Gold price this afternoon November 8, 2025: SJC PNJ ACB gold price list, BTMC gold ring, world gold

Gold price this afternoon November 8, 2025: SJC DOJI PNJ ACB gold bar price remains at 148.4 million VND. BTMC gold ring price remains at 148.8 million, world gold price is around 4,000 USD.

Gold pricedomestic this afternoon 11/8/2025

Updated at 4:00 p.m. this afternoon, November 8, 2025, the domestic gold bar price remains at 148.4 million VND. Specifically:

DOJI Group listed the price of SJC gold bars at 146.4 - 148.4 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday.

At the same time, the price of gold bars was listed by Saigon Jewelry Company Limited - SJC at 146.4 - 148.4 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 147.2 - 148.4 million VND/tael for buying and selling. Compared to yesterday, the gold price remained unchanged in both buying and selling directions.

The price of gold bars at Bao Tin Minh Chau Company Limited is traded by the enterprise at 146.9 - 148.4 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to the same period yesterday.

The price of SJC gold bars at Phu Quy is traded by businesses at 145.4 - 148.4 million VND/tael (buy - sell), the gold price has not changed in both buying and selling directions compared to yesterday.

The price of ACB gold bars is traded by businesses at 147.4 - 148.4 million VND/tael (buy - sell). Compared to yesterday, the gold price has not changed in both buying and selling directions.

As of 4:00 p.m. on November 8, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 145 - 148 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 145.8 - 148.8 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday.

The latest gold price list this afternoon, November 8, 2025 is as follows:

| Gold price this afternoon | November 8, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 146.4 | 148.4 | - | - |

| DOJI Group | 146.4 | 148.4 | - | - |

| Mi Hong | 147.2 | 148.4 | - | - |

| PNJ | 146.4 | 148.4 | - | - |

| Bao Tin Minh Chau | 146.9 | 148.4 | - | - |

| Phu Quy | 145.4 | 148.4 | - | - |

| ACB Gold | 147.4 | 148.4 | - | - |

| 1.DOJI- Updated: 11/8/2025 16:00 - Source website time - ▲/▼ Compared to yesterday. | ||

| AVPL/SJC - RETAIL | 146,400 | 148,400 |

| 9999 ROUND RING (HUNG THINH VUONG - RETAIL) | 145,000 | 148,000 |

| 9999 JEWELRY - RETAIL | 143,300 | 147,300 |

| 999 JEWELRY - RETAIL | 143,000 | 147,000 |

| Ingredients 99.99 | 139,600 | 141,600 |

| Ingredients 99.9 | 139.400 | 141,400 |

| 2. PNJ - Updated: November 8, 2025 16:00 - Website supply time - ▲/▼ Compared to yesterday. | ||

| SJC 999.9 gold bar | 146,400 | 148,400 |

| PNJ 999.9 Plain Ring | 145,000 | 148,000 |

| Kim Bao Gold 999.9 | 145,000 | 148,000 |

| Gold Phuc Loc Tai 999.9 | 145,000 | 148,000 |

| PNJ Gold - Phoenix | 145,000 | 148,000 |

| 999.9 gold jewelry | 144,900▲400K | 147,400▲400K |

| 999 gold jewelry | 144,750▲400K | 147,250▲400K |

| 9920 gold jewelry | 143,820▲400K | 146,320▲400K |

| 99 gold jewelry | 143,530▲400K | 146,030▲400K |

| 916 Gold (22K) | 132,620▲370K | 135,120▲370K |

| 750 Gold (18K) | 103,200▲300K | 110,700▲300K |

| 680 Gold (16.3K) | 92,880▲270K | 100,380▲270K |

| 650 Gold (15.6K) | 88,460▲260K | 95,960▲260K |

| 610 Gold (14.6K) | 82,560▲240K | 90,060▲240K |

| 585 Gold (14K) | 78,880▲230K | 86,380▲230K |

| 416 Gold (10K) | 53,970▲170K | 61,470▲170K |

| 375 Gold (9K) | 47,930▲150K | 55,430▲150K |

| 333 Gold (8K) | 41,200▲130K | 48,790▲130K |

| 3.SJC- Updated: 11/8/2025 16:00 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 146,400 | 148,400 |

| SJC gold 5 chi | 146,400 | 148,420 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 146,400 | 148,430 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 143,300 | 145,800 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 143,300 | 145,900 |

| 99.99% jewelry | 141,800 | 144,800 |

| 99% Jewelry | 138,866 | 143,366 |

| Jewelry 68% | 91,123 | 98,623 |

| Jewelry 41.7% | 53,037 | 60,537 |

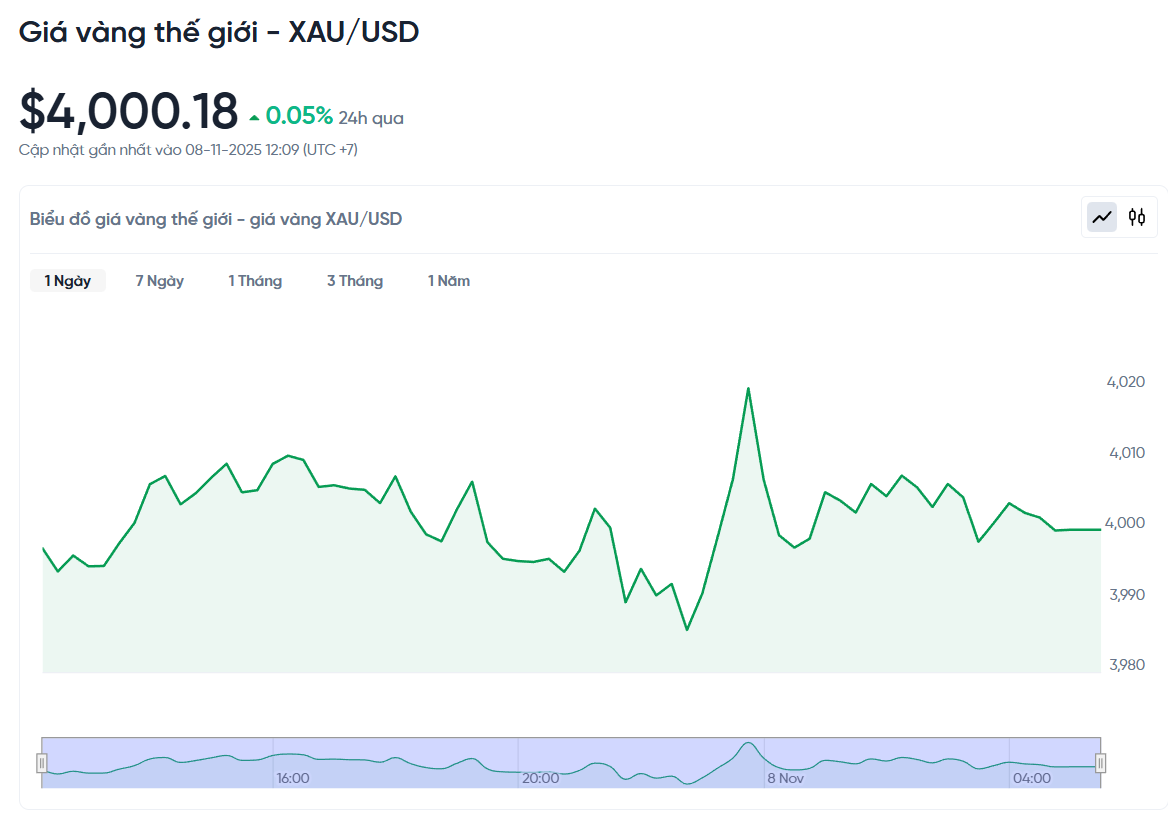

World gold price this afternoon November 8, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:00 p.m. on November 8, Vietnam time, was 4,000.18 USD/ounce. This afternoon's gold price increased by 2.02 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,358 VND/USD), the world gold price is about 127.15 million VND/tael (excluding taxes and fees). Thus, the gold bar price is 21.25 million VND/tael higher than the international gold price.

The prolonged US government shutdown has made it difficult to assess the health of the US economy, directly affecting the world gold price. Investors have to find direction from the stock market and the USD. This week, the gold price has been almost flat, around 4,000 USD/ounce, an important psychological resistance level.

Barbara Lambrecht (Commerzbank) said that despite the slight increase in the USD, gold prices are still supported by the demand for shelter. She predicted that the US will cut interest rates more strongly than expected, helping gold prices to rebound when economic data is released again.

Michael Brown (Pepperstone) commented that gold prices are fluctuating in the range of 3,900 - 4,400 USD/ounce, and the risk is still tilted to the upside. He said that safe-haven demand, inflation concerns and reserve demand from central banks continue to play an important role.

With the government shutdown disrupting official data, investors are relying on private data. ADP reported 42,000 jobs were created in October, but Challenger reported more than 150,000 job cuts, the most in 20 years. Despite mixed signals, the market still believes the Fed will cut interest rates next month, supporting gold prices to remain stable until the end of the year.

Neil Welsh (Britannia Global Markets) said gold prices are being “tug of war” between safe-haven buying and profit-taking pressure. He said the upcoming Fed meeting will decide whether gold can break the $4,000 mark or continue to move sideways.

According to CME FedWatch, there is a 66% chance that the Fed will cut interest rates at its next meeting. If so, gold prices will benefit. In addition, US stocks are at historic highs, a factor that could cause investors to turn to gold when risks increase.

Phillip Streible (Blue Line Futures) believes that if the stock market corrects, gold will return to its attractive role as a safe haven. After 7 consecutive weeks of increase, the USD index fell to 99.5 points, which is also a positive signal for gold prices.

Gold price forecast

World gold prices are consolidating around the $4,000/ounce mark as experts are divided between forecasts of a sharp increase to $5,000 and the risk of short-term weakness.

According to Adrian Day, Chairman of Adrian Day Asset Management, gold prices are still in a consolidation phase after the recent volatility. He believes that the factors that have supported gold prices over the past three years are still intact, from inflation, political instability to US monetary policy. However, the possibility of the US Supreme Court canceling the Trump-era tariff policy could create new fluctuations in the market and cause unexpected impacts on gold prices.

Although admitting that gold prices need more time to accumulate, Adrian Day still maintains an optimistic view in the short term, saying that this precious metal can soon return to an upward trend when stronger supporting factors appear.

Contrary to the positive view, Alex Kuptsikevich, Head of Analysis at FxPro, said that gold prices are under pressure after two weeks of selling. He said the uptrend has been broken and the price of gold is now stable around $4,000 an ounce, with attempts to push the price below $3,900 being resisted by strong buying.

He analyzed that the Supreme Court is considering the legality of Trump-era tariffs. If the decision goes against the president, the government may have to repay the tax, causing a budget deficit and a high public debt that could cause a sharp swing in gold prices.

Although many major banks such as HSBC, Bank of America and Société Générale still forecast gold prices to reach $5,000/ounce, Kuptsikevich warned that the upward momentum has weakened, and a strategy of selling when prices rise may be reasonable in the short term.

According to a Kitco News survey of 21 Wall Street professionals, 13 (59%) are neutral on gold prices in the short term. Seven (32%) expect gold prices to rise next week, while two (9%) see prices falling.

In addition, an online survey of 221 participants showed that positive sentiment still prevailed, with 123 people (55.7%) expecting gold prices to rise, 59 people (26.7%) remaining neutral, and 39 people (17.6%) predicting gold prices to fall.