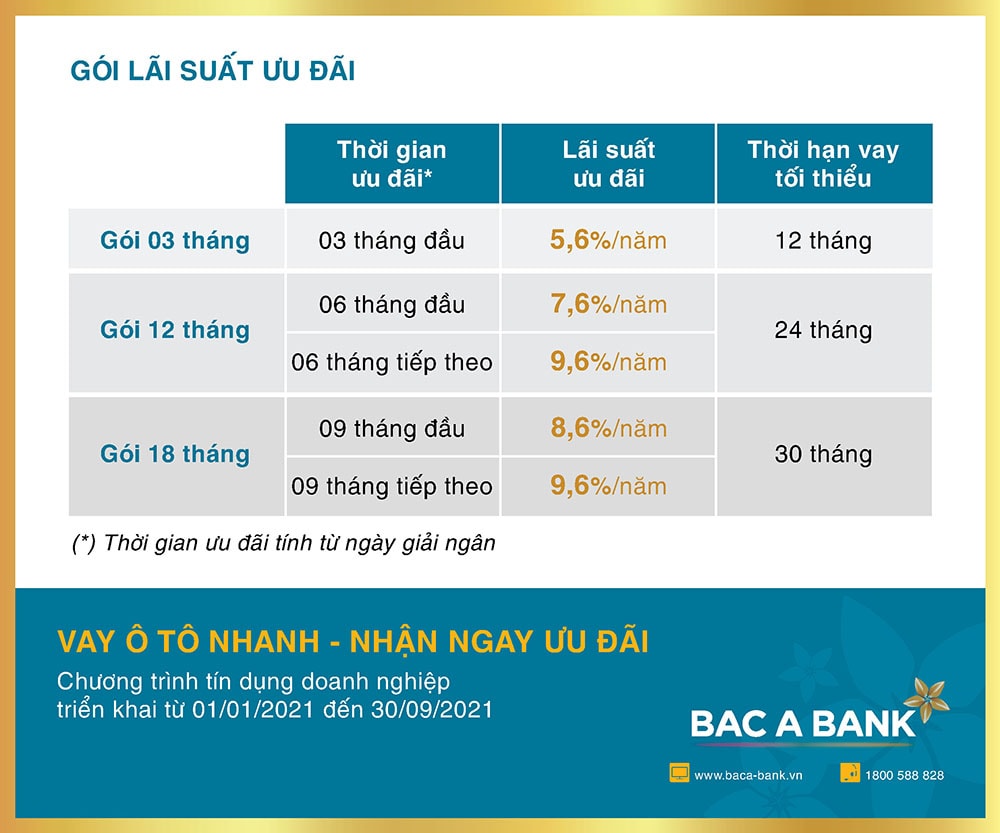

To optimize cash flow efficiency,businessshould look for banks that are implementing policiesendowdesigned specifically for this customer segment. Typically, the program "Fast car loan - Get incentives immediately" with a limit of up to 500 billion VND is implemented by BAC A BANK from now until September 30, 2021. The program has many attractive loan interest rate packages for customers to proactively balance and choose according to their needs, with the lowest interest rate from only 5.6%/year.

This incentive program applies to new and existing customers with a minimum operating period of 6 months from the date of issuance of the first Business Registration Certificate, provided that the customer has not incurred bad debt at BAC A BANK or other credit institutions within the last 1 year; ensuring an internal credit rating of BB or higher at the time of joining the program.

|

| Interest rate table of the program "Fast car loan - Get incentives now". Photo: PV |

Always on topcompanionAlong with the business, BAC A BANK provides many other utilities for customers borrowing to buy cars such as flexible loan period up to 120 months, loan limit up to 100% of car value, diverse collateral - allowing maximum loan ratio of 75% of collateral value and extremely preferential early repayment fee.

In particular, the big difference compared to similar products on the market is that BAC A BANK accepts most types of vehicles on the market, including Chinese branded vehicles.

For more information about the program "Fast car loan - Get instant incentives", please visit the BAC A BANK website www.baca-bank.vn or Customer Care Center 1800588828.