Why is it mandatory to buy motorbike insurance?

Clause 2, Article 58 of the 2008 Road Traffic Law clearly stipulates that motorbike owners are required to carry insurance when driving.

Motorbike insurance is a mandatory document required when people participate in traffic by motor vehicle. This type of insurance aims to protect the financial aspect of the vehicle owner. Participants pay benefits when an accident occurs leading to health damage. Accordingly, the subjects who are paid benefits include:

Motorcycle

Motor vehicle

Passengers, accident victims/persons suffering bodily injury due to the fault of the vehicle owner.

According to current legal regulations, motor vehicles (including cars, motorbikes, and scooters) are identified as sources of high danger.

According to Articles 2 and 3, Decree 03/3021/ND-CP of the Government effective from March 1, 2021, regulating motorbike insurance to protect the financial rights of motorbike owners (including electric motorbikes) participating in traffic and operating in the territory of Vietnam.

The effects of motorcycle insurance will help the parties involved solve problems including:

Financial support in case of vehicle damage or loss due to circumstances beyond control such as fire, collision. If the vehicle is damaged more than 75% or cannot be repaired, the insurance company will be responsible for supporting compensation for the entire actual value of the vehicle.

Compensate the injured party for bodily and property damage due to the fault of the motor vehicle owner.

Avoid getting fined by traffic police for not having motorbike insurance.

Financial compensation for bodily injury caused by traffic to people riding motorbikes (including the vehicle owner and the passenger).

Limit the situation of accident victims fleeing for fear of having to pay compensation.

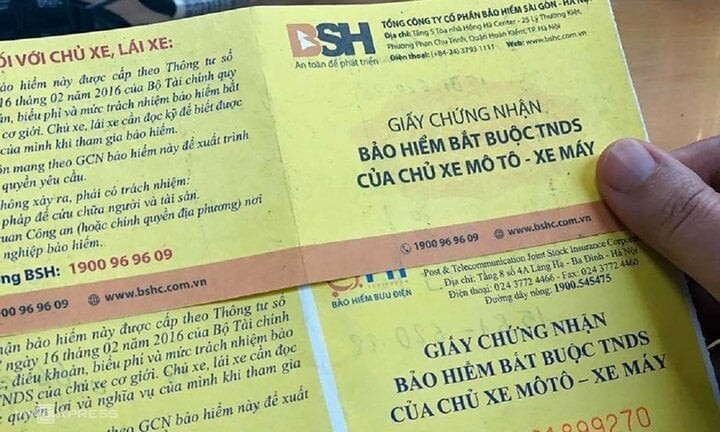

Motorcycle insurance is mandatory

Compulsory motorcycle insurance is precisely the compulsory civil liability insurance (TNDS) of motorcycle owners towards third parties (the party causing the accident). The main purpose of this insurance product is to ensure the responsibility of motorcycle drivers when participating in traffic and to remedy the consequences of accidents for victims.

According to Circular 04/2021/TT-BTC, the maximum compensation for motor vehicle civil liability insurance is as follows:

150 million VND/person/accident for human damage caused by motor vehicles.

50 million VND/accident for property damage caused by the owner of a 2-wheeled motorbike, 3-wheeled motorbike, or motorbike (including electric motorbike).

Therefore, according to many experts, compulsory civil liability insurance for motorbike owners is a necessary and humane policy.

When participating in traffic by motor vehicles in general and motorbikes in particular, unavoidable accidents can occur. Dealing with these consequences is a must, whether the person involved wants it or not. Therefore, without insurance, the economic burden will often exceed the vehicle owner's ability.

Therefore, in most countries in the world, including Vietnam, motorbike insurance is mandatory. Insurance companies act as intermediaries so that everyone can share the burden of traffic accident consequences. This is also the responsibility of vehicle owners to other road users and to society.

There are also opinions that insurance compensation procedures are quite complicated, so many people are afraid. Therefore, they tend to negotiate when traffic collisions occur. However, this trend can be good, but it can also lead to more complicated situations such as fights and arguments. There are many cases of fights leading to serious consequences and violations of criminal law.

Currently, insurance companies in Vietnam have caught up with international practices. That is, simplifying many steps to create the best conditions for insurance participants. Legal documents also stipulate more clearly the responsibility of insurance companies towards customers. Therefore, participating in motorbike insurance is not only to comply with the law, but also brings many benefits to the vehicle owner, passengers and third parties in accidents.

The benefits of compulsory civil liability insurance for motorbike owners include:

Insurance companies compensate third parties on behalf of vehicle owners: In cases of risks when participating in traffic, accidents within the scope of insurance, drivers of motorbikes and scooters with legal driving licenses will not have to compensate the person in the collision and the person directly sitting on the vehicle. Instead, the insurance company will pay this civil liability on behalf of the vehicle owner.

Importantly, the insurance company covers all bodily injuries to third parties regardless of whether the victim is at fault or not.

What is the penalty for not having motorcycle insurance?

Of course, when a policy is created to be enforced and disseminated to all citizens, the authorities always need to impose it. That is, the traffic police patrol the streets, can stop vehicles when drivers violate the law and they will certainly ask for a certificate of motorbike insurance.

Penalties for not having civil liability insurance for motorbikes are implemented according to Article 21 of Decree 100/2019/ND-CP:

Drivers of motorbikes, mopeds or similar vehicles without or without carrying a valid motor vehicle owner's civil liability insurance certificate shall be fined from 100,000 to 200,000 VND.

Therefore, not only do motor vehicle owners need to buy civil liability insurance, but traffic participants also need to carry it when driving on the road. This avoids trouble if the traffic police stop the vehicle for inspection, or in unexpected situations.