On November 4, 2021, through the inspection, the Interdisciplinary Inspection Team under Decision No. 3892/QD-UBND dated October 21, 2021 of the Provincial People's Committee drew up the Administrative Violation Record No. 01/BB-VPHC against Dong Tien Joint Stock Company (legal representative is Mr. Duong Trong Tu - Chairman of the Board of Directors and Director). The record shows that the Team agreed to draw up an administrative violation record to transfer to the competent person to handle 4 violations of Dong Tien Joint Stock Company:

First act, Dong Tien Joint Stock Company discharged waste into water sources at the Mineral Processing Factory Project in Chau Tien Commune, Quy Hop District without a discharge license as prescribed in Point a, Clause 1, Article 20 of Decree No. 36/2020/ND-CP dated March 24, 2020 of the Government.

Second act, in 2021, Dong Tien Joint Stock Company did not update the current status map and cross-section of the mine area permitted for mineral exploitation at least once every 6 months as prescribed in Circular No. 17/TT-BTNMT dated December 24, 2020 of the Ministry of Natural Resources and Environment.

The third act is incompletely establishing books, vouchers, documents, and related materials to determine the actual annual mining output according to regulations (no books to track the output of raw minerals and waste rock; no minutes of acceptance of the volume of each mining stage; no statistical table of mining output according to regulations in Circular No. 61/2017/TT-BTNMT of the Ministry of Natural Resources and Environment stipulating the process, method of determining and statistical forms of actual mining mineral output).

Fourth act, not organizing occupational safety and hygiene training for employees according to the provisions of law (93 people).

The head of the interdisciplinary inspection team under Decision No. 3892/QD-UBND issued Official Dispatch No. 06/DKTLN on administrative sanctions in the field of minerals (November 8, 2021); Official Dispatch No. 08/DKTLN dated December 17, 2021 on supplementing documents on administrative sanctions sent to the Provincial People's Committee, requesting sanctions for the above violations of Dong Tien Joint Stock Company.

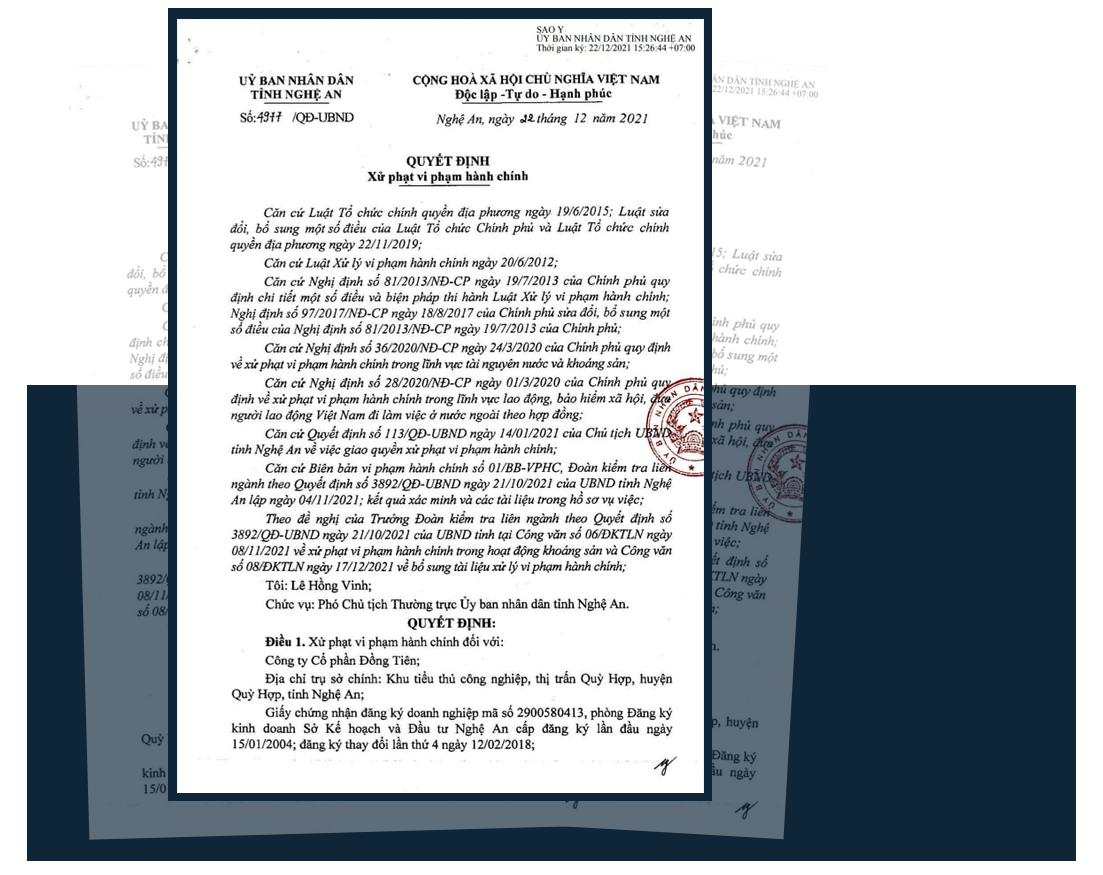

On December 22, 2021, the Provincial People's Committee issued Decision No. 4977/QD-UBND on administrative sanctions against Dong Tien Joint Stock Company. It clearly states the level of sanctions for each administrative violation of Dong Tien Joint Stock Company as follows:

The act of discharging wastewater into water sources with a wastewater flow of over 5 m3/day and night up to under 50 m3/day and night without a license as prescribed by law, as prescribed in Point a, Clause 1, Article 20 of Decree No. 36/2020/ND-CP dated March 24, 2020 of the Government, shall be subject to a fine of 70 million VND.

The act of not fully preparing books, vouchers, documents and related materials to determine the actual annual exploitation output as prescribed in Point d, Clause 4, Article 40 of Decree No. 36/ND-CP dated March 24, 2020 of the Government shall be subject to a fine of VND 80 million.

Failure to update the mine status map within 6 months as prescribed in Point d, Clause 5, Article 40 of Decree No. 36/ND-CP dated March 24, 2020 of the Government shall be subject to a fine of VND 170 million.

The act of not organizing occupational safety and hygiene training for 93 people according to the provisions of law, as prescribed in Point c, Clause 1, Article 24 of Decree No. 28/2020/ND-CP dated March 1, 2020 of the Government, shall be subject to a fine of VND 50 million.

With the above 4 violations, the total amount of money Dong Tien Joint Stock Company was fined is 370 million VND.

Also in the Administrative Violation Record No. 01/BB-VPHC, full information on the inspection of tax-related obligations for Dong Tien Joint Stock Company is provided.

Specifically, in 2020, Dong Tien Joint Stock Company was inspected by the Tax Department at the enterprise according to Decision No. 1158/QD-CT dated June 9, 2020; inspection year 2018 - 2019. Through the inspection, tax arrears, administrative violations and late payment fees were collected with a total amount of more than 636 million VND. Therefore, in this inspection, the inspection team members did not conduct an inspection of tax law compliance in 2018 and 2019.

In addition, due to time constraints during the inspection process, the inspection team members only inspected and compared the declaration and payment of resource tax and environmental protection fees in 2020 and the first 9 months of 2021.

Checking the declaration of resource tax determined that from January 1, 2020 to September 6, 2020, the output of white marble for producing Carbonnat powder in stock was 61,042 tons, equivalent to 31,151 m3; the resource tax incurred is 1,602,359,089 VND, Dong Tien Joint Stock Company declared 1,081,127,040 VND, the difference is 521,232,049 VND. From September 7, 2020 to December 31, 2020, the output of white marble for producing Carbonnat powder in stock is 25,985 tons, equivalent to 16,241 m3; the resource tax incurred is 389,778,339 VND, Dong Tien Joint Stock Company declared 318,608,880 VND, the difference is 71,169,459 VND. In the first 9 months of 2021, the output of white marble for producing Carbonnat powder in stock was 50,918.21 tons, equivalent to 31,824 m3; the resource tax incurred was 763,773,089 VND, Dong Tien Joint Stock Company declared 502,819,968 VND, the difference was 260,953,121 VND. Also in the first 9 months of 2021, Dong Tien Joint Stock Company exploited white marble in block form (<0.4 m3) to cut paving stones (type 3) with an output of 485.13 tons; the resource tax incurred was 240,139,150 VND, the declared amount was 252,650,525 VND, a difference of 37,488,825 VND.

Regarding environmental protection fees, the Interdisciplinary Inspection Team determined that the amount of fees payable from 2020 to September 2021 that Dong Tien Joint Stock Company had to pay was VND 595,744,838, but the declared amount was VND 488,702,187, a difference of VND 107,042,651.

According to the assessment of the Interdisciplinary Inspection Team, regarding natural resource tax, the taxable output in the period was converted in accordance with Decision No. 22/2020/QD-UBND dated August 24, 2020 of the Provincial People's Committee on promulgating the price for calculating natural resource tax in Nghe An province; the taxable price is based on Decision No. 73/2017/QD-UBND dated December 1, 2017 of the Provincial People's Committee on promulgating the minimum price list of natural resources in Nghe An province.

Regarding environmental protection fees, the mineral output for which fees are calculated during the period has been converted from finished product output to raw mineral output according to Decision No. 39/2017/QD-UBND dated April 1, 2017 of the Provincial People's Committee. Applying the fee calculation coefficient according to the open-pit mining method K=1.1 (Article 5, Decree No. 164/2016/ND-CP); the fee calculation level is based on Resolution No. 07/2017/NQ-HDND stipulating the environmental protection fee calculation level for mineral exploitation in the area.

However, Dong Tien Joint Stock Company's declaration of resource tax and environmental protection fee in 2020 and the first 9 months of 2021 was lower than the amount of resource tax incurred and environmental protection fee payable to the State budget. The Interdisciplinary Inspection Team requested the Provincial Tax Department to direct: Issue a decision to sanction administrative violations in tax, calculate late tax payment and collect resource tax and environmental protection fee in 2020 and the first 9 months of 2021 with a total amount of VND 997,886,104 (of which, resource tax was VND 890,843,453 and environmental protection fee was VND 107,042,651).

In the article “Around a mineral enterprise being charged with back taxes", we raised concerns when Dong Tien Joint Stock Company was charged with additional taxes. The reason for this is because this enterprise has been assessed for many years as a top enterprise, strictly complying with tax laws in Quy Hop district. Therefore, when we learned that the reason for Dong Tien Joint Stock Company being charged with additional taxes was because of the "difference" in declaring resource tax and environmental protection fees, we were even more concerned?

Because according to the investigation, the above-mentioned figures on the volume of mineral imports into the warehouse are all shown in the records and books provided by Dong Tien Joint Stock Company to the Interdisciplinary Inspection Team; moreover, the price for calculating natural resource tax and the environmental protection fee have been clearly regulated. So is it possible that Dong Tien Joint Stock Company made a mistake, or intentionally declared a "difference"? As the Administrative Violation Record No. 01/BB-VPHC of the Interdisciplinary Inspection Team clearly informed, in June 2020, Dong Tien Joint Stock Company was inspected by the Tax Department, collected tax arrears, administrative fines and late payment fees with a total amount of more than 636 million VND. Therefore, it would be hard to believe that this enterprise dared to intentionally declare a "difference", to deceive the State agency!

Assuming that Dong Tien Joint Stock Company made mistakes in calculation and declaration; or intentionally declared "differences", the question must be asked: Why did the tax and fee collection management unit of this enterprise, Phu Quy 1 Regional Tax Department, not detect it?