Gold price today January 20, 2025: World and domestic gold prices fluctuate

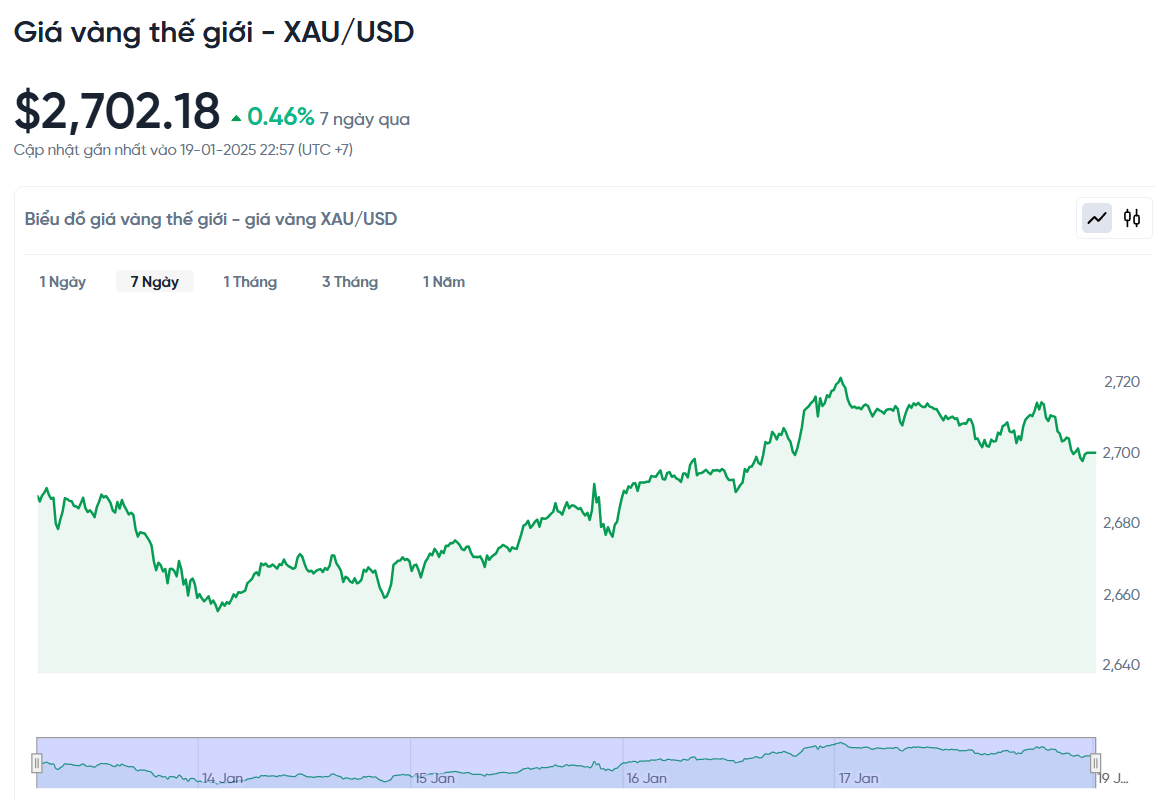

Gold price today January 20, 2025: Domestic gold prices witnessed a sharp decline across the week. In contrast to the world gold price increasing for 3 consecutive weeks, exceeding 2,700 USD

To conclude the week, domestic gold prices fluctuated in opposite directions when SJC gold increased slightly by 100,000 VND/tael in both buying and selling directions. Meanwhile, the price of gold rings and jewelry turned to decrease sharply by 200,000-400,000 VND/tael (depending on the type).

At the time of survey at 4:30 a.m. on January 20, 2025, the gold price on the trading floors of some companies was as follows:

The price of 9999 gold today is listed by DOJI at 84.9 million VND/tael for buying and 86.9 million VND/tael for selling. Both buying and selling prices remain unchanged compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 85.5-86.5 million VND/tael for buying and selling. Compared to yesterday, the gold price remained unchanged in both buying and selling directions.

SJC gold price at Bao Tin Minh Chau Company Limited was traded by businesses at 84.9-86.9 million VND/tael (buying - selling), unchanged in both buying and selling directions compared to yesterday.

SJC gold price at PNJ is traded by businesses at 84.9-86.9 million VND/tael (buying - selling), unchanged in both buying and selling directions compared to yesterday.

The latest gold price list today, January 20, 2025 is as follows:

| Gold price today | January 20, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 84.9 | 86.9 | - | - |

| DOJI Group | 84.9 | 86.9 | - | - |

| Mi Hong | 85.5 | 85.5 | - | - |

| PNJ | 84.9 | 86.9 | - | - |

| Vietinbank Gold | 86.9 | - | ||

| Bao Tin Minh Chau | 84.9 | 86.9 | - | - |

| 1.DOJI- Updated: 2025-1-20 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| AVPL/SJC HN | 84,900 | 86,900 |

| AVPL/SJC HCM | 84,900 | 86,900 |

| AVPL/SJC DN | 84,900 | 86,900 |

| Raw material 9999 - HN | 84,400 | 85,300 |

| Raw materials 999 - HN | 84,300 | 85,200 |

| AVPL/SJC Can Tho | 84,900 | 86,900 |

| 2.PNJ- Updated: 18/1/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| HCMC - PNJ | 85,000 | 86,900 |

| HCMC - SJC | 84,900 | 86,900 |

| Hanoi - PNJ | 85,000 | 86,900 |

| Hanoi - SJC | 84,900 | 86,900 |

| Da Nang - PNJ | 85,000 | 86,900 |

| Da Nang - SJC | 84,900 | 86,900 |

| Western Region - PNJ | 85,000 | 86,900 |

| Western Region - SJC | 84,900 | 86,900 |

| Jewelry gold price - PNJ | 85,000 | 86,900 |

| Jewelry gold price - SJC | 84,900 | 86,900 |

| Jewelry gold price - Southeast | PNJ | 85,000 |

| Jewelry gold price - SJC | 84,900 | 86,900 |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 85,000 |

| Jewelry gold price - Jewelry gold 999.9 | 85,000 | 86,400 |

| Jewelry gold price - 999 jewelry gold | 85,510 | 86,310 |

| Jewelry gold price - 99 jewelry gold | 84,640 | 85,640 |

| Jewelry gold price - 916 gold (22K) | 78,240 | 79,240 |

| Jewelry gold price - 750 gold (18K) | 63,550 | 64,950 |

| Jewelry gold price - 680 gold (16.3K) | 57,500 | 58,900 |

| Jewelry gold price - 650 gold (15.6K) | 54,910 | 56,310 |

| Jewelry gold price - 610 gold (14.6K) | 51,450 | 52,850 |

| Jewelry gold price - 585 gold (14K) | 49,290 | 50,690 |

| Jewelry gold price - 416 gold (10K) | 34,690 | 36,090 |

| Jewelry gold price - 375 gold (9K) | 31,150 | 32,550 |

| Jewelry gold price - 333 gold (8K) | 27,260 | 28,660 |

| 3. SJC - Updated: 20/1/2025 20:30 - Website time of supply - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| SJC 1L, 10L, 1KG | 84,900 | 86,900 |

| SJC 5c | 84,900 | 86,920 |

| SJC 2c, 1C, 5 phan | 84,900 | 86,930 |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 84,600 | 86,300 |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 84,600 | 86,400 |

| 99.99% Jewelry | 84,500 | 86,000 |

| 99% Jewelry | 82,648 | 85,148 |

| Jewelry 68% | 55,635 | 58,635 |

| Jewelry 41.7% | 33,015 | 36,015 |

World gold price today January 20, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 5:00 a.m. today, Vietnam time, was 2,702.18 USD/ounce. Today's gold price is unchanged from yesterday. Converted to the USD exchange rate, on the free market (25,530 VND/USD), the world gold price is about 83.1 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 4.2 million VND/tael higher than the international gold price.

Precious metals rose as investors forecast the US Federal Reserve would be slower to cut interest rates than previously expected and demand for safe-haven assets remained strong.

The strong growth of gold prices this week is also attributed to investors predicting that Mr. Donald Trump will implement his tariff commitment right after his inauguration, which could increase inflation while the FED keeps interest rates unchanged, creating favorable conditions for gold prices to increase sharply next week.

In addition, if Mr. Trump implements the tariff policy after his inauguration, there is a high possibility that there will be a tariff war, especially the US-China trade war. This could destabilize the global economy, even the risk of stagflation (low growth, high inflation), pushing gold prices up sharply in the near future.

Gold price forecast

Increased uncertainty from the new administration and policies is making gold an attractive short-term trade, said Michael Langford, investment director at Scorpion Minerals.

Gold prices could hit $3,200 an ounce this year, according to Ross Norman, CEO of Metals Daily.

The expert said that the rising USD and Treasury yields may only help to restrain the rate of increase in gold prices. Gold prices may accelerate again when the "handbrake" is released. The reason for the increase in gold prices is due to central bank buying and OTC derivatives activities in Asia.

Norman predicts an average spot gold price of $2,888/ounce in 2025, with a high of $3,175/ounce and a low of $2,630/ounce.

Kitco News’ survey of gold price forecasts for next week shows that the majority of opinions still expect the precious metal to go up. Specifically, of the 11 Wall Street analysts participating in the survey, 7 people, or 64%, said that gold will increase. On the other hand, 2 analysts predicted a decrease and the remaining 2 opinions said that gold prices will go sideways.

In a Main Street survey of 156 individual investors, 105, or 64%, also predicted gold prices would rise, while 34, or 22%, held the opposite view; the remaining 17 investors thought gold would move sideways.