Prosperity from policy credit capital in Nghe An

(Baonghean.vn) - In the first 6 months of this year, despite the complicated developments of the epidemic, policy credit continued to make important contributions to the socio-economic development achievements of the province; Nghe An Branch was recognized and highly appreciated by the Emulation and Reward Council of the Vietnam Bank for Social Policies (VBSP), being one of 15 branches nationwide that excellently completed its tasks...

Effective lending models

In 2015, Ms. Nguyen Thi Thanh in Tho Son hamlet, Quy Hop district started implementing a model of breeding cows, fromcapital of the People's Credit Fundto develop the economy. From a loan of 50 million VND, Ms. Thanh's family boldly invested in buying 3 breeding cows. Although a poor household in Tho Hop commune, with her hard-working and studious nature, when the commune association opened training classes on basic knowledge of production and animal husbandry, Ms. Thanh always registered to participate to learn.

Thanks to that, after only 3 years of raising cows, Ms. Thanh's family's herd of cows increased to 5. She raised them for a while and sold 4 cows for more than 100 million VND. With the profit from raising cows, she continued to invest in raising pigs, chickens and goats. After 5 years of investing in a variety of cow, pig, chicken and goat farming models from loans from the district's Social Policy Bank, Ms. Thanh's family paid off their debt, escaped poverty and became a well-off household in Tho Son hamlet, Tho Hop commune.

Also in Tho Son commune (Quy Hop), Mr. Vi Van Duyen borrowed100 million VND near-poor household programInitially, Mr. Duyen bought 6 cows and now his family has 10. Raising cows effectively, Mr. Duyen's family has paid off the principal and interest in full.

|

| Many farm economic models in Quy Hop were built with loans from the Vietnam Bank for Social Policies. Photo: TH |

Adhering to the planning targets assigned by the provincial Social Policy Bank since the beginning of the year, the district Social Policy Bank has coordinated with political and social organizations entrusted to organize timely disbursement. Loan turnover from the beginning of the year to date has reached more than 127 billion VND. Some programs with large loan turnover include: Loans for near-poor households 41 billion VND, poor households 23 billion VND, production and business 43 billion VND, clean water and rural environmental sanitation nearly 8 billion VND... Implementing loans for 16 policy credit programs with 12,418 borrowers. Timely allocation of capital sources to the People's Committees of communes and towns, thanks to which, the organization of disbursement of credit programs has been promoted, without capital backlog.

Recently, the Covid-19 epidemic situation has been extremely complicated on a large scale, greatly affecting all aspects of economic and social life and branch activities. However, many branches have overcome difficulties to maintain good operations. Along with mobilization and lending activities, many transaction offices in Quy Hop, Nam Dan... regularly pay attention to transaction activities at commune transaction points, fully equipped with machines, equipment and other supporting tools to perform transaction work well. Branches have strictly implemented the instructions of the locality and the industry in epidemic prevention and control. Fully equipped with epidemic prevention and control tools, hand washing with sanitizer, body temperature measurement, and arrangement of distanced seating... for all customers when coming to transact.

|

| Members of the savings and loan group in Chau Thai commune, Quy Hop district look at loan information at the commune People's Committee headquarters. Photo: TH |

Speed up disbursement to support businesses and workers

Mr. Tran Khac Hung - Director of the Provincial Social Policy Bank said: The epidemic has had a serious impact on the socio-economy. Faced with these difficulties, the Provincial and District Board of Directors have directed the branches of the Social Policy Bank, political and social organizations entrusted at all levels to effectively implement the dual goal of "both fighting the epidemic and completing professional tasks". Well implementing the policy of transferring budget capital to entrust to the Social Policy Bank to provide loans to poor households and policy beneficiaries. In the first six months of the year, the whole province received 28.6 billion VND from local budgets at all levels and organizations and enterprises entrusted to the Social Policy Bank to provide preferential loans to poor households and policy beneficiaries in the area, completing 114.3% of the plan assigned by the Central Government.

The Provincial and District Board of Directors have promptly assigned the growth plan targets for the 2021 policy credit programs announced by the Central Government in accordance with the needs and implementation capabilities of each locality, with a total capital of 414 billion VND; at the same time, adjusting capital sources from programs that reduce demand to programs with increased demand. Specifically: Transferring capital sources from the poor household lending program to lend to the near-poor household program and newly escaped poverty households with 79 billion VND; Transferring capital sources from the student credit program to lend to the newly escaped poverty household program and the clean water and rural environmental sanitation program with 17 billion VND.

|

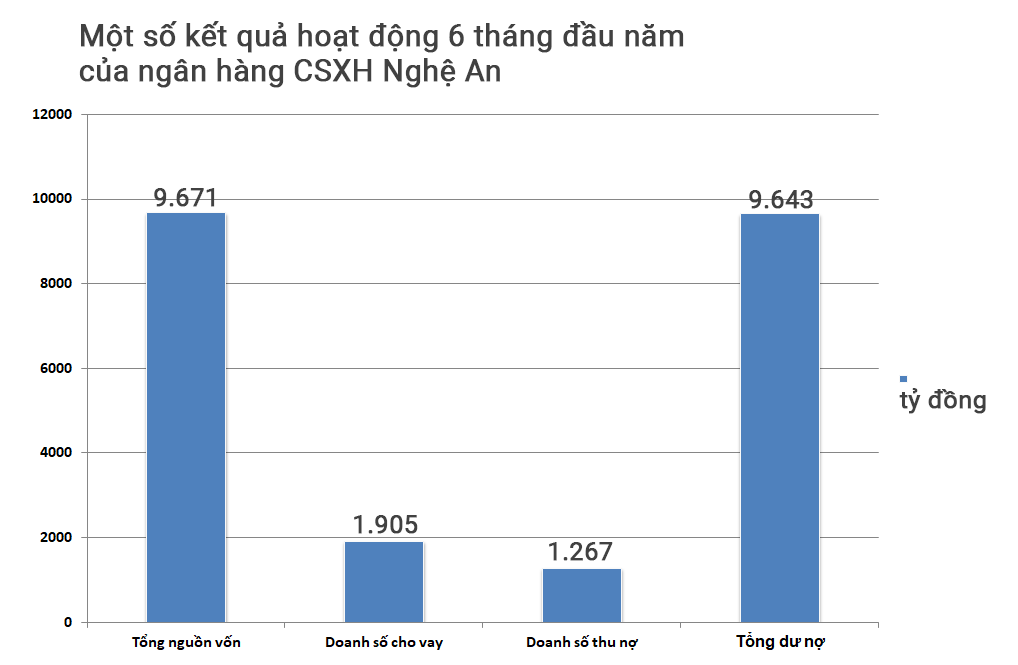

| Graphics: Lam Tung |

As of June 30, 2021, the total capital of the Social Policy Bank reached VND 9,671 billion, an increase of 7.15% over the same period; total outstanding loans reached VND 9,643 billion/20 policy credit programs, an increase of VND 635 billion compared to the beginning of the year, achieving a growth rate of 7.05%, completing the credit growth target in 2021 according to the Resolution of the Provincial Board of Directors.

Policy credit capital has provided capital to 43,854 poor households and other policy beneficiaries, many businesses have been able to borrow capital to pay wages to employees who have stopped working. Implementing the directives of the Vietnam Bank for Social Policies on supporting customers who have difficulty repaying their loans due to the impact of the Covid-19 pandemic, the branch has promptly implemented solutions to create favorable conditions for customers such as: Restructuring the repayment period for 768 customers/VND 19.3 billion; Providing additional loans to implement production and business plans, creating jobs for 482 customers, amounting to VND 21.2 billion.

Recently, the Nghe An Provincial Branch of the Vietnam Bank for Social Policies has disbursed a 0% interest loan package according to Resolution 68 and Decision 23 to the first enterprise in the province. This is an enterprise operating in the healthcare sector in Yen Thanh district, with a total of 35 employees, of which 28 employees have paid social insurance and meet the criteria for loans to pay salaries to restore production according to regulations.

The total capital borrowed for 3 months by this enterprise is 245 million VND, loan term is 11 months, interest rate is 0%.

|

| The Yen Thanh District Social Policy Bank transaction office signed a credit contract to support businesses in borrowing capital to restore production due to the Covid-19 epidemic. Photo: TH |

Mr. Phan Huu Trang - Director of the Transaction Office of the Social Policy Bank of Yen Thanh District said: This is a preferential loan package with 0% interest rate and no need to take loan security measures, loan term is less than 12 months. Access to this loan source will help businesses affected by the Covid-19 epidemic in Yen Thanh District overcome difficulties and stabilize production.

According to information from the Nghe An branch of the Vietnam Bank for Social Policies, up to now, 3 enterprises in Nghe An province have had their preferential loan applications approved according to Resolution 68 and Decision 23; and will receive loan disbursement as soon as possible.

In the coming time, the Board of Directors and the Vietnam Bank for Social Policies at all levels will continue to direct and organize the timely implementation of credit policies for lending to employers to pay wages for work suspension and production recovery for employees affected by the Covid-19 pandemic according to Resolution No. 68/NQ-CP dated July 1, 2021 of the Government and Decision No. 23/2021/QD-TTg dated July 7, 2021 of the Prime Minister. Direct the quick disbursement of capital sources for programs, meeting the needs of production and social security loans for poor households and policy beneficiaries.