Gold price today September 4, 2025: Domestic and world gold prices are expected to continue to increase

Gold price today 9/4: Domestic gold price increased by nearly 3 million VND to a continuous peak. World gold price reached an unprecedented high and may increase even higher.

Gold pricedomestic today 9/4/2025

As of 4:00 a.m. today, September 4, 2025, the domestic gold bar price increased by nearly 3 million VND, breaking a continuous record. Specifically:

DOJI Group listed the price of SJC gold bars at 131.9 - 133.4 million VND/tael (buy - sell), an increase of 2.8 million VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of gold bars was listed by Saigon Jewelry Company Limited - SJC at 131.9 - 133.4 million VND/tael (buy - sell), an increase of 2.8 million VND/tael in both buying and selling directions compared to the closing price on September 2.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 132.4-133.4 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 2.8 million VND/tael for both buying and selling.

The price of gold bars at Bao Tin Minh Chau Company Limited was traded by the enterprise at 131.4 - 133.4 million VND/tael (buy - sell), an increase of 2.8 million VND/tael in both buying and selling directions compared to the same period yesterday.

The price of SJC gold bars at Phu Quy is traded by businesses at 131-133.4 million VND/tael (buy - sell), the gold price increased by 2.9 million VND/tael in buying - increased by 2.8 million VND/tael in selling compared to yesterday.

As of 4:00 a.m. on September 4, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 125.8-128.8 million VND/tael (buy - sell); an increase of 1.3 million VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 126-129 million VND/tael (buy - sell); an increase of 1.3 million VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, September 4, 2025 is as follows:

| Gold price today | September 4, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 131.9 | 133.4 | +2800 | +2800 |

| DOJI Group | 131.9 | 133.4 | +2800 | +2800 |

| Mi Hong | 132.4 | 133.4 | +2800 | +2800 |

| PNJ | 131.9 | 133.4 | +2800 | +2800 |

| Bao Tin Minh Chau | 131.4 | 133.4 | +2800 | +2800 |

| Phu Quy | 131 | 133.4 | +2900 | +2800 |

| 1.DOJI- Updated: 4/9/2025 04:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| AVPL/SJC HN | 131,900▲2800K | 133,400▲2800K |

| AVPL/SJC HCM | 131,900▲2800K | 133,400▲2800K |

| AVPL/SJC DN | 131,900▲2800K | 133,400▲2800K |

| Raw material 9999 - HN | 118,000▲1600K | 119,000▲1600K |

| Raw materials 999 - HN | 117,900▲1600K | 118,900▲1600K |

| 2.PNJ- Updated: 4/9/2025 04:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC 999.9 gold bar | 131,900▲2800K | 133,400▲2800K |

| PNJ 999.9 Plain Ring | 125,800▲1300K | 128,800▲1300K |

| Kim Bao Gold 999.9 | 125,800▲1300K | 128,800▲1300K |

| Gold Phuc Loc Tai 999.9 | 125,800▲1300K | 128,800▲1300K |

| PNJ Gold - Phoenix | 125,800▲1300K | 128,800▲1300K |

| 999.9 gold jewelry | 123,900▲1000K | 126,400▲1000K |

| 999 gold jewelry | 123,770▲1000K | 126,270▲1000K |

| 9920 gold jewelry | 122,990▲1000K | 125,490▲1000K |

| 99 gold jewelry | 122,740▲990K | 125,240▲990K |

| 916 Gold (22K) | 113,380▲910K | 115,880▲910K |

| 750 Gold (18K) | 87,450▲750K | 94,950▲750K |

| 680 Gold (16.3K) | 78,600▲680K | 86,100▲680K |

| 650 Gold (15.6K) | 74,810▲650K | 82,310▲650K |

| 610 Gold (14.6K) | 69,750▲610K | 77,250▲610K |

| 585 Gold (14K) | 66,590▲580K | 74,090▲580K |

| 416 Gold (10K) | 45,230▲410K | 52,730▲410K |

| 375 Gold (9K) | 40,050▲370K | 47,550▲370K |

| 333 Gold (8K) | 34,360▲330K | 41,860▲330K |

| 3.SJC- Updated: 4/9/2025 04:00 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 131,900▲2800K | 133,400▲2800K |

| SJC gold 5 chi | 131,900▲2800K | 133,420▲2800K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 131,900▲2800K | 133,430▲2800K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 125,500▲3000K | 128,100▲3000K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 125,500▲3000K | 128,000▲3000K |

| 99.99% jewelry | 123,900▲2400K | 126,400▲2900K |

| 99% Jewelry | 120,148▲2871K | 125,148▲2871K |

| Jewelry 68% | 78,610▲1972K | 86,110▲1972K |

| Jewelry 41.7% | 45,364▲1209K | 52,864▲1209K |

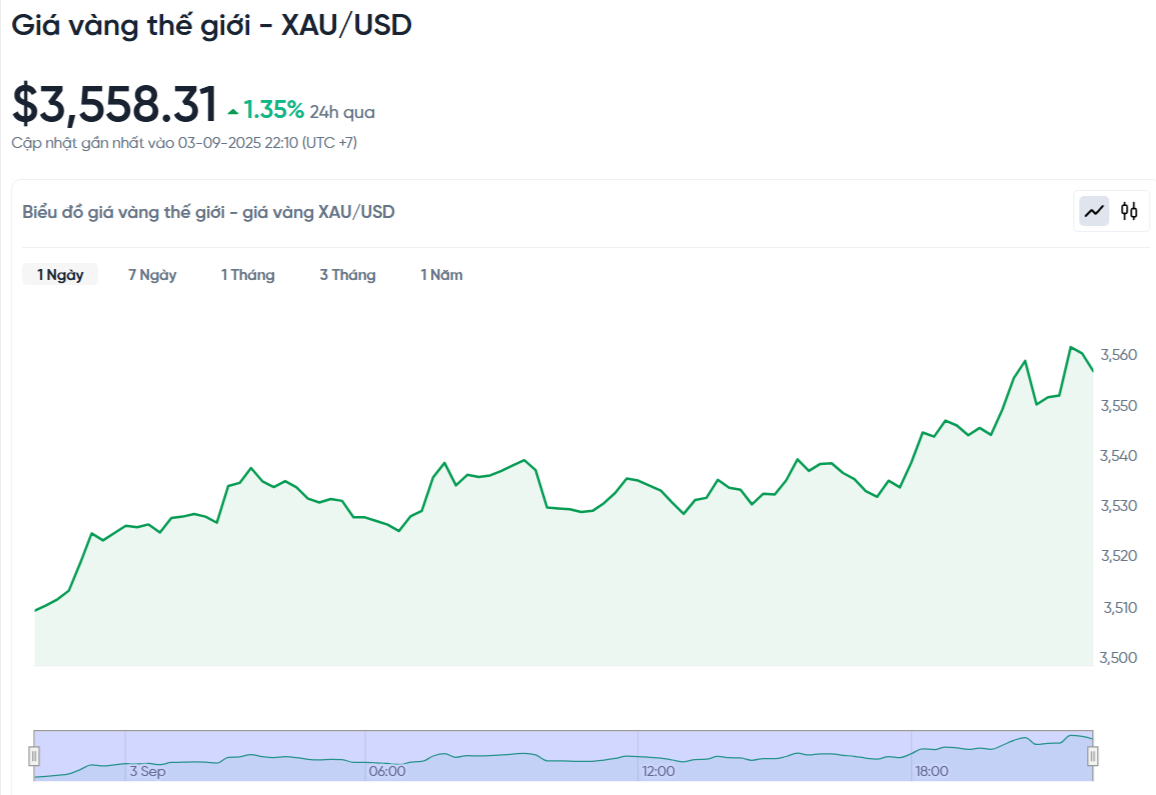

World gold price today September 4, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:00 a.m. on September 4, Vietnam time, was 3,558.31 USD/ounce. Today's gold price increased by 47.52 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,508 VND/USD), the world gold price is about 113.7 million VND/tael (excluding taxes and fees). Thus, the price of gold bars is 19.7 million VND/tael higher than the international gold price.

Surpassing all expectations, the world gold price increased in one breath, surpassing the threshold of 3,550 USD/Ounce, and could approach 3,600 USD/Ounce by the end of today. The reason comes from the expectation that the US Federal Reserve (Fed) will cut interest rates, along with the fear of risk in the market, boosting the demand for safe assets.

Specifically, spot gold prices increased by 1.35%, after hitting a record high of 3,556.01 USD/Ounce during the session. US gold futures for December delivery also increased by 0.8% to 3,621.30 USD/Ounce.

Investors are focusing on a series of important data on the US labor market this week, including weekly jobless claims and ADP employment figures (Thursday), and the non-farm payroll report (Friday). These indicators are key to assessing the possibility of the Fed cutting interest rates.

Against this backdrop, concerns about the Fed’s independence are growing after President Donald Trump’s repeated criticism of Chairman Jerome Powell for not lowering interest rates, which is undermining confidence in dollar-denominated assets and pushing money toward gold, according to traders at Heraeus Metals.

The CME Group's FedWatch tool shows there is now a 92% chance the Fed will cut interest rates by 25 basis points at its September policy meeting. Fed Governor Christopher Waller has again called for a cut in September and said the pace of cuts after that will depend on economic developments.

Gold prices are rising in part because of the increasingly unpredictable political and trade policies of the United States. A US appeals court recently declared most of the tariffs imposed by the country illegal, a decision that raises questions about President Donald Trump’s authority to impose tariffs on imports.

For now, the tariffs remain in place while the lawsuit continues, but the uncertainty has caused many businesses to postpone investment decisions until they have more clarity on the cost of the tariffs.

Another reason for the rise in gold prices is that the market is entering the strongest consumption season of the year. Demand for gold from ETFs also contributes to supporting gold prices. The world's largest gold trust fund, SPDR Gold Trust, increased its holdings by 1% in just a few days to more than 977 tons, the highest in the past three years.

Besides gold prices, spot silver prices fell 0.5% to $40.48/ounce. Platinum fell 0.7% to $1,389.75/ounce, while palladium fell 1.4% to $1,121.75/ounce.

Gold price forecast

Technically, spot gold has broken through the $3,500/ounce level and is continuing to push higher towards $3,600/ounce. December gold has hit $3,605. The next target is to break and hold above the resistance level at $3,700/ounce.

According to forecasts from JP Morgan experts, gold prices could reach $3,675/Ounce by the end of 2025 and reach $4,250/Ounce by the end of 2026.

If the jobs report on Friday is weaker than expected, the possibility of the Fed cutting rates by 25 basis points in September will further support the gold price, according to Peter Grant, vice president and senior metals strategist at Zaner Metals. He predicts that gold prices will be able to rise even higher, with short- and medium-term targets of $3,600 to $3,800 per ounce, and even $4,000 per ounce by the end of the first quarter of next year.

Michele Schneider, chief market strategist at MarketGauge, said it is difficult to predict how high gold prices can go. Last week, she predicted that gold would soon surpass $3,500 an ounce.

Ms. Schneider commented that the $4,000/ounce level could be within sight, as the gold market is only in the beginning of a strong increase. Technically, the longer the accumulation period, the stronger the subsequent increase.

She believes that a move to $3,800-$4,000 an ounce is highly possible and could be a reasonable target before some investors decide to take profits. Even at that price, the window of opportunity is not closed for those who want to enter the market.

Wellington Letter editor Bert Dohmen also pointed out that there is a shift of money from the stock market to gold. He said that the US stock market is in the most dangerous speculative state of his career and predicted a serious recession, possibly the worst since 1929.

According to Mr. Dohmen, in the initial phase of the financial market downturn, gold and silver may also be sold off because they are used as a source of cash to meet margin calls. However, this is the premise for the second phase, when central banks print more money and investors flock to safe assets like gold and silver.

Based on a 40-year cycle study he conducted in 1980, Mr. Dohmen predicts that gold prices will continue to rise in the long term and peak in 2031. He believes that the world is entering a period of many conflicts, making tangible assets like gold a real safe haven.