Gold price today March 19, 2025: Domestic and world gold prices may increase to 100 million by the end of March

Gold price this morning March 19, 2025: Domestic gold price continues to increase by nearly 500 thousand VND. World gold price increases due to new political instability in the world.

Domestic gold price today March 19, 2025

At the time of survey at 9:30 a.m. on March 19, 2025, the domestic gold price continuously increased to nearly 100 million VND for both gold bars and gold rings:

DOJI Group listed the price of SJC gold bars at 97.1-98.6 million VND/tael (buy - sell), an increase of 400 thousand VND/tael in both buying and selling directions compared to the previous session.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 97.1-98.6 million VND/tael (buy - sell), an increase of 400 thousand VND/tael in both buying and selling directions compared to the early morning session today.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 97.6-98.6 million VND/tael for buying and selling. Compared to the early morning session, the gold price increased by 100 thousand VND/tael for both buying and selling.

SJC gold price at Bao Tin Minh Chau Company Limited was traded by businesses at 97.1-98.6 million VND/tael (buying - selling), an increase of 400 thousand VND/tael in both buying and selling directions compared to the previous session.

SJC gold price at Phu Quy was traded by businesses at 97.1-98.6 million VND/tael (buy - sell), gold price increased 400 thousand VND/tael in both buying and selling directions compared to the previous session.

As of 9:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 97.65-99.2 million VND/tael (buy - sell); an increase of 400,000 VND/tael in buying - an increase of 500,000 VND/tael in selling compared to the previous session.

Bao Tin Minh Chau listed the price of gold rings at 97.25-98.8 million VND/tael (buy - sell); an increase of 400 thousand VND/tael in both buying and selling directions compared to the previous session.

Following the current strong increase, it is forecasted that the domestic gold price may increase to reach the historical milestone of 100 million VND by the end of March. This is an important milestone marking the strong increase in gold prices in the context of escalating conflicts in the world and global financial instability.

The latest gold price list today, March 19, 2025 is as follows:

| Gold price today | March 19, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 97.1 | 98.6 | +400 | +400 |

| DOJI Group | 97.1 | 98.6 | +400 | +400 |

| Mi Hong | 97.6 | 98.6 | +100 | +100 |

| PNJ | 97.1 | 98.6 | +400 | +400 |

| Vietinbank Gold | 98.6 | +400 | ||

| Bao Tin Minh Chau | 97.1 | 98.6 | +400 | +400 |

| Phu Quy | 97.1 | 98.6 | +400 | +400 |

| 1.DOJI- Updated: 19/3/2025 09:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| AVPL/SJC HN | 97,100▲400K | 98,600▲400K |

| AVPL/SJC HCM | 97,100▲400K | 98,600▲400K |

| AVPL/SJC DN | 97,100▲400K | 98,600▲400K |

| Raw material 9999 - HN | 97,600▲400K | 98,200▲400K |

| Raw materials 999 - HN | 97,500▲400K | 98,100▲400K |

| AVPL/SJC Can Tho | 97,100▲400K | 98,600▲400K |

| 2.PNJ- Updated: 19/3/2025 09:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| HCMC - PNJ | 97,400▲500K | 99,000▲500K |

| HCMC - SJC | 97,100▲400K | 98,600▲400K |

| Hanoi - PNJ | 97,400▲500K | 99,000▲500K |

| Hanoi - SJC | 97,100▲400K | 98,600▲400K |

| Da Nang - PNJ | 97,400▲500K | 99,000▲500K |

| Da Nang - SJC | 97,100▲400K | 98,600▲400K |

| Western Region - PNJ | 97,400▲500K | 99,000▲500K |

| Western Region - SJC | 97,100▲400K | 98,600▲400K |

| Jewelry gold price - PNJ | 97,400▲500K | 99,000▲500K |

| Jewelry gold price - SJC | 97,100▲400K | 98,600▲400K |

| Jewelry gold price - Southeast | PNJ | 97,400▲500K |

| Jewelry gold price - SJC | 97,100▲400K | 98,600▲400K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 97,400▲500K |

| Jewelry gold price - Jewelry gold 999.9 | 96,500▲500K | 99,000▲500K |

| Jewelry gold price - 999 jewelry gold | 96,400▲500K | 98,900▲500K |

| Jewelry gold price - 99 jewelry gold | 95,610▲490K | 98,110▲490K |

| Jewelry gold price - 916 gold (22K) | 88,280▲450K | 90,780▲450K |

| Jewelry gold price - 750 gold (18K) | 71,900▲370K | 74,400▲370K |

| Jewelry gold price - 680 gold (16.3K) | 64,970▲340K | 67,470▲340K |

| Jewelry gold price - 650 gold (15.6K) | 62,000▲320K | 64,500▲320K |

| Jewelry gold price - 610 gold (14.6K) | 58,040▲300K | 60,540▲300K |

| Jewelry gold price - 585 gold (14K) | 55,570▲300K | 58,070▲300K |

| Jewelry gold price - 416 gold (10K) | 38,830▲200K | 41,330▲200K |

| Jewelry gold price - 375 gold (9K) | 34,780▲190K | 37,280▲190K |

| Jewelry gold price - 333 gold (8K) | 30,320▲160K | 32,820▲160K |

| 3. SJC - Updated: March 19, 2025 09:30 - Website time of supply - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| SJC 1L, 10L, 1KG | 97,100▲400K | 98,600▲400K |

| SJC 5c | 97,100▲400K | 98,620▲400K |

| SJC 2c, 1C, 5 phan | 97,100▲400K | 98,630▲400K |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 97,000▲400K | 98,500▲400K |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 97,000▲400K | 98,600▲400K |

| 99.99% Jewelry | 97,000▲400K | 98,200▲400K |

| 99% Jewelry | 94,227▲396K | 97,227▲396K |

| Jewelry 68% | 63,932▲272K | 66,932▲272K |

| Jewelry 41.7% | 38,103▲166K | 41,103▲166K |

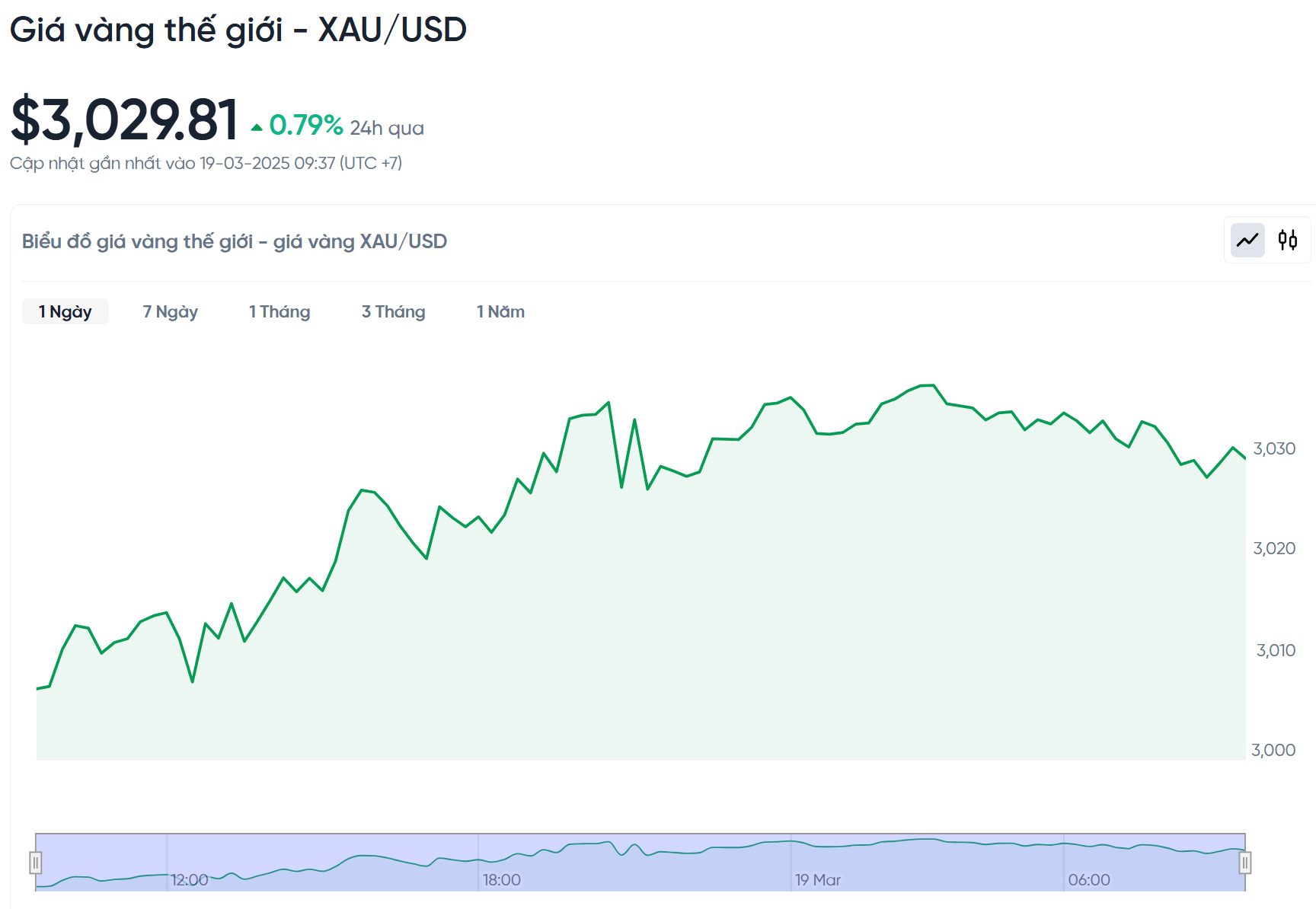

World gold price today March 19, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 9:30 am today, Vietnam time, was 3,029.81 USD/ounce. Today's gold price increased by 23.83 USD/ounce compared to yesterday. Converted according to the USD exchange rate, on the free market (25,840 VND/USD), the world gold price is about 95.4 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 3.2 million VND/tael higher than the international gold price.

The world gold price is increasing sharply in the context of many economic and political factors. One of the main reasons is the need for investors to seek safe havens due to concerns about the global trade war and the loose monetary policy of the US Federal Reserve (Fed). At the same time, the weakening US dollar also contributes to pushing up the gold price.

The Fed holds its two-day monetary policy meeting this week. Despite recent weak U.S. economic data, markets expect the Fed to hold off on changing interest rates for now. Instead, they will wait to see how tariffs and other Trump administration policies affect the economy.

The gloomy outlook for the US and global economy is driving investors to buy gold. Gold prices have risen more than 14% this year, continuing a strong upward trend from last year. Many financial institutions have also revised their gold price forecasts higher in recent weeks.

Analysts say a combination of factors such as economic policy, geopolitical situation and monetary policy are creating a solid foundation for current gold prices. These factors are likely to continue to support gold prices in the near term, as they are unlikely to disappear quickly.

Geopolitical developments are also helping to push gold higher. Israel launched airstrikes in the Gaza Strip on Tuesday morning, breaking a ceasefire that has been in place since January and raising the risk of a resurgence in the 17-month war. Meanwhile, the US has also attacked Houthi targets in the Middle East and said it would continue airstrikes.

In the stock market, shares of Berkshire Hathaway, the conglomerate run by Warren Buffett, also hit a record high in Tuesday trading, showing that, like gold, Berkshire Hathaway shares are also considered a safe haven asset in times of uncertainty.

The world gold price hitting a new peak can create a strong spillover effect to the domestic gold market. Normally, domestic gold prices often fluctuate according to international trends, especially gold rings, which are very sensitive to supply and demand and investment psychology.

Gold price forecast

In the gold market, the April gold contract has the near-term technical advantage. The next target for bulls is to push prices above the resistance level of $3,100/ounce. Meanwhile, the bears are trying to push prices below the support level of $2,900/ounce. Resistance and support levels are determined based on overnight price movements.

If gold prices hold above $3,040 an ounce, the next resistance level would be $3,080 an ounce, a level that could be reached in extreme market scenarios, according to City Index market analyst Razan Hilal.

Although gold has surpassed the $3,000/ounce mark, institutional investors have not yet joined in strongly. Currently, the amount of gold held in ETFs is only about 86 million ounces, much lower than the more than 110 million ounces during the COVID-19 pandemic. This shows that gold prices still have a lot of growth potential.

Speculators have been selling gold contracts in droves over the past six weeks, pushing their net long positions to a three-month low. However, selling pressure eased last week. Latest data from the U.S. Commodity Futures Trading Commission (CFTC) showed that hedge funds have started buying back short positions, which could help gold prices maintain their upward momentum in the near term.

The World Gold Council (WGC) believes that if gold prices continue to stay above the $3,000/ounce mark in the coming weeks, investment demand for gold will increase strongly.

Although gold prices still have many supportive factors, experts warn that the market may soon face correction pressure. Currently, gold is trading at a record high, increasing the psychology of investors to take profits before the end of the first quarter.

According to expert Ole Hansen, gold prices could fall to $2,956/ounce, or even $2,930/ounce if investors rush to take profits. However, he still asserts that any price drop will be a buying opportunity, and the gold price target for 2025 is still kept at $3,300/ounce.