Nghe An's tax debt decreased by 507 billion VND compared to the same period.

(Baonghean.vn) - According to the report of Nghe An Tax Department, as of March 31, 2021, Nghe An's tax debt was 928 billion VND, a decrease of 507 billion VND compared to the same period last year (in 2020 it was 1,435 billion VND).

In the first 3 months of 2021, the entire Nghe An tax sector has implemented many drastic measures to recover tax arrears. As of March 31, 2021, the total debt of the entire tax sector was: 928 billion VND, of which the Tax Department Office was 421 billion VND, the Tax Branch block was 507 billion VND, compared to the same period, a decrease of 570 billion VND.

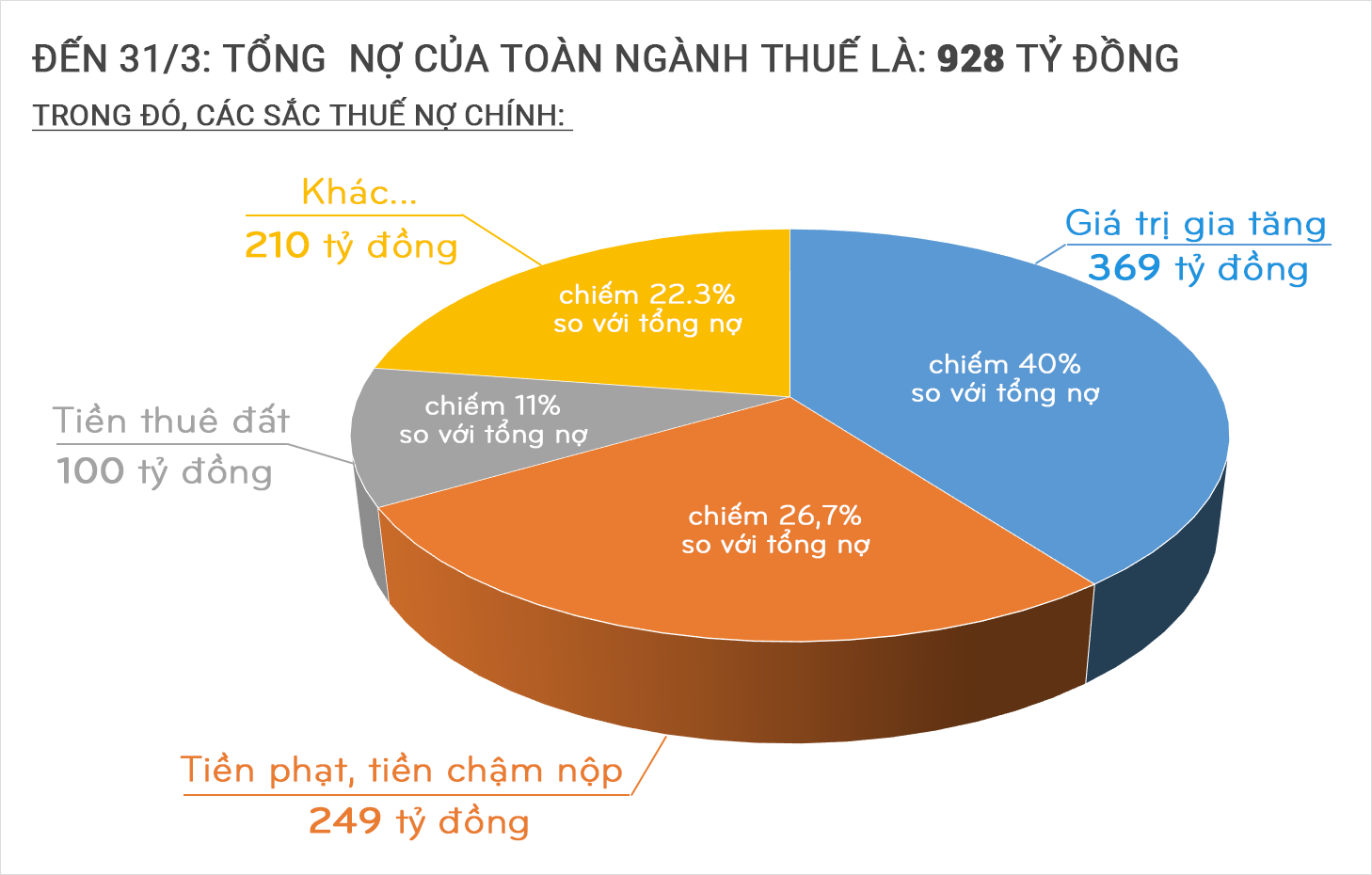

In which, the main tax debts are: Value added tax: 369 billion VND, accounting for 40% of total debt; Fines and late payment fees: 249 billion VND, accounting for 26.7% of total debt; Land rent: 100 billion VND, accounting for 11% of total debt.

|

| Chart of tax debt structure. Graphics: Lam Tung |

Mr. Vuong Dinh Chinh - Head of Propaganda and Support DepartmentNghe An Tax Departmentsaid: Recently, Nghe An Provincial Tax Department has implemented many measures to manage tax debts such as: Assigning debt collection targets to each department; Assigning additional debt collection targets; resolutely implementing debt collection and tax arrears collection measures such as issuing debt and late payment notices, issuing tax arrears collection decisions for cases of forced tax debt collection; coordinating with the Department of Natural Resources and Environment to collect tax debts of mineral exploitation enterprises; sending text messages to urge tax debt payment to enterprise directors; publishing information about taxpayers who are slow to pay tax debts on the Tax Department's Newspaper, website, ward and commune loudspeakers, etc.;

In addition, strengthen close coordination with the State Treasury, commercial banks, and credit institutions in tax debt enforcement; coordinate with departments and branches to collect tax debts. Therefore, tax debt management has achieved remarkable results, contributing significantly to budget collection and completing the overall political tasks of the whole sector.

Nghe An Tax Department promotes propaganda and explains obligations to taxpayers, strengthens strict handling of tax violations to deter. Closely monitor the tax declaration and payment situation of taxpayers to promptly grasp arising debts, implement measures to urge collection and payment to avoid new debts. Advise the People's Committee on the Steering Committee for tax debt collection to effectively collect tax debts; Coordinate with departments, branches and functional agencies to collect tax debts. Strictly implement the policy of tax debt suspension, cancellation of late payment fines and late payment fees according to Resolution 94/NQ-QH and Circular 69/2020/TT-BTC.

Fortax-debt businessesIn case of large, prolonged or deliberately delaying tax payment, information on tax debt of taxpayers will be posted on mass media (newspapers, radio, industry websites, commune and ward loudspeakers, etc.). Particularly for households and individuals doing business with outstanding tax and fines, the Tax Departments are required to coordinate with the People's Committees of communes and wards to request these households and individuals to come to work. Coordinate with the Market Management Board and hamlet block to announce on loudspeakers the list of individuals with outstanding tax debts.

Although tax debt has decreased compared to the same period, it is still high due to the Covid-19 pandemic causing difficulties in production activities of many businesses.