Gold price today November 18, 2025: ACB SJC PNJ gold price list, BTMC gold ring, world gold

Gold price today November 18, 2025: ACB SJC PNJ gold bar price, BTMC gold ring price is at 151 million, world gold price is 4072 USD. Gold buyers profit 66 million VND after 12 months.

Gold pricedomestic today 11/18/2025

Updated at 5:00 a.m. today, November 18, 2025, the price of gold bars remains at 151 million VND. Specifically:

DOJI Group listed the price of SJC gold bars at 149 - 151 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday.

At the same time, the price of gold bars was listed by Saigon Jewelry Company Limited - SJC at 149 - 151 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 149.8 - 151 million VND/tael for buying and selling. Compared to the opening price on November 17 yesterday, the gold price remained unchanged in both buying and selling directions.

The price of gold bars at Bao Tin Minh Chau Company Limited is traded by businesses at 149.5 - 151 million VND/tael (buy - sell), the price increased by 500 thousand VND/tael for buying - unchanged for selling compared to the same period yesterday.

The price of SJC gold bars at Phu Quy is traded by businesses at 148 - 151 million VND/tael (buy - sell), the gold price has not changed in both buying and selling directions compared to yesterday.

The price of ACB gold bars is traded by businesses at 149.5 - 151 million VND/tael (buy - sell). Compared to yesterday, the gold price has not changed in both buying and selling directions.

As of 5:00 a.m. on November 18, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 146.9 - 149.9 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 148 - 151 million VND/tael (buy - sell); an increase of 200 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, November 18, 2025 is as follows:

| Gold price today | November 18, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 149 | 151 | - | - |

| DOJI Group | 149 | 151 | - | - |

| Mi Hong | 149.8 | 151 | - | - |

| PNJ | 149 | 151 | - | - |

| Bao Tin Minh Chau | 149.5 | 151 | +500 | - |

| Phu Quy | 148 | 151 | - | - |

| ACB Gold | 149.5 | 151 | - | - |

| 1.DOJI- Updated: 11/18/2025 05:00 - Source website time - ▲/▼ Compared to yesterday. | ||

| AVPL/SJC - RETAIL | 149,000 | 151,000 |

| 9999 ROUND RING (HUNG THINH VUONG - RETAIL) | 146,900 | 149,900 |

| 9999 JEWELRY - RETAIL | 146,000▼700K | 149,500▼200K |

| 999 JEWELRY - RETAIL | 145,800▼700K | 149,300▼200K |

| Ingredients 99.99 | 140,500▼1900K | 142,500▼1900K |

| Ingredients 99.9 | 140,300▼1900K | 142,300▼1900K |

| 2.PNJ- Updated: 11/18/2025 05:00 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC 999.9 gold bar | 149,000 | 151,000 |

| PNJ 999.9 Plain Ring | 146,900 | 149,900 |

| Kim Bao Gold 999.9 | 146,900 | 149,900 |

| Gold Phuc Loc Tai 999.9 | 146,900 | 149,900 |

| PNJ Gold - Phoenix | 146,900 | 149,900 |

| 999.9 gold jewelry | 143,300▼400K | 149,500▼200K |

| 999 gold jewelry | 143,150▼400K | 149,350▼200K |

| 9920 gold jewelry | 142,000▼400K | 148,300▼200K |

| 99 gold jewelry | 141,810▼490K | 148,010▼290K |

| 916 Gold (22K) | 130,740▼490K | 136,940▼290K |

| 750 Gold (18K) | 102,830▼300K | 112,130▼300K |

| 680 Gold (16.3K) | 92,360▼290K | 101,660▼290K |

| 650 Gold (15.6K) | 87,880▼280K | 97,180▼280K |

| 610 Gold (14.6K) | 81,900▼270K | 91,200▼270K |

| 585 Gold (14K) | 78,160▼260K | 87,460▼260K |

| 416 Gold (10K) | 52,890▼240K | 62,190▼240K |

| 375 Gold (9K) | 46,760▼230K | 56,060▼230K |

| 333 Gold (8K) | 40,480▼220K | 49,780▼220K |

| 3.BTMC- Updated: 11/18/2025 05:00 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC BTMC gold bars | 149,500▲500K | 151,000 |

| Thang Long Dragon Gold Bar | 148,000▲200K | 151,000▲200K |

| BTMC plain gold ring | 148,000▲200K | 151,000▲200K |

| Thang Long Dragon 9999 Gold Jewelry | 146,300▲200K | 149,600▲200K |

| Thang Long Dragon 999 Gold Jewelry | 146,200▲200K | 149,500▲200K |

| 4.SJC- Updated: 11/18/2025 05:00 - Source website time - ▲/▼ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 149,000 | 151,000 |

| SJC gold 5 chi | 149,000 | 151,020 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 149,000 | 151,030 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 146,500 | 149,000 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 146,500 | 149,100 |

| 99.99% jewelry | 145,000 | 148,000 |

| 99% Jewelry | 142,034 | 146,534 |

| Jewelry 68% | 93,300 | 100,800 |

| Jewelry 41.7% | 54,372 | 61,872 |

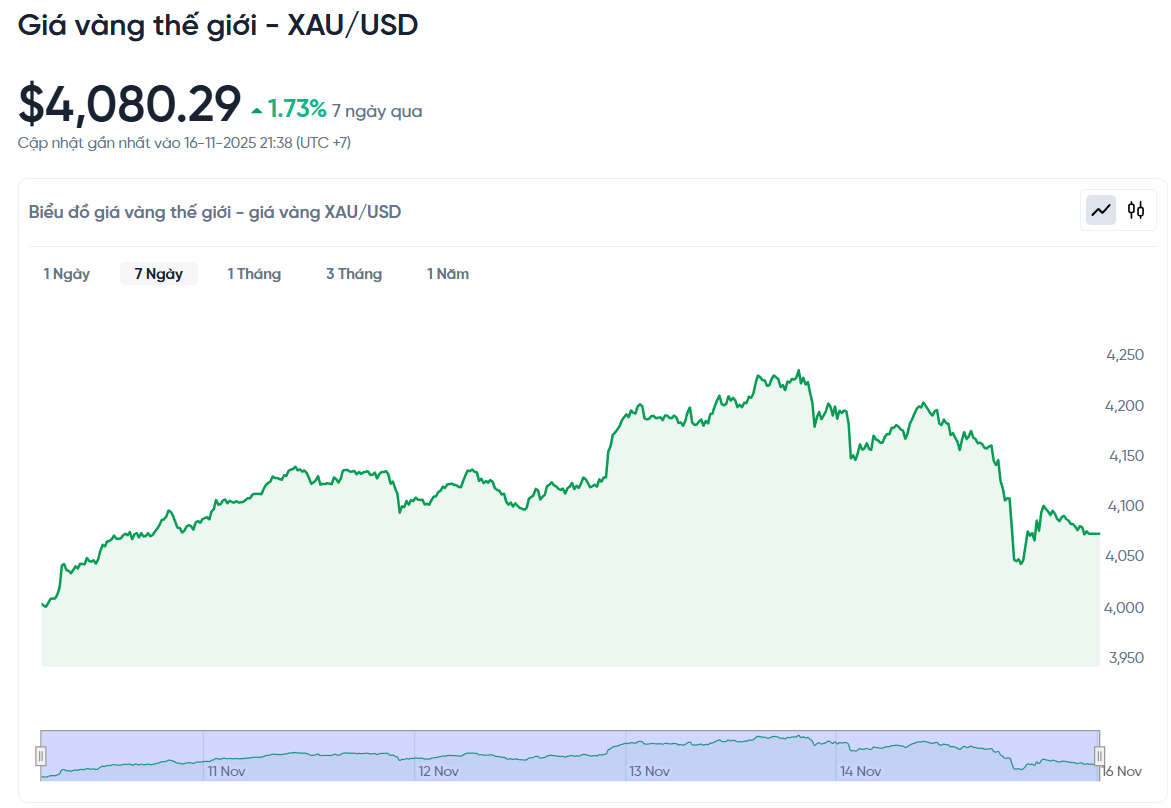

World gold price today November 18, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 5:00 a.m. on November 18, Vietnam time, was 4,072.9 USD/ounce. Today's gold price decreased by 7.39 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,376 VND/USD), the world gold price is about 129.5 million VND/tael (excluding taxes and fees). Thus, the price of gold bars is 21.5 million VND/tael higher than the international gold price.

At Bao Tin Minh Chau, staff said that this morning the store only sold a maximum of 5 taels of gold rings per person and delivered immediately after payment. However, due to the large number of customers, the store could only serve the first 150 people and was forced to stop selling because it was temporarily out of stock.

Mr. Minh Quan (Lang Ward, Hanoi) shared that he came to buy gold but was informed that the sale had stopped. Before that, when asking via fanpage, he was also informed that each customer could buy 5 taels. Just over an hour later, the amount of gold sold was sold out, making him unable to wait any longer because he still had work to do.

The domestic gold price market has fluctuated violently over the past year, reaching peaks many times for both SJC gold bars and 9999 gold rings. If comparing the two times of November 18, 2024 and November 18, 2025, the increase is much higher than all previous forecasts.

A year ago, SJC gold bars were listed by DOJI and SJC at VND80 - 83.5 million/tael. By the morning of November 18, 2025, the price had jumped to VND149 - 151 million/tael. Thus, the buying price increased by VND69 million/tael, equivalent to about 86.25%, while the selling price increased by VND67.5 million/tael, equivalent to more than 80%.

Not only gold bars, 9999 gold rings also increased at a similar rate. At DOJI, the price of rings from 81 - 82.7 million VND/tael (11/2024) has increased to 146.9 - 149.9 million VND/tael (11/2025), an increase of 65.9 million VND for buying and 67.2 million VND for selling.

At Bao Tin Minh Chau, 9999 gold rings also increased from 81.03 - 82.68 million VND/tael to 148 - 151 million VND/tael. This is an increase equivalent to 66.97 million VND in buying and 68.32 million VND in selling, showing the heat spreading throughout the gold ring market.

If an investor buys gold on November 17, 2024 and sells it on November 17, 2025, the profit is huge. With SJC gold bars, the profit is about 65.5 million VND/tael. DOJI gold rings bring in about 64.2 million VND/tael, while BTMC gold rings give a profit of about 65.32 million VND/tael. On average, a person holding gold for 12 months can earn 64 - 66 million VND/tael, far exceeding many other financial channels.

The domestic price increase follows the global trend. From 2,563.2 USD/ounce on November 18, 2024, the international gold price has increased to 4,087 USD/ounce after one year, equivalent to an increase of 59.5%. The strong escalation of the world market is an important factor helping the domestic gold price increase rapidly and continuously reach new peaks.

Gold price forecast

According to Kitco News, although the gold price has stabilized above the $4,000/ounce threshold, the failure to break above the $4,200 mark means the market may need more time to accumulate. Many experts believe that gold is still in a long-term upward trend, but is "stuck" in a fluctuating zone as expectations of a Fed rate cut next month begin to weaken.

Overall, gold price forecasts are divided into two distinct trends: the group of experts warning of a possible decline without the Fed signaling easing, and the group of experts expecting gold to increase based on the long-term trend. Both sides consider $4,000 as the decisive zone.

Mr. Aaron Hill, Director of Analysis at FP Markets, said that although gold has maintained its resistance level above $4,000, there is no clear signal for an increase due to the instability of US monetary policy.

Jim Wyckoff of Kitco.com said that the buying pressure is fading rapidly, making the short-term technical signals negative. He forecasts that prices could fall further this week.

Alex Kuptsikevich (FxPro) said gold benefited from a weaker USD and speculation that the Fed would increase asset purchases, but the last two sessions of the week showed that the upward momentum had slowed. According to him, gold often falls sharply after each recovery because the sellers want to gain the upper hand. If the Fed keeps interest rates unchanged, the USD will be stronger and gold could fall further. However, he warned that the bigger risk lies in the possibility of a weakening US economy, which could cause gold to surge due to safe-haven demand and then face strong selling pressure soon after.

Mr. Michael Moor (MoorAnalytics.com) also leans towards the bearish scenario. Based on his technical system, he believes that gold is in a volatile cycle and has not yet found a solid price base.

Ole Hansen, head of commodity strategy at Saxo Bank, still expects gold to rise this week if the stock market does not experience a sharp sell-off. He said the S&P 500 index, despite being under pressure, still holds important support levels, helping to stabilize sentiment towards gold.

James Stanley, senior strategist at Forex.com, said the market is entering a consolidation phase similar to the end of last year and the period from April to before the Fed Chairman's speech at Jackson Hole. According to him, gold needs time to recover slowly, increase buying at support and be cautious at resistance. The $4,000 mark is still the main observation level, while the $3,895 area is the level that makes him consider changing his perspective.