Gold price on April 24, 2025: Domestic and world gold prices increased again, exceeding 121 million VND/tael

Gold price this afternoon, April 24, 2025: Domestic and world gold prices increased again, exceeding 121 million VND. World gold prices recovered strongly after the sell-off by investors due to the low PMI index, causing investors to rush to buy gold.

Domestic gold price today April 24, 2025

At the time of survey at 4:30 p.m. on April 24, 2025, the domestic gold price returned to exceed 121 million VND. Specifically:

DOJI Group listed the price of SJC gold bars at 118.5-121 million VND/tael (buy - sell), an increase of 2 million VND/tael for buying - an increase of 1.5 million VND/tael for selling compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 118.5-121 million VND/tael (buy - sell), an increase of 2 million VND/tael in buying price - an increase of 1.5 million VND/tael in selling price compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 119-121 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 2.5 million VND/tael for buying and 1.5 million VND/tael for selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 118.5-121 million VND/tael (buying - selling, up 2 million VND/tael in buying - up 1.5 million VND/tael in selling compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 118-121 million VND/tael (buy - sell), gold price increased 1.5 million VND/tael in both buying and selling directions compared to yesterday.

As of 4:30 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 113.5-116.3 million VND/tael (buy - sell); an increase of 1 million VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 117-121 million VND/tael (buy - sell); an increase of 2 million VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, April 24, 2025 is as follows:

| Gold price today | April 24, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 118.5 | 121 | +2000 | +1500 |

| DOJI Group | 118.5 | 121 | +2000 | +1500 |

| Mi Hong | 119 | 121 | +2500 | +1500 |

| PNJ | 118.5 | 121.5 | +2000 | +2000 |

| Vietinbank Gold | 121 | +1500 | ||

| Bao Tin Minh Chau | 118.5 | 121 | +2000 | +1500 |

| Phu Quy | 118 | 121 | +1500 | +1500 |

| 1.DOJI- Updated: 4/24/2025 4:30 PM - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 118,500▲2000K | 121,000▲1500K |

| AVPL/SJC HCM | 118,500▲2000K | 121,000▲1500K |

| AVPL/SJC DN | 118,500▲2000K | 121,000▲1500K |

| Raw material 9999 - HN | 113,300▲1000K | 115,400▲1000K |

| Raw materials 999 - HN | 113,200▲1000K | 115,300▲1000K |

| 2.PNJ- Updated: 4/24/2025 4:30 PM - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| SJC 999.9 gold bar | 11,850 | 12,150 |

| PNJ 999.9 Plain Ring | 11,350 | 11,680 |

| Kim Bao Gold 999.9 | 11,350 | 11,680 |

| Gold Phuc Loc Tai 999.9 | 11,350 | 11,680 |

| 999.9 gold jewelry | 11,350 | 11,600 |

| 999 gold jewelry | 11,338 | 11,588 |

| 9920 gold jewelry | 11,267 | 11,517 |

| 99 gold jewelry | 11,244 | 11,494 |

| 750 Gold (18K) | 7,965 | 8,715 |

| 585 Gold (14K) | 6,051 | 6,801 |

| 416 Gold (10K) | 4,091 | 4,841 |

| PNJ Gold - Phoenix | 11,350 | 11,680 |

| 916 Gold (22K) | 10,386 | 10,636 |

| 610 Gold (14.6K) | 6,341 | 7,091 |

| 650 Gold (15.6K) | 6,805 | 7,555 |

| 680 Gold (16.3K) | 7,153 | 7,903 |

| 375 Gold (9K) | 3,615 | 4,365 |

| 333 Gold (8K) | 3,093 | 3,843 |

| 3. SJC - Updated: April 24, 2025 16:30 - Website time of supply - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 118,500▲2000K | 121,000▲1500K |

| SJC gold 5 chi | 118,500▲2000K | 121,020▲1500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 118,500▲2000K | 121,030▲1500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 113,500▲1000K | 116,500▲1000K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 113,500▲1000K | 116,600▲1000K |

| 99.99% jewelry | 113,500▲1000K | 115,900▲1000K |

| 99% Jewelry | 109,752▲990K | 114,752▲990K |

| Jewelry 68% | 72,969▲680K | 78,969▲680K |

| Jewelry 41.7% | 42,485▲417K | 48,485▲417K |

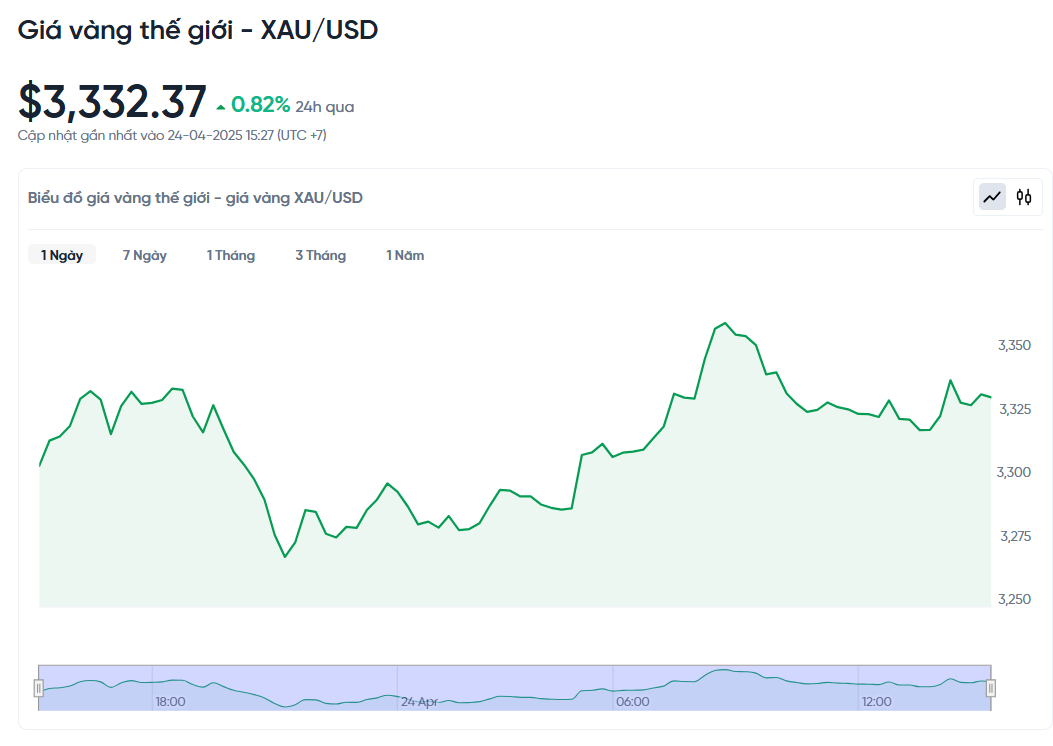

World gold price today April 24, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 p.m. today, Vietnam time, was 3,332.27 USD/ounce. Today's gold price increased by 27 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,174 VND/USD), the world gold price is about 106.21 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 14.79 million VND/tael higher than the international gold price.

Gold prices rose nearly 1% on Monday as investors rushed to buy on dips, after hitting a one-week low on optimism over a US-China trade deal. US gold futures also rose 1.1% to $3,330.20.

According to the latest report from S&P Global, the preliminary PMI (measurement of service activity) fell to 51.4 points compared to 54.4 points in March, while the manufacturing sector showed a slight improvement when the preliminary PMI index increased slightly to 50.7 points. The composite PMI index reflecting the entire economy reached 51.2 points, the lowest level in 16 months, causing investors to rush to buy gold.

Kyle Rodda, financial markets analyst at Capital.com, said: "The price movements in gold this week have been largely technical and news-driven. However, gold remains fundamentally sound, so buying on dips reflects investors' long-term investment bias."

US Treasury Secretary Scott Bessent said high tariffs between the US and China are unsustainable and need to be reduced before trade talks resume, but he insisted President Donald Trump would not unilaterally reduce tariffs on Chinese goods.

Meanwhile, a report said Mr Trump is considering cutting tariffs on the auto industry after weeks of lobbying by businesses. "Gold prices will continue to rise until the Trump administration actually changes its trade policy," Rodda stressed.

The Swiss National Bank (SNB) reported a profit of 6.7 billion Swiss francs ($8.08 billion) in the first quarter of 2025, as a surge in gold prices offset losses from stock markets and a stronger franc. The bank holds 1,030 tonnes of gold, and the value of the metal has soared as investors have rushed to buy it to avoid risks from financial markets.

The International Monetary Fund (IMF) warned that tariffs would slow growth and push up global debt. The dollar index (.DXY) fell 0.2% against other currencies, making gold cheaper for foreign investors.

While gold prices increased, silver prices decreased 0.8% to 33.29 USD/ounce, platinum prices decreased slightly by 0.1% to 972.26 USD, and palladium prices remained unchanged at 943.20 USD.

Gold price forecast

In the past two days, gold prices have fallen about 6.8% from a record high to around $3,260 an ounce. However, Mr. Razaqzada, a market analyst at StoneX, confirmed that this is only a temporary correction. If gold continues to fall to the $3,100 area, he will reconsider the bullish outlook. According to him, the current decline is still normal when viewed in the context of the previous impressive price increase.

Trade Nation expert David Morrison also warned that even at $3,300 an ounce, gold is still "overbought" according to technical indicators. He said the market may need a deeper correction to reset expectations.

If gold falls to the $3,000 region and holds there, technical indicators like MACD will have time to stabilize, thereby opening up the possibility of further price increases. However, the shape of this correction will determine the possibility of future recovery.

Meanwhile, JP Morgan bank gave a rather positive forecast, saying that gold prices could surpass the $4,000/ounce mark by 2026. According to their estimates, the average gold price in the fourth quarter of 2025 will be around $3,675/ounce and will increase rapidly in the first half of 2026 if demand remains high.

JP Morgan stressed that the main driver of the upward trend is strong capital flows from investors and especially from central banks, with average purchases of up to 710 tonnes per quarter this year. However, the bank also noted that if central banks suddenly reduce their gold purchases one day, this would be a big risk for the market to reverse.

Investors are also increasingly betting that the Fed will soon resume its rate-cutting path. Low interest rates tend to weaken the US dollar and increase the attractiveness of gold. Meanwhile, the recent decline in the US dollar is also a positive factor supporting gold prices.

However, the market is sending mixed signals. On the one hand, there are expectations of a potential trade deal and waning concerns about the independence of the Fed. On the other hand, investor sentiment is also improving, limiting the possibility of a sharp rise in gold prices.

Another factor that could impact gold price trends is economic stability in the US. If the US economy continues to be strong despite tariff policies, the Fed may raise interest rates faster than expected to control inflation. In that case, the expectation of rising interest rates again will put pressure on gold prices.