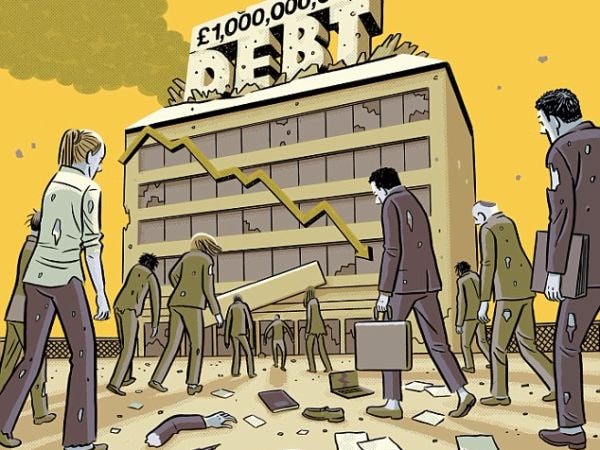

'Zombies' are 'eating' Asia

(Baonghean) - Governments and banks in Asia continue to disburse preferential financial packages and other forms of support to help maintain the survival of companies on the brink of bankruptcy - also known as "zombie" companies. They hope that these companies will become sustainable businesses once they recover their growth momentum. However, in reality, these types of companies are destroying the global economy...

For example, the current situation in Korea is with Daewoo Shipbuilding and Marine Engineering Co., Ltd. On March 23, two state-owned banks, the Korea Development Bank and the Export-Import Bank of Korea, agreed to lend the struggling shipbuilder $2.6 billion and convert the debt into equity to prevent the possibility of bankruptcy.

In a statement, the Korea Development Bank also warned that if Daewoo goes bankrupt, “the damage to the country's economy could be huge as the entire shipbuilding industry could collapse and financial institutions could face even greater losses.”

|

| Daewoo Shipbuilding has faced many difficulties recently. Photo: Bloomberg |

Indeed, Daewoo is suffering a severe crisis across the entire shipbuilding and shipping industry, which has been hit hard by the slowdown in global growth and trade. Another Korean giant, Hanjin Shipping Co. Ltd., went bankrupt last year. Daewoo’s creditors are likely hoping for a bailout to sustain the company until conditions in the industry improve.

Yet it is a film with a very familiar plot. It has been less than two years since Daewoo Shipbuilding received its first bailout loan and a debt-for-equity swap. In reality, the company began as a sprawling, cash-strapped shipyard that the government forced upon a reluctant Daewoo Business Group in 1978.

Then, when the Daewoo Group collapsed following the Asian financial crisis of the late 1990s, Daewoo Shipbuilding was pulled from the ashes and became an independent company in 2000 with another debt swapped for equity.

Certainly, forcing a company like Daewoo into bankruptcy comes at a high cost. Workers may lose their jobs, banks may be saddled with bad debts, etc. But if these “zombies” are maintained, the price to pay is much higher.

A study published in January by the Organisation for Economic Co-operation and Development (OECD) said that “zombie” businesses – defined as older companies that have difficulty paying interest on their debt – are contributing to slow productivity growth and therefore sluggish growth in developed countries.

Zombie companies deprive healthy businesses of opportunities to expand and create barriers to entry for new businesses, which in turn affects investment. For OECD countries, the authors of the study link the increase in zombie companies compared to the period before the 2008 financial crisis to a cumulative loss of 2% in investment and 0.7% in employment.

In a context of sluggish growth and persistent unemployment due to a slow post-crisis recovery, missing out on such opportunities to create jobs and encourage investors is clearly no small matter.

“The results show that the number of zombie firms and the resources poured into them have increased since the mid-2000s, and that more and more of these low-productivity firms are on the verge of bankruptcy, clogging up the market and inhibiting the growth of more productive firms,” the study authors assert.

|

| Zombie companies have low or no profits and are at high risk of becoming illiquid. Photo: Dailymail |

Yet policymakers still believe to some extent that they can defy the market. In China, senior government officials have repeatedly broken promises to crack down on “zombie” businesses in industries with excess capacity and massive debt.

According to estimates, one of the fertile economic lands for “zombies” in China is iron and steel, the actual operating capacity increased in 2016. Although bankruptcies are still on the rise, the number of companies barely surviving is still very large.

He Fan, an economist at Renmin University in Beijing, recently estimated that about 10% of listed companies in China meet the criteria of “zombie” businesses – a figure that the expert said is modest compared to the actual scale of the problem.

By wasting money on dying businesses and adding to the massive corporate debt in the process, Chinese officials are sacrificing the growth, jobs and innovation the economy needs in the future, he said.

“Zombie businesses are holding back China’s economic recovery. Their existence prevents the reallocation of resources to more productive industries, leading to an uneven playing field,” He Fan wrote.

And there may be lessons for America. In pursuing his goal of reviving American manufacturing, President Donald Trump must be careful that government intervention does not upset the market, such as by imposing high taxes in response to the cost benefits of producing goods abroad.

Factories that survive under such protection are not necessarily “zombie” businesses, but they would certainly have the same impact on the economy. By blocking production overseas, Trump may save some American jobs, but he places the burden on indirect consumers through higher prices, and on shareholders through reduced corporate profits.

If that happens, it will be like another horror movie, when this "zombie" creates more "zombies".

Thu Giang

(According to Bloomberg)

| RELATED NEWS |

|---|