Grasping the payment needs of many individuals, units, and subjects, including some taxpayers, have used many tricks to trade value-added invoices, causing significant tax losses to the State budget.

“As long as we have the information of the paying party, we can write down any amount of money and any business line” – that was the affirmation of the director of a company based in Vinh City, when we (PV) mentioned the need to find an invoice to pay for an electrical repair contract.

According to this director, the buying and selling of value added invoices is mainly using real invoices to create documents, export fake goods, legalize inputs, increase costs, reduce taxable income, legalize smuggled goods... to commit fraud and tax evasion. Buying and selling a few invoices for many individuals and businesses is as easy as... "buying vegetables".

To verify the above issue, we were present at an electronics business in Vinh market area; when we expressed our desire to buy an invoice worth 10 million VND for the electrical equipment repair business, the owner of this business immediately nodded and offered a price of 5% of the amount written on the invoice (ie 500,000 VND in fees). Just provide specific information about the name of the payment unit, address, tax code and it will be available immediately without having to wait. The owner of this business also affirmed that if payment is not made, the seller will take responsibility and issue another invoice.

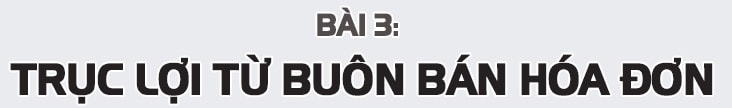

Buying and selling invoices is even easier for food services, hotels, motels, and train tickets. Nowadays, there are even many groups and secret societies on social networks specializing in buying and selling invoices. Try joining a group buying and selling invoices on Facebook with more than 15,000 members, and you will immediately see invitations to buy and sell reputable invoices with low discounts. Just post information about the need to buy invoices in any field, and dozens of messages will come to introduce the service, along with the level of security, safety, and payment commitment.

In particular, the most common activity of trading invoices is in the business of trading agricultural, forestry, aquatic, seafood products, and mineral exploitation such as stone, sand, etc. For each transaction of buying and selling invoices, both the seller and the buyer can agree on a difference of 5-15% per invoice on the total amount stated in the invoice. Not creating any business or trading activities but still recording invoices has caused the State not only to not collect any amount, but also to lose a tax refund due to these virtual transactions.

Talking about the trick of buying and selling invoices, according to some experts in the economic field, the most dangerous and serious is still the act of establishing a ghost enterprise just to trade invoices. Because currently, the mechanism and procedures for establishing an enterprise are very open and simple, only needing personal information, along with declarations about address, business registration industry, charter capital declaration... and waiting for about 1 week to complete the procedures to establish a business. Taking advantage of this point, many subjects have hired people or established a series of private enterprises to buy and sell value-added invoices. After having legal status, the subjects still submit full monthly tax reports to the tax authority, but instead of real production and business activities, these subjects will proceed to buy and sell invoices.

Invoice traders often operate in groups, including groups that specialize in establishing businesses, and other groups that are responsible for finding customers in each locality to consume invoices. With this method, businesses that need to legalize input goods also benefit, invoice buyers and sellers also receive money according to a percentage of the amount written on the invoice, and only the State suffers when it has to spend billions of dong to refund taxes.

With the increasing trend of invoice trading and the subjects using more sophisticated tricks, the authorities have also handled many cases and many subjects buying and selling invoices. However, it is possible that due to the huge profits, many subjects are still willing to rush into this illegal business.

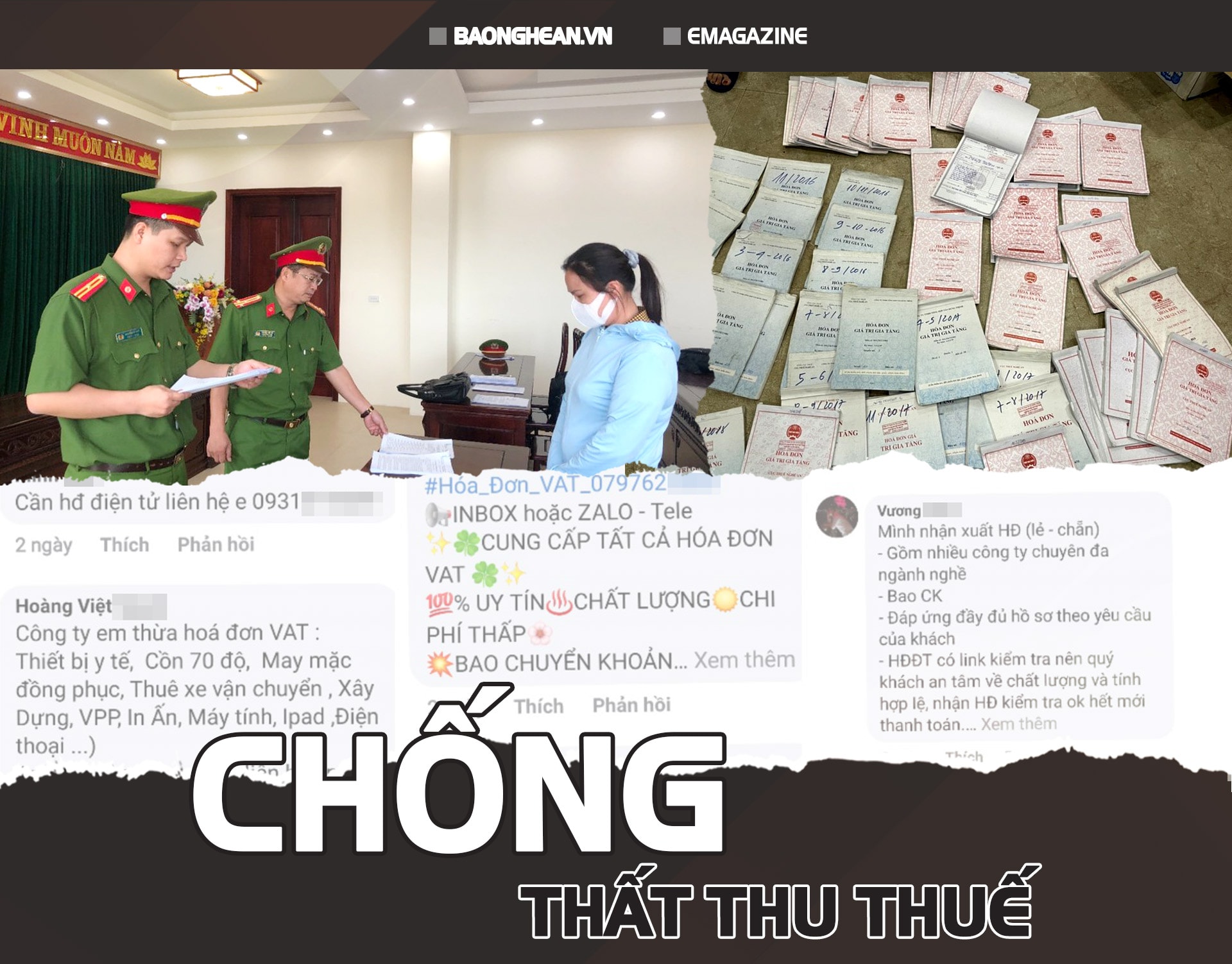

One year ago, on April 29, 2021, the Investigation Police Agency of Nghe An Province Police issued a decision to prosecute Vu Thi Hong T. (born in 1983) and Ha Thi H. (born in 1985), both residing in Vinh city, to investigate the act of illegally buying and selling invoices and documents.

Accordingly, Vu Thi Hong T. used another person's identity card and signature to register the establishment of Dat Tien Phat Construction and Investment Company Limited and registered the company's legal representative for the purpose of illegally buying and selling invoices. After establishing the enterprise, T. and Ha Thi H. managed and operated the company's activities. These two subjects signed economic contracts, payment records, and value-added invoices of a company, and at the same time prepared financial reports, tax reports, managed the company's value-added invoices, and wrote value-added invoices for sale. Although this company had no fixed assets, no construction machinery and equipment, no records of renting means of transport..., it still issued output invoices related to the industry of supplying labor, renting means of transport, machinery, and equipment to other units to make a profit.

Previously, in January 2021, Vinh City Police also arrested Nguyen Thi D. (born in 1988), residing in Vinh Tan Ward and Tran Thi Kim N. (born in 1987), residing in Hung Dong Commune (Vinh City), who are managers and accountants of two enterprises, to investigate the act of illegally buying and selling invoices and documents.

During the urgent search at the locations, the police force seized a large number of invoices, documents of payment to the State budget, many seals of enterprises... and many related evidences. Through investigation, the police agency determined that since 2015, Nguyen Thi D. and Tran Thi Kim N. had established many ghost companies to illegally buy and sell invoices. The subjects rented locations or falsified locations to register to establish companies, register to print and issue Value Added Tax invoices at tax offices in Nghe An. After obtaining the operating licenses of those companies, the subjects sold invoices to businesses in need to legalize business items that did not exist in reality. The subjects selling invoices earned a profit of 5-8% of the total amount of goods. Since 2015, the total amount of goods recorded in the issued invoices was more than 100 billion VND.

The above-mentioned cases may only be a small part of the lucrative cake that illegal invoice trading brings. In fact, according to the assessment of the tax authorities, violations in the use of invoices in recent times have not only not decreased but also tended to increase with more sophisticated tricks.

In addition to the act of establishing "ghost companies" to sell fake invoices, many subjects also issue retail invoices for goods but not to the right buyers; invoices do not fully state the indicators, not in the prescribed order; input invoices are determined by the selling unit with the wrong tax rate; invoices have expired; retail goods with a large proportion but do not issue invoices, do not declare taxes; do not issue invoices for retail lists or issue retail lists that do not comply with regulations; buy and sell invoices, issue invoices but do not match the arising business...

Many opinions say that the reason for the illegal invoice trading activities to take place is partly due to the lack of strict sanctions, along with the responsibility of the people and businesses when conducting transactions and buying and selling. Not to mention that letting businesses self-declare and take responsibility also makes it easier for invoice traders to operate, because they are not inspected and controlled by the authorities as before.

In response to the situation of illegal trading and use of invoices, according to regulations from July 1, 2022, all organizations, businesses, households, families, and individuals doing business will have to use electronic invoices with authentication codes from the tax authorities. All invoices of these entities will have to be transferred through the tax authority's control system to verify, check, and issue invoice identification codes to ensure.

(To be continued)