Gold price today January 25, 2025: World gold price and domestic gold price increase, approaching historical peak

Gold price today January 25, 2025: World gold price increased sharply at a level close to the record high in October. Domestic gold price skyrocketed, approaching the historical peak of 89 million VND.

Domestic gold price today January 25, 2025

At the time of survey at 4:30 a.m. on January 25, 2025, the gold price on the trading floors of some companies was as follows:

DOJI listed the price of 9999 gold today at 86.6 million VND/tael for buying and 88.1 million VND/tael for selling. An increase of 200 thousand VND/tael in both buying and selling compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 86.8-88.5 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 500 thousand VND/tael for buying and 1.1 million VND/tael for selling.

SJC gold price at Bao Tin Minh Chau Company Limited was traded by businesses at 86.8-88.8 million VND/tael (buying - selling), an increase of 700 thousand VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 86.4-88.9 million VND/tael (buy - sell), an increase of 200 thousand VND/tael in buying - an increase of 500 thousand VND/tael in selling compared to yesterday.

The latest gold price list today, January 25, 2025 is as follows:

| Gold price today | January 25, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 86.8 | 88.8 | +700 | +700 |

| DOJI Group | 86.9 | 88.9 | +800 | +800 |

| Mi Hong | 86.8 | 88.5 | +500 | +1,100 |

| PNJ | 86.8 | 88.8 | +400 | +400 |

| Vietinbank Gold | 88.8 | +700 | ||

| Bao Tin Minh Chau | 86.8 | 88.8 | +700 | +700 |

| Phu Quy | 86.4 | 88.9 | +200 | +500 |

| 1.DOJI- Updated: 25/1/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| AVPL/SJC HN | 86,900▲800K | 88,900▲800K |

| AVPL/SJC HCM | 86,900▲800K | 88,900▲800K |

| AVPL/SJC DN | 86,900▲800K | 88,900▲800K |

| Raw material 9999 - HN | 86,400▲200K | 87,200▲200K |

| Raw materials 999 - HN | 86,300▲200K | 87,100▲200K |

| AVPL/SJC Can Tho | 86,900▲800K | 88,900▲800K |

| 2.PNJ- Updated: 25/1/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| HCMC - PNJ | 86,600▲500K | 88,100▲400K |

| HCMC - SJC | 86,800▲400K | 88,800▲400K |

| Hanoi - PNJ | 86,600▲500K | 88,100▲400K |

| Hanoi - SJC | 86,800▲400K | 88,800▲400K |

| Da Nang - PNJ | 86,600▲500K | 88,100▲400K |

| Da Nang - SJC | 86,800▲400K | 88,800▲400K |

| Western Region - PNJ | 86,600▲500K | 88,100▲400K |

| Western Region - SJC | 86,800▲400K | 88,800▲400K |

| Jewelry gold price - PNJ | 86,600▲500K | 88,100▲400K |

| Jewelry gold price - SJC | 86,800▲400K | 88,800▲400K |

| Jewelry gold price - Southeast | PNJ | 86,600▲500K |

| Jewelry gold price - SJC | 86,800▲400K | 88,800▲400K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 86,600▲500K |

| Jewelry gold price - Jewelry gold 999.9 | 86,500▲500K | 87,900▲500K |

| Jewelry gold price - 999 jewelry gold | 86,410▲500K | 87,810▲500K |

| Jewelry gold price - 99 jewelry gold | 86,120▲490K | 87,120▲490K |

| Jewelry gold price - 916 gold (22K) | 79,620▲460K | 80,620▲460K |

| Jewelry gold price - 750 gold (18K) | 64,680▲380K | 66,080▲380K |

| Jewelry gold price - 680 gold (16.3K) | 58,520▲340K | 59,920▲340K |

| Jewelry gold price - 650 gold (15.6K) | 55,890▲330K | 57,290▲330K |

| Jewelry gold price - 610 gold (14.6K) | 52,370▲310K | 53,770▲310K |

| Jewelry gold price - 585 gold (14K) | 50,170▲290K | 51,570▲290K |

| Jewelry gold price - 416 gold (10K) | 35,320▲210K | 36,720▲210K |

| Jewelry gold price - 375 gold (9K) | 31,710▲180K | 33,110▲180K |

| Jewelry gold price - 333 gold (8K) | 27,760▲170K | 29,160▲170K |

| 3. SJC - Updated: January 25, 2025 04:30 - Website time of supply - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| SJC 1L, 10L, 1KG | 86,800▲700K | 88,800▲700K |

| SJC 5c | 86,800▲700K | 88,820▲700K |

| SJC 2c, 1C, 5 phan | 86,800▲700K | 88,830▲700K |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 86,300▲200K | 88,000▲200K |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 86,300▲200K | 88,100▲200K |

| 99.99% Jewelry | 86,200▲200K | 87,700▲200K |

| 99% Jewelry | 84,331▲198K | 86,831▲198K |

| Jewelry 68% | 56,791▲136K | 59,791▲136K |

| Jewelry 41.7% | 33,724▲83K | 36,724▲83K |

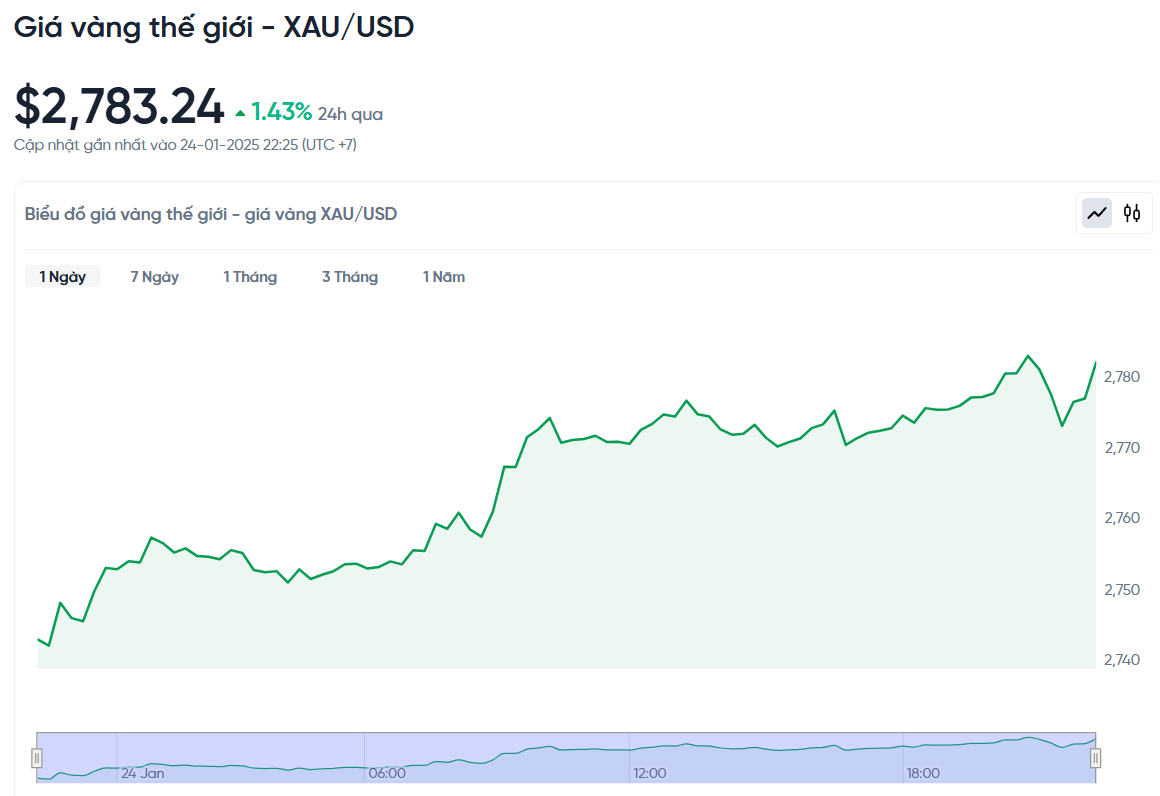

World gold price today January 25, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 5:00 am today, Vietnam time, was 2,783.24 USD/ounce. Today's gold price increased by 39.32 USD/ounce compared to yesterday. Converted according to the USD exchange rate, on the free market (25,600 VND/USD), the world gold price is about 86.84 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 1.96 million VND/tael higher than the international gold price.

Gold prices continued to rise sharply, remaining close to the record high reached in October, mainly due to the impact of US President Donald Trump's call for lower interest rates and uncertainty surrounding his trade policies.

World gold prices increased by 2.67% compared to last week. This is the highest price since October 31, when gold prices hit a record high of 2,790.15 USD/ounce. US gold futures for February delivery also increased by 0.7% to 2,783.80 USD/ounce.

The dollar fell to a one-month low, making gold cheaper for foreign investors. Gold’s rise toward a new record high coincided with a pullback in the dollar after comments from Mr. Trump that he could ease tariffs and reach a trade deal with China, according to independent analyst Ross Norman.

Mr. Norman also predicted that gold prices are likely to reach $3,175 an ounce by 2025.

On Thursday at the World Economic Forum, Mr. Trump said he would demand an immediate interest rate cut. In an interview with Fox News, he also said he did not want to impose tariffs on China.

Gold, a non-yielding asset, is often seen as a hedge against political and economic uncertainty, and tends to appreciate in low-interest-rate environments.

Mr Trump's comments came ahead of next week's Federal Reserve meeting, where policymakers are expected to keep interest rates unchanged.

Besides gold, spot silver also rose 1.4% to $30.88 an ounce, palladium rose 1% to $1,001.51 an ounce and platinum rose 0.6% to $947.63 an ounce. All three precious metals were on an upward trend this week.

However, platinum and palladium could face some short-term downward pressure, according to Zain Vawda, market analyst at OANDA's MarketPulse. He also noted that sanctions against Russia could impact the market, as Russia is one of the world's largest producers of palladium.

This week, Mr. Trump said he might impose new sanctions, including tariffs, on Russia if a deal on Ukraine is not reached.

Gold price forecast

Giving a forecast for the gold market next year, Dr. Le Xuan Nghia, a member of the National Financial and Monetary Policy Advisory Council, said that the gold price in 2025 will not fluctuate as much as in 2024. It will be difficult to increase but also difficult to decrease deeply because a new price level has been established.

According to economist Pham Thi Lan, Director of ABE Asset Management and Investment Fund Company, the gold price in 2025 will increase more slowly than in 2024, mainly concentrated in the first half of the year. Although the upward trend still exists, the strong increase like in 2024 (gold bars increased by 10.2 million VND/tael, gold rings increased by 20.8 million VND/tael) is unlikely to repeat.

Commenting on the gold market in 2025, Dr. Nguyen Minh Phong, an economic expert, affirmed that domestic gold prices this year will continue to be adjusted, but the fluctuations will be less than in previous years.

"Gold prices will still fluctuate, but the gap between domestic and international gold prices will gradually narrow and the price differentiation between gold brands such as SJC, gold rings or gold bars will also decrease," said Mr. Phong.

According to Mr. Phong, the Vietnamese gold market will gradually become more stable thanks to the strong intervention of the authorities, along with the fact that commercial banks are implementing more transparent policies in supplying gold to the market. This will help minimize risks for investors and people in gold transactions.