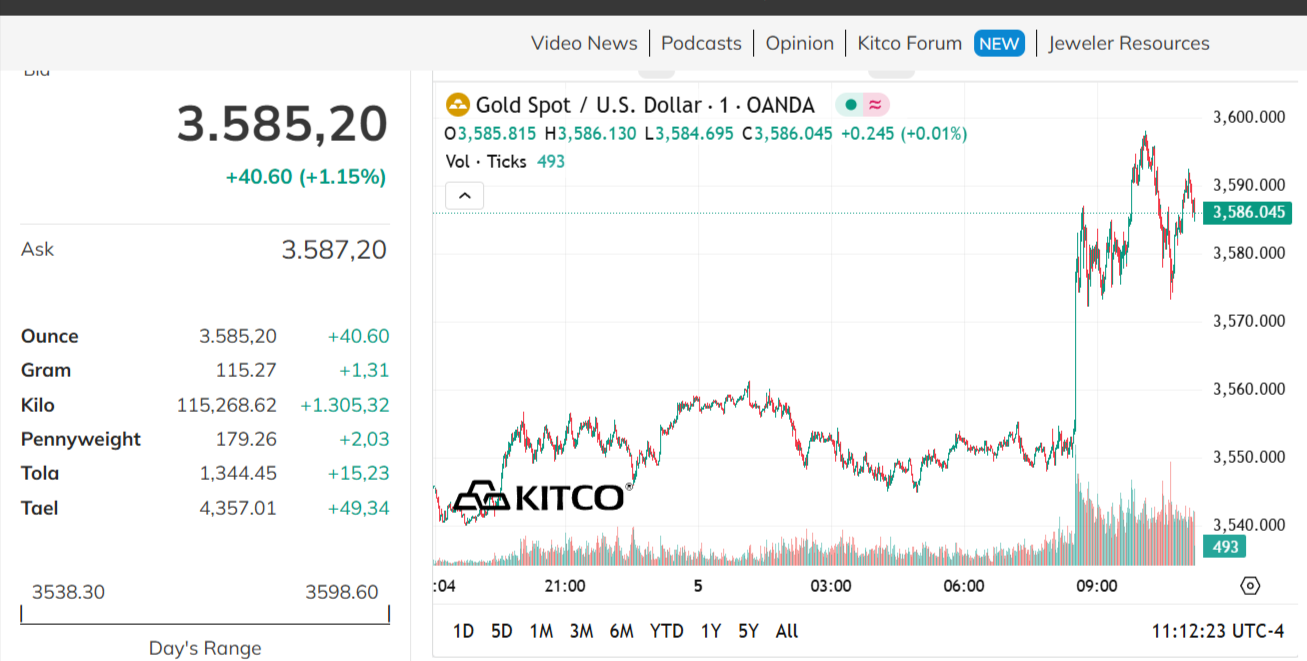

The road to the peak of 3600 USD of world gold price

World gold prices set a new record, approaching the threshold of 3,600 USD/Ounce. After the US employment data report for August, the number of non-agricultural jobs was much lower than forecast.

Gold prices continued to rise strongly and set a new record on Friday, approaching the threshold of 3,600 USD per ounce. The main reason came from the weaker-than-expected US employment data in August, which strongly reinforced expectations that the US Federal Reserve (Fed) would soon cut interest rates.

At 04:00 GMT+7, spot gold rose 1.4% to $3,596.49 an ounce, after hitting a record high of $3,596.76. Gold is expected to have its strongest weekly gain in nearly four months. US gold futures for December delivery also rose 1.3% to $3,653.30.

The gold market is once again attracting safe-haven flows as the US labor market is losing momentum faster than expected.

The US August jobs report just released showed that the key non-farm payrolls increased by only 22,000, much lower than the expected increase of 75,000. After the jobs report, the market now expects the Fed to cut interest rates by 0.25% three more times this year.

Meanwhile, the unemployment rate edged up to 4.3% from 4.2% in July. The increase was in line with earlier forecasts.

The market is also sensitive to revisions. June's jobs data was revised down by 13,000 jobs, while July's figure was revised up slightly by 79,000 jobs.

With these adjustments, total employment in June and July was 21,000 lower than previously reported, the report said.

Despite the slowdown in job growth, the report also showed solid wage gains. Average hourly earnings rose 10 cents, or 0.3%, to $36.53 last month, in line with expectations.

Average hourly earnings have increased 3.7% over the past 12 months, the report said.

A weak US labor market is bolstering expectations that the Federal Reserve will cut interest rates aggressively for the rest of the year. Markets still expect a quarter-point cut later this month and forecast a total of one percentage point reduction by year-end.

In a commentary, Standard Chartered Bank expert Suki Cooper warned that if jobs growth falls below 40,000, markets could start expecting a 0.5% cut later this month.

Expectations for interest rate cuts continue to rise as inflationary pressures remain high. Analysts say this is a favorable environment for gold, as the risk of stagflation is rising.

According to expert Aakash Doshi, if the current trend continues, the US economy could fall into stagflation in the next 3 to 6 months, and that could push gold prices to $4,000/ounce.

The August jobs data is the latest to confirm the deepening weakness in the labor market, said Mohammed Taha, an economist at the Institute for Economic and Social Research. Disappointing data also came from ADP, a private payroll processor. The Labor Department also reported a sharp drop in job openings in July.

The 22,000 jobs figure could push gold prices toward $3,600 an ounce or a new record, fueled by increased safe-haven demand amid economic uncertainty and potential geopolitical tensions, Taha said. The wide discrepancy in the data suggests a very strong bullish momentum for gold.

However, Mr. Jeffrey Roach, chief economist at LPL Financial, said that although the labor market is slowing, it may not be enough to force the Fed to cut by 0.50% later this month.

Fed policymakers will likely focus on labor market weakness to justify a rate cut. Labor data is unlikely to be weak enough for the Fed to cut by 0.5% as inflation remains stubborn, so the current expectation is still for a 0.25% cut.