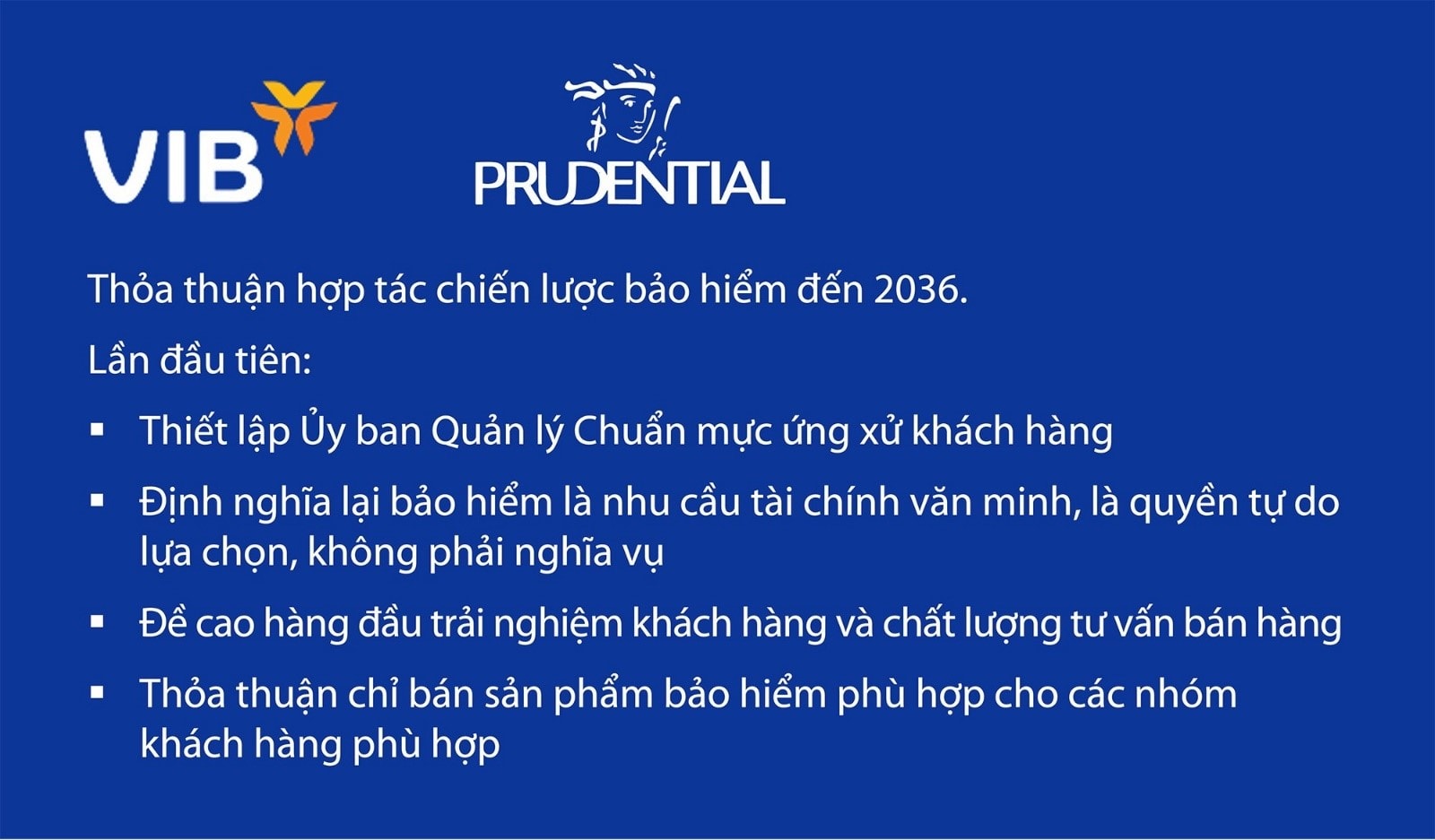

PRUDENTIAL Vietnam and VIB extend strategic cooperation agreement until 2036

(Baonghean.vn) - The extension of the strategic cooperation agreement on insurance distribution through banks (bancassurance) aims to realize the two businesses' goal of strengthening customer trust and strongly promoting the development trend of the "new generation of bancassurance".

-For the first time, the quality of sales consulting and contract service is built into the agreement by establishing a minimum “contract retention rate” limit and gradually increasing it to the ideal rate.

-For the first time, a “Customer Conduct Standards Management Committee” was established between the two partners, setting out criteria and sanctions to manage and monitor issues related to sales consulting and customer care, while also making quality monitoring calls and verifying customer demand information.

-For the first time, the agreement to sell only the right insurance products to the right customer groups is incorporated into the partnership contract through the allocation of product portfolio proportions and customer groups.

Mr. Phuong Tien Minh - General Director of Prudential Vietnam shared: "The Life Insurance market in Vietnam is still quite new with nearly 25 years of development, in which the bancassurance channel has only really recorded strong growth from 2016 to present. This strong growth has helped us see many opportunities to improve products, services and sales quality. We are proud to have a partner with the same vision as VIB. The extension of the cooperation agreement between Prudential and VIB until 2036 is part of the plan of both parties, demonstrating a common commitment to putting customers at the center, focusing on improving the quality of distribution channels, leading the cooperation channel through banks to develop more sustainably.".

“This new cooperation extension is an important milestone in the strategic cooperation relationship between the two parties with the expectation of setting a new standard for bancassurance in Vietnam. The important changes related to the quality of distribution channels and customer experience this time demonstrate our seriousness and commitment to sustainable development in accordance with the Government's direction, while creating positive changes for the Life Insurance market in general and the banking cooperation channel in particular, thereby helping the Life Insurance industry to play a better role in economic development and social security."Mr. Phuong Tien Minh added.

Mr. Han Ngoc Vu - General Director of Vietnam International Bank (VIB) said: "With the vision of becoming the most innovative and customer-oriented bank in Vietnam, VIB has identified its strategic priority as providing comprehensive financial solutions to meet the increasing demands of the Vietnamese people. An important orientation is to provide customers with options in both risk insurance and ensuring long-term and sustainable financial planning. Distributing Prudential insurance products through banks is one of the options we bring to customers. Prudential is a large international corporation, with leading prestige in the world, a model enterprise with a strong commitment to the Vietnamese market, they have good insurance products, very transparent and professional policies, processes and coordination mechanisms. With this choice, we have seriously invested on a large scale with innovative service solutions as well as extensively applied technology to advise and provide solutions that meet customer needs, as well as continuously improve processes and service quality.".

“The extension of the strategic cooperation term with Prudential demonstrates the commitment of both parties towards a sustainable insurance market development in line with the direction of State management agencies, while continuing to bring opportunities for us to better serve customers, expand retail business activities and affirm VIB's goal of becoming a leading retail bank.", Mr. Han Ngoc Vu shared more.

Since its establishment, the Vietnamese insurance industry has made positive contributions to the realization of the country's socio-economic development goals. By the end of April 2023, insurance companies had reinvested an estimated VND 708.4 trillion into the economy, and the insurance industry is expected to reach a scale of about 3 - 3.3% of GDP by 2025.

In 2022, the entire Life Insurance industry is paying over 42 trillion VND, of which Prudential accounts for 25% of the total payment amount with nearly 9,600 billion VND. More than 1,600 billion VND has been paid for more than 150,000 cases with death, total and permanent disability, critical illness and medical care benefits, an increase of 35% compared to 2021. In the Bancassurance channel alone at Prudential, the number of payments and the amount of insurance benefits increased by 64% and 69% respectively compared to 2021, showing that the need for protection of customers through banks is increasing.

On VIB's side, when implementing the bancassurance model, the bank's top concern is to ensure the input quality of the consultant team and control the quality of consulting through specific processes and regulations on the basis of ensuring general principles. At the same time, in order to promptly record and answer customer questions and improve consulting quality, the bank also widely deploys after-sales activities such as: random probability visits, updating financial milestones and other activities. From January 1, 2023, the two partners have coordinated to deploy calls from the insurance hotline to 100% of new bancassurance customers to check the quality of consultants, from which there are monthly reports on consultant quality.

In the coming time, the two partners will simultaneously coordinate to promote training, coaching and supervision of employees, and communications so that the market has more complete information about the characteristics of insurance products; continue to accompany customers to resolve problems to bring the best possible experience to customers and continuously improve service quality./.