The case of late payment penalty for winning land auction in Cua Lo: Citizens' complaints have grounds

The case of a citizen complaining about the Bac Vinh Tax Department's fine for late payment of land use fees for auctioned land that is not in accordance with the law was reported by Nghe An Newspaper on June 13, 2024. The content has been clarified, accordingly, the citizen's complaint is well-founded.

Summary of the case

As Nghe An Newspaper reported in the article “What can we see from citizens’ complaints about fines for late payment of auctioned land use fees”, Mr. Nguyen Van Dinh, residing in Block 10, Le Loi Ward (Vinh City), is the winner of the auction of 3 land lots in the planned Cold Storage area, Nghi Tan Ward, Cua Lo Town, with a total amount of more than 5 billion VND.

When carrying out the procedures to obtain a Land Use Rights Certificate, he was fined for late payment of land use fees, even though he had previously paid the full auction winning amount to the State budget.

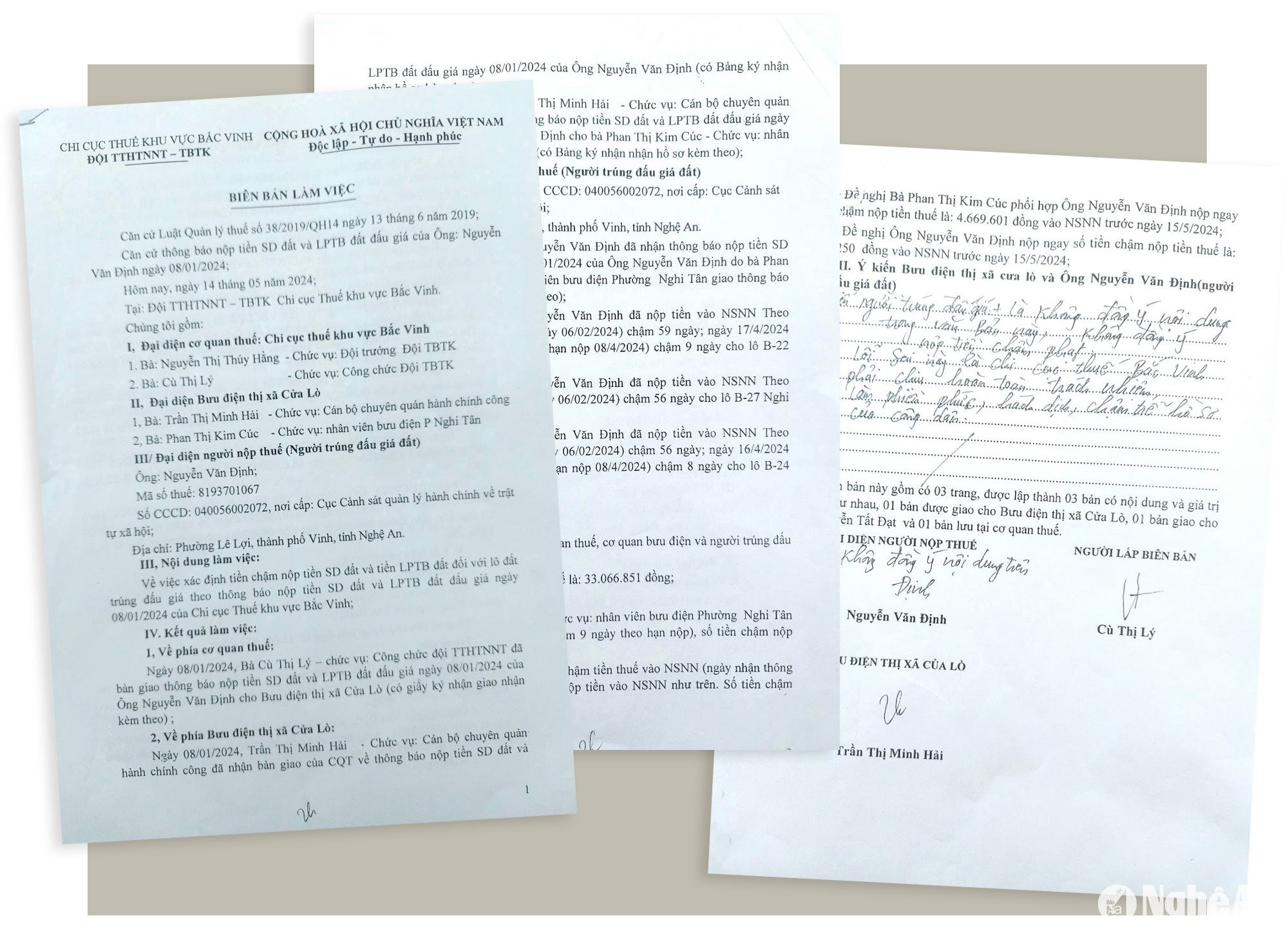

Requesting clarification of the reason, on May 14, 2024, Mr. Nguyen Van Dinh was met by a representative of the Taxpayer Support Information Team (Bac Vinh Tax Branch) in coordination with Cua Lo Town Post Office. Here, the citizen was informed: On January 8, 2024, the Bac Vinh Tax Branch issued a Notice of payment of land use fees and land auction registration fees to Mr. Nguyen Van Dinh; on the same day, the tax officer handed over the notice to Cua Lo Town Post Office.

Cua Lo Town Post Office confirmed that on January 8, 2024, it received the notice from the tax authority, and on the same day, it handed over the notice to the staff of Nghi Tan Ward Post Office. This unit also confirmed that Mr. Nguyen Van Dinh received the notice of payment of land use fees and land auction fees on February 15, 2024, delivered by the staff of Nghi Tan Ward Post Office.

At the same time, compare the time Mr. Nguyen Van Dinh paid land use fees for each plot of land to the State budget with the payment deadline stated in the notice, to conclude that the total amount of late payment for land use fees for auctioned land is 33,066,851 VND.

From here, it is determined that the Nghi Tan Ward Post Office staff is responsible for the late tax payment of VND 4,669,601; Mr. Nguyen Van Dinh personally is responsible for paying the late tax payment of VND 28,397,250; and it is requested that the Nghi Tan Ward Post Office staff coordinate with Mr. Nguyen Van Dinh to pay the amount of VND 4,669,601, and Mr. Nguyen Van Dinh personally pay the amount of VND 28,397,250 before May 15, 2024.

However, Mr. Nguyen Van Dinh did not agree because “The notice of the Bac Vinh Regional Tax Department was not delivered to him; the Nghi Tan Ward Post Office staff delivered the notice late, and delivered it to another land auction winner, but this person did not deliver it to him…”. And Mr. Dinh commented in the minutes: “I do not agree with the content of this document, I do not agree to pay the late penalty…”. After that, Mr. Dinh filed a complaint to a number of provincial agencies, the Tax Department and Nghe An Newspaper.

In the complaint, Mr. Dinh cited Article 13, Circular 14/2015/TTLT-BTNMT-BTP stipulating the responsibility of the tax authority in issuing notices of land use fee payment; the responsibility of the tax officer in charge of sending tax notices and guiding the auction winner to implement the provisions in the tax notice... Thereby, Mr. Dinh said that the Bac Vinh Tax Department's fine for late payment of auction land use fee against him was against the law and recommended: "The Bac Vinh Tax Department must take full responsibility for the delay in my red book issuance, causing damage to my economy, my rights and legitimate interests. So I write this petition to respectfully request that your agency step in to verify, handle and resolve the matter so that the People's Committee of Cua Lo town can issue me a Land Use Right Certificate...".

"Partially correct" complaint

Working with the Bac Vinh Regional Tax Department on June 11, 2024, we were informed that the unit was organizing an inspection and review to handle the complaint. Specifically, the Deputy Head of the Department, Pham Thi Hong Van, said: “We have worked with the person authorized by Mr. Dinh; on the same day, we also arranged to work with the Cua Lo Town Post Office. Because the person with the complaint also complained about the working attitude of the tax officer, we will also verify. After that, we will organize a working session with all relevant parties to resolve the matter and respond to the press…”.

Therefore, in the article "What can be seen from the citizen's complaint about the fine for late payment of land use fees for the auctioned land", Nghe An Newspaper only mentioned the content of the complaint, at the same time, reminded that the Tax Department of Bac Vinh area issued the tax payment notice on January 8, 2024, while the Taxpayer Support Information Team determined that Mr. Nguyen Van Dinh had just received the notice on February 15, 2024, to determine that the Nghi Tan Ward Post Office staff had been late; while the relevant tax officers were not interested in checking, guiding, and urging the land auction winners to fulfill their obligations to the State.

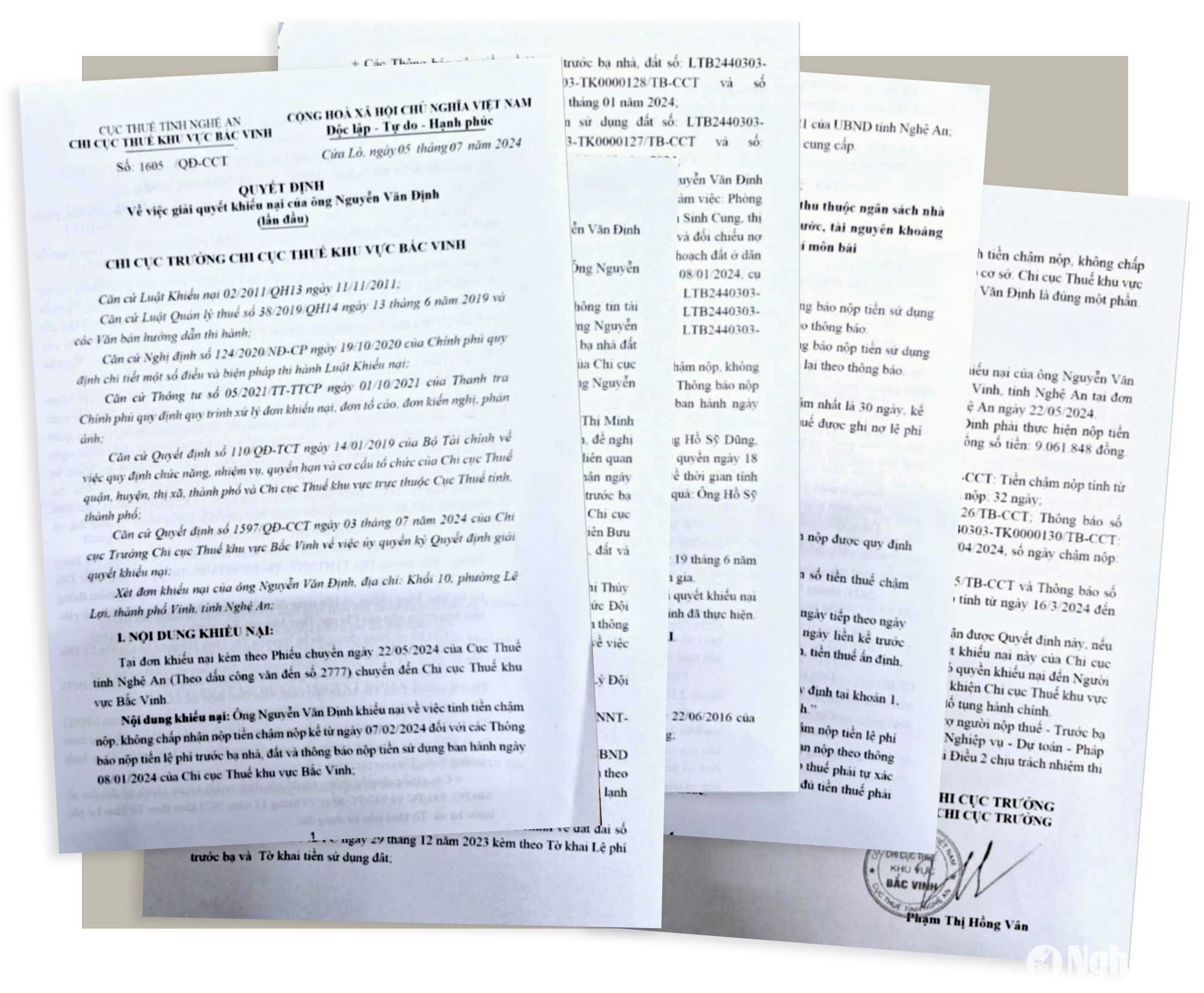

According to Deputy Head of the Bac Vinh Tax Branch Pham Thi Hong Van, the Branch has completed the settlement of Mr. Nguyen Van Dinh's complaint in Decision No. 1605/QD-CCT dated July 5, 2024. Accordingly, the Verification Team of the Bac Vinh Tax Branch has collected, checked, reviewed records and documents as well as worked with relevant parties to conclude: "Mr. Nguyen Van Dinh's complaint about the calculation of late payment fees, not accepting late payment fees from February 7, 2024 for the Notices of payment of house and land registration fees and notices of payment of land use fees issued on January 8, 2024 of the Bac Vinh Tax Branch is well-founded".

In addition, Decree No. 126/2020/ND-CP dated October 19, 2020 of the Government was used to review and clarify the responsibilities of relevant parties regarding the late payment of land use fees applied to Mr. Nguyen Van Dinh.

That is the basis for the Bac Vinh Tax Department to conclude: "Mr. Nguyen Van Dinh's complaint about the calculation of late payment fees and refusal to pay late payment fees from February 7, 2024 is well-founded. The Bac Vinh Tax Department determined that Mr. Nguyen Van Dinh's complaint was partially correct. And decided: "Partially recognized the content of the complaint of Mr. Nguyen Van Dinh, address: Block 10, Le Loi Ward, Vinh City, Nghe An Province in the complaint attached with the transfer receipt of the Nghe An Provincial Tax Department dated May 22, 2024. Mr. Nguyen Van Dinh's responsibility is to pay late payment fees for registration fees and land use fees, with a total amount of VND 9,061,848".

After receiving information from the Bac Vinh Tax Department about the complaint settlement, we contacted the person authorized by Mr. Nguyen Van Dinh (Mr. Ho Sy Dung), and were provided with 2 "State budget payment receipts". In which, 1 receipt shows that a tax officer "paid on behalf of" Mr. Nguyen Van Dinh the amount of 19,335,402 VND; 1 receipt shows that a post office employee "paid on behalf of" Mr. Nguyen Van Dinh the amount of 4,669,601 VND.

According to Mr. Ho Sy Dung, although the fine was reduced, Mr. Nguyen Van Dinh still did not completely agree with the complaint settlement of the Bac Vinh Tax Department, because the basis for forcing him to pay the amount of 9,061,848 VND was unclear. However, in order to have the government issue a Land Use Rights Certificate for the 3 auctioned plots of land, Mr. Nguyen Van Dinh paid the full amount.

Reviewed the responsibility of the staff

Speaking with Nghe An Newspaper on July 25, 2024, Deputy Head of the Bac Vinh Tax Department Pham Thi Hong Van said that after resolving Mr. Nguyen Van Dinh's complaint, the Department organized a review of responsibilities and took disciplinary action against the relevant tax officers.