Gold price this afternoon August 17: Gold ring price drops sharply, gold bars set new record

Gold price this afternoon August 17, 2025: Gold ring price dropped sharply, gold bar price increased to a new record of 124.5 million VND but buyers after a week still suffered heavy losses

Gold pricedomestic this afternoon August 17, 2025

As of 5:00 p.m. today, August 17, 2025, the domestic gold bar price has not changed compared to yesterday. Specifically:

The price of SJC gold bars listed by DOJI Group is 123.5-124.5 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to yesterday. The price increased 300 thousand VND/tael in buying direction - increased 100 thousand VND/tael in selling direction compared to last week.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 123.5-124.5 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to the closing price on August 16 yesterday. The price increased by 300 thousand VND/tael in buying direction - increased by 100 thousand VND/tael in selling direction compared to the closing price on August 10 last week.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 124-124.5 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 200 thousand VND/tael for buying - unchanged for selling. Compared to last week, the gold price increased by 600 thousand VND/tael for buying - increased by 100 thousand VND/tael for selling.

SJC gold price at Bao Tin Minh Chau Company Limited was traded by businesses at 123.5-124.5 million VND/tael (buying - selling), the price remained unchanged in both buying and selling directions compared to the same period yesterday; the price increased by 300 thousand VND/tael in buying direction - increased by 100 thousand VND/tael in selling direction compared to the same period last week.

SJC gold price at Phu Quy is traded by businesses at 122.7-124.5 million VND/tael (buy - sell), gold price is unchanged in both buying and selling directions compared to yesterday, gold price increased 500 thousand VND/tael in buying direction - increased 100 thousand VND/tael in selling direction compared to last week.

As of 5:00 p.m. on August 17, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 116.5-119.5 million VND/tael (buy - sell); the price remained unchanged in both buying and selling directions compared to yesterday; the price decreased by 1 million VND/tael in buying direction - decreased by 500 thousand VND/tael in selling direction compared to last week.

Bao Tin Minh Chau listed the price of gold rings at 116.8-119.8 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday; down 1 million VND/tael in both buying and selling directions compared to last week.

The latest gold price list this afternoon, August 17, 2025 is as follows:

| Gold price this afternoon | August 17, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 123.5 | 124.5 | - | - |

| DOJI Group | 123.5 | 124.5 | - | - |

| Mi Hong | 124 | 124.5 | - | - |

| PNJ | 123.5 | 124.5 | - | - |

| Bao Tin Minh Chau | 123.5 | 124.5 | - | - |

| Phu Quy | 122.7 | 124.5 | - | - |

| 1.DOJI- Updated: 17/8/2025 17:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| AVPL/SJC HN | 123,500 | 124,500 |

| AVPL/SJC HCM | 123,500 | 124,500 |

| AVPL/SJC DN | 123,500 | 124,500 |

| Raw material 9999 - HN | 109,300 | 110,300 |

| Raw materials 999 - HN | 109,200 | 110,200 |

| 2.PNJ- Updated: 17/8/2025 17:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC 999.9 gold bar | 123,500 | 124,500 |

| PNJ 999.9 Plain Ring | 116,600 | 119,500 |

| Kim Bao Gold 999.9 | 116,600 | 119,500 |

| Gold Phuc Loc Tai 999.9 | 116,600 | 119,500 |

| PNJ Gold - Phoenix | 116,600 | 119,500 |

| 999.9 gold jewelry | 116,100 | 118,600 |

| 999 gold jewelry | 115,980 | 118,480 |

| 9920 gold jewelry | 115,250 | 117,750 |

| 99 gold jewelry | 115,010 | 117,510 |

| 916 Gold (22K) | 106,240 | 108,740 |

| 750 Gold (18K) | 81,600 | 89,100 |

| 680 Gold (16.3K) | 73,300 | 80,800 |

| 650 Gold (15.6K) | 69,740 | 77,240 |

| 610 Gold (14.6K) | 65,000 | 72,500 |

| 585 Gold (14K) | 62,030 | 69,530 |

| 416 Gold (10K) | 41,990 | 49,490 |

| 375 Gold (9K) | 37,130 | 44,630 |

| 333 Gold (8K) | 31,790 | 39,290 |

| 3.SJC- Updated: 17/8/2025 17:00 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 123,500 | 124,500 |

| SJC gold 5 chi | 123,500 | 124,520 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 123,500 | 124,530 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 116,600 | 119,200 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 116,600 | 119,100 |

| 99.99% jewelry | 116,400 | 118,200 |

| 99% Jewelry | 112,529 | 117,029 |

| Jewelry 68% | 73,334 | 80,534 |

| Jewelry 41.7% | 42,244 | 49,444 |

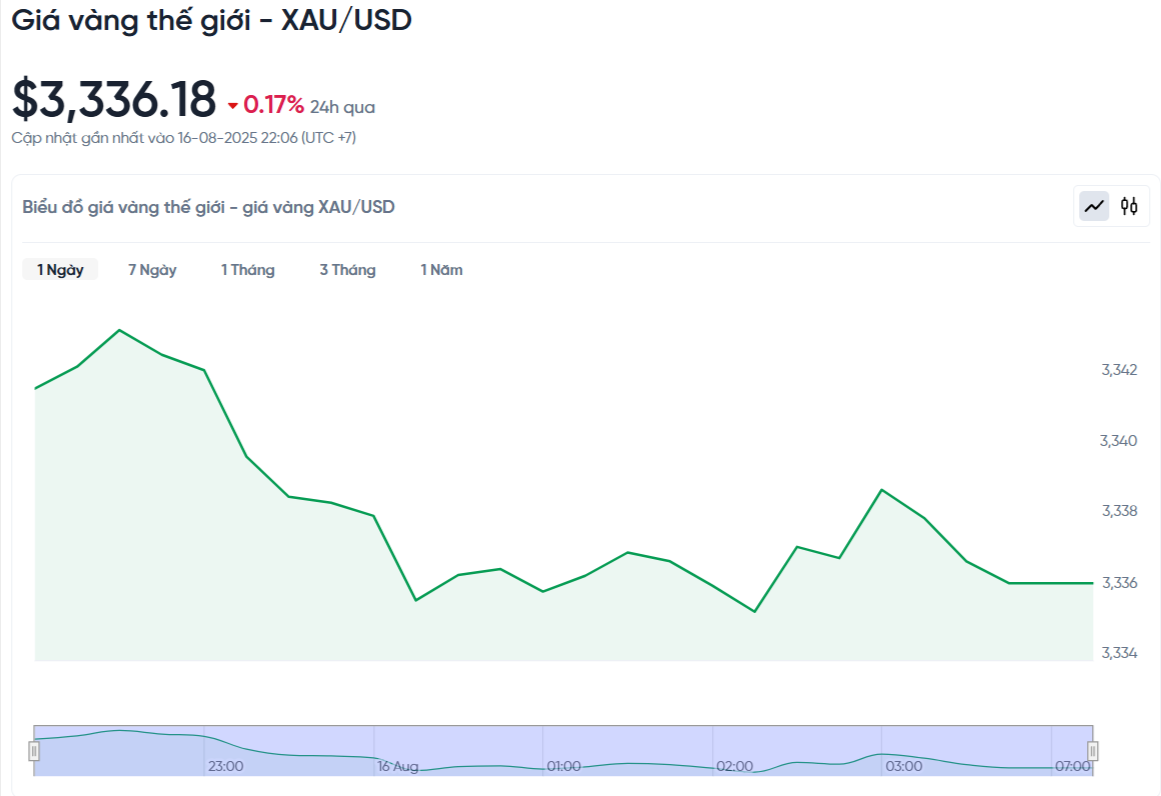

World gold price this afternoon August 17, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 5:00 p.m. on August 17, Vietnam time, was 3,336.18 USD/ounce. This afternoon's gold price decreased by 5.5 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,450 VND/USD), the world gold price is about 106.39 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 18.11 million VND/tael higher than the international gold price.

At Saigon Jewelry Company (SJC), the price of gold bars has increased to an all-time high, reaching 124.5 million VND/tael for selling. The gap between buying and selling prices has narrowed to 1 million VND/tael, lower than last week.

The price of SJC 4-digit 9 gold rings has dropped sharply after a week. Although the domestic gold price has reached its peak, gold bar buyers still lost nearly 1 million VND/tael, while gold ring buyers lost up to 3.2 million VND because the difference between buying and selling prices remained at 2.5 million VND/tael.

Gold prices have struggled to regain some of their lost ground this week after last week’s tariff turmoil, but mixed inflation and consumer data have not been enough to entice investors to take fresh positions.

Spot gold started the week at $3,394.89 an ounce but quickly eased as the Swiss tariff saga from last week continued to haunt the market. By Sunday evening US time, gold was down to $3,373 and on Monday morning continued to fall below the $3,350 threshold.

A brief rebound pushed gold back to $3,360 at the US open, but the rally was short-lived. Shortly after the North American market closed, gold hit a short-term bottom around $3,340.

The following days saw gold prices fluctuate in a narrow range of around $30. The lowest was recorded at $3,335 on Tuesday morning, while the highest peak reached $3,367 after the CPI report as expected on Wednesday morning.

Gold briefly crossed the $3,370 mark on Wednesday evening but quickly fell back. When the July PPI report was released Thursday morning, gold was trading around $3,350.

A sharp rise in the producer price index has shaken expectations of a possible Fed rate cut in September, sending gold prices down to a weekly low of around $3,330 at midday on Thursday US time.

From that point until the end of the weekend trading session, gold prices fluctuated in a very narrow range of about $10. Retail sales reports and consumer confidence indexes had almost no significant impact on the gold market.

Gold price forecast

According to the latest survey from Kitco News, most experts on Wall Street predict that gold prices will continue to move sideways in the near future. Meanwhile, most individual investors remain optimistic that gold prices can increase.

Specifically, 10 experts participated in the Kitco News survey. The results showed that only 1 person expected the gold price to increase, 1 person predicted the price to decrease, and the remaining 8 people believed that gold would continue to fluctuate within a narrow range. From the perspective of retail investors, the results of the online survey with 183 votes showed that 63% (115 people) expected the gold price to increase, 18% (33 people) predicted a decrease, and 19% (35 people) thought the price would stabilize.

Adrian Day, President of Adrian Day Asset Management, said that gold prices could fluctuate strongly depending on the outcome of the meeting between President Trump and Putin. However, if there are no surprises, gold tends to increase slightly within the current range. He also said that the market has already reflected the possibility of the Federal Reserve cutting interest rates in September, so more signals of flexible monetary policy are needed for gold prices to break out.

Colin Cieszynski, strategist at SIA Wealth Management, predicts gold prices will be little changed next week, unless there is an impact from the Jackson Hole conference, where central banks discuss monetary policy.

James Stanley, senior market strategist at Forex.com, said gold prices are at support and could rise on expectations that the Fed will maintain a dovish monetary policy after the Jackson Hole conference. In the short term, the market will pay attention to July core inflation data and signals from the Jackson Hole conference from August 21-23.

Ole Hansen, head of commodity strategy at Saxo Bank, said the recent inflation data does not change the long-term bullish outlook for gold. He believes the Fed will have to strike a balance between controlling inflation and supporting economic growth.

Gold is currently trading in a $200 range around $3,350, but demand from ETFs remains strong, hitting a two-year high, suggesting the market still expects the Fed to ease policy and the risk of stagflation remains.

There will be little major economic data next week, so the market will focus on the Fed's moves. Most notable will be the minutes of the July FOMC meeting and Fed Chairman Jerome Powell's speech at the Jackson Hole conference on Friday.

With a relatively light economic calendar next week, aside from preliminary PMIs and the Fed’s Jackson Hole conference, gold is likely to continue moving sideways. The surprise factor could come from geopolitical developments, although the Trump-Putin meeting is too late on Friday to have an immediate impact.