Breakthrough in policy credit in Dien Chau

As the transaction office with the largest outstanding debt in the province, after 10 years of implementing Directive No. 40 on "Strengthening the Party's leadership in social policy credit", the loan capital from the Policy Bank in Dien Chau has actively contributed to poverty reduction, helping hundreds of thousands of poor households and policy families to develop their economy.

Hand over the fishing rod

Regularly, on the 21st of every month, the Dien Chau District Social Policy Bank conducts transactions at the People's Committee of Dien Ngoc Commune. Early in the morning, Ms. Pho Thi Thi - Head of the women's loan group in Ngoc Minh hamlet, Dien Ngoc Commune, went to the transaction point of the Commune People's Committee to deposit savings (more than 15 million VND) of households managed by the group into the Social Policy Bank. Ms. Thi said that her group manages 57 members with a total capital of 1.643 billion VND, mainly people borrowing from the clean water program, investing in buying fishing gear, machinery and equipment, building grocery kiosks, etc. Since having loans from the Social Policy Bank, the lives of members have become more and more stable and developed.

During the production and business process, members consciously save money and deposit it in the Policy Bank. Thereby, they not only save for themselves and their families but also accompany the State in implementing the poverty reduction campaign, increasing capital sources for lending to the poor and other policy beneficiaries.

Ms. Pho Thi Thi - Head of the women's loan group in Ngoc Minh hamlet, Dien Ngoc commune

Dien Van is a difficult coastal commune, in the past people mainly only looked at fish, salt grains... However, coming to Dien Van today, the rural appearance has changed. Along the Bung River, many houses are close together. People here produce and raise livestock in the direction of goods, associated with the development of small-scale industry and seafood farming and processing.

-5cf312286e92a5a6d8489ac504da6ad0.jpg)

Visiting Mr. Tran Dinh Quyen's family in Dong Ha hamlet, Dien Van commune, his wife was busy with wholesale grocery business, while Mr. Quyen was busy raising deer and shrimp ponds. In 2015, with 50 million VND approved for a loan from the program for production and business households in difficult areas, Mr. Quyen started building a barn and bought a pair of breeding deer to raise. Thanks to proper breeding techniques, the deer grew quickly and reproduced, increasing in number rapidly. At one point, the deer barn had up to 16 deer.

In addition to selling deer antlers, his family has also become a reliable supplier of deer breeds for people. The family continues to use the profits from raising deer to invest in white-leg shrimp ponds. Mr. Quyen said that with the policy of encouraging the conversion of ineffective agricultural land into local aquaculture and seafood farming, he has converted to shrimp farming. Currently, each crop, he sells 2.5 - 3 tons of commercial shrimp. Raising deer and shrimp brings in more than 200 million VND/year for the family, allowing them to send their children to school.

In Dien Chau district, there are many effective economic models thanks to loans from the Policy Bank. Coming to Dien Lien commune, we were surprised by the garden-pond-cage model of the family of Mr. Duong Van Khieu and Ms. Phan Thi Hue in hamlet 3, Dien Lien commune. As a near-poor household, in 2019, his family was able to borrow 50 million VND to invest in a fish pond. After paying off this loan, his family was approved to borrow another 100 million VND. With this amount of money, the family invested in expanding the fish pond to 4 hectares; planting fruit trees such as jackfruit, grapefruit, sapodilla and raising chickens and ducks, bringing in a profit of more than 200 million VND for his family each year.

Thanks to diligence and hard work, the farm has borne fruit, each season has its own products, very pleasing to the eye. “Products are produced and consumed as soon as they are produced thanks to the effective application of digital technology platforms to introduce and promote products. When it is time to harvest fish, poultry or fruits in the garden, I post on Facebook, Zalo, TikTok with my phone number so that everyone knows, and anyone who is interested can contact me in advance. Since applying technology, my family's agricultural products have been consumed many times faster, and I have gained new loyal customers. My family hopes to continue to borrow capital from the Policy Bank to expand livestock production and develop a sustainable economy,” Ms. Hue shared.

The government got involved

Directive No. 40 is considered a breath of fresh air that positively changes social policy credit, making an important contribution to the construction of new rural areas, changing the face of Dien Chau district. And in that process, the Social Policy Bank has accompanied the people, quickly disbursed capital with low interest rates, quick procedures, on-site transactions, providing practical support for many households to rise up and stabilize their lives.

Mr. Nguyen Van Tuan - Director of Dien Chau District Social Policy Bank said: As the transaction office with the largest outstanding debt in the province, in 10 years of implementing Directive No. 40-CT/TW, Dien Chau District Social Policy Bank has provided loans to 53,261 poor households, near-poor households, and newly escaped poverty households with a turnover of more than VND 1,837 billion, accounting for 81% of total loans for production, business, and gradually escaping poverty sustainably. In addition, capital sources serving the goals of social security and new rural construction achieved a loan turnover of more than VND 432.2 billion.

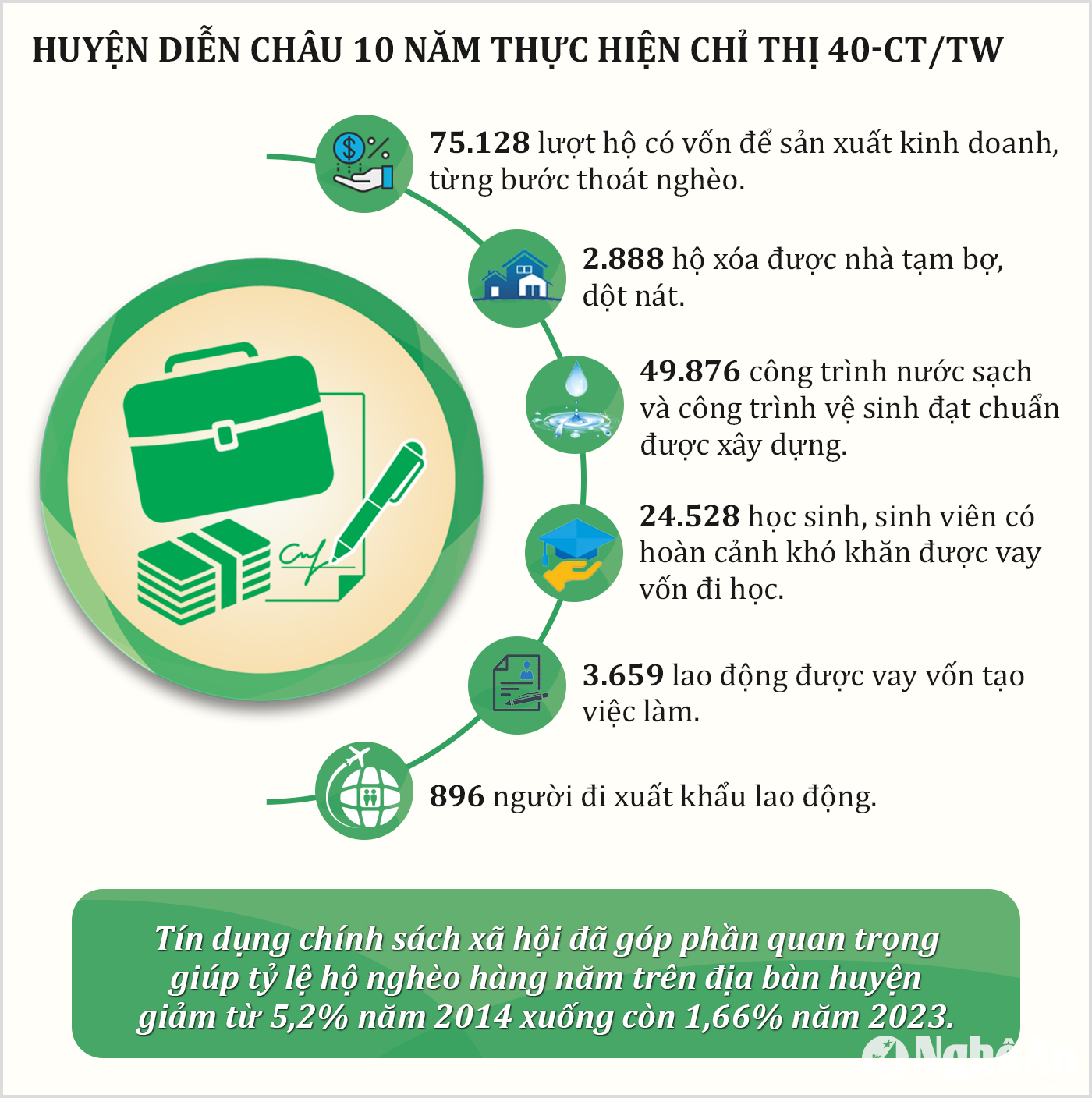

Thanks to that, in 10 years, 75,128 households have had capital for production and business, gradually escaping poverty, 2,888 households have eliminated temporary and dilapidated houses, built 49,876 clean water works and standard sanitation works, nearly 24,528 students in difficult circumstances have received loans to study, 3,659 workers have received loans to create jobs, 896 people have gone to work abroad... Social policy credit has contributed significantly to helping the annual poverty rate in the district decrease from 5.2% in 2014 to 1.66% in 2023.

The results achieved cannot be mentioned without mentioning the role and support of authorities at all levels in using policy capital. Mr. Ha Xuan Quang - Secretary of Dien Chau District Party Committee said: Dien Chau is a coastal district with a large population, high demand for loans for production and business development, especially credit capital from the Social Policy Bank.

To effectively implement Directive No. 40-CT/TW and Directive No. 29 dated June 17, 2015 of the Provincial Party Committee Standing Committee on strengthening the Party's leadership over social policy credit, we focus on the role and responsibility of local leaders in grassroots credit work, creating favorable conditions for the poor and policy beneficiaries to access capital and use loans effectively. Mobilizing resources for social policy credit is also a task of local concern. The outstanding policy capital debt in the area is nearly one thousand billion VND, of which more than 7 billion VND is transferred from the district budget.

It can be affirmed that policy loans have become a solid foundation to help poor households, near-poor households, and newly escaped-poverty households in Dien Chau district to cover their living expenses, continue to invest in production development, improve their living standards, escape poverty, and become rich legitimately. This is also an important driving force to help Dien Chau district continue to complete the criteria in building advanced new rural areas.