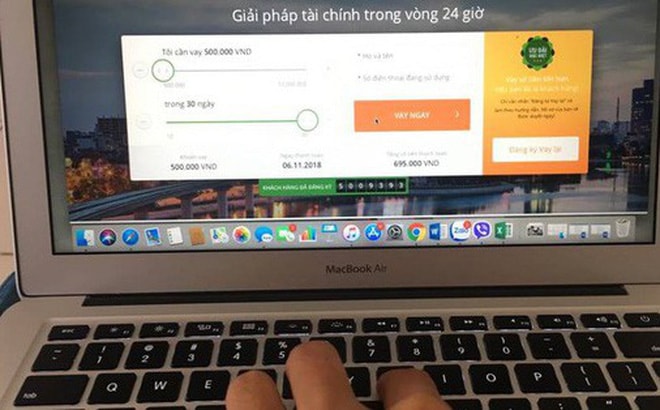

Online peer-to-peer lending with 720% interest rate

Peer-to-peer lending is not inherently bad, but it has been transformed, distorted, and operated outside the law by many investors.

At a training session on the consumer finance market recently held by the Vietnam Banking Association in Vung Tau, many experts acknowledged that the online lending model, peer-to-peer lending (P2P), is developing very "hotly" in Vietnam.

|

Currently, there is a P2P lending company in Vietnam that has been established for nearly two years, but each day there are about 2,000 loan applications. Meanwhile, according to a survey by PV, as of 8:00 a.m. yesterday, the peer-to-peer lending company Tima has mobilized a total amount of more than 45,709 billion VND from 25,051 investors participating in lending.

Ambiguous relationship between intermediary and investor

Evaluating this lending model, Dr. Can Van Luc, chief economist of the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) and Director of BIDV Training School, said: Recently, the peer-to-peer lending model, online lending, without going through a bank intermediary, but only with an intermediary unit which is a company providing a technology platform connecting the lender and the borrower like Uber and Grab, has appeared in Vietnam.

In the world, this model is also developing very strongly. In China, the outstanding balance of peer-to-peer lending as of the end of last year was somewhere around 30 - 40 billion USD and there were about 6,000 companies participating in the P2P lending sector. However, facing the reality of this form of transformation, China has now reduced the number of P2P companies to about 2,000 units.

Talking about the positive side of the online lending model, Mr. Luc shared: There is always a real need in the economy that there are people who need to borrow and there are also people who want to lend. Now, thanks to the development of technology, there is no need to go through intermediary financial institutions, no need for branches or headquarters, the number of transaction staff is not much, helping to reduce transaction costs extremely low. And people who need to borrow get disbursed very quickly.

“It has many advantages, but the worrying thing is that this form of borrowing, which is considered to have many advantages, has been distorted, because many capital raisers deliberately do wrong, using the mobilized money to invest in other fields, not just lending. The relationship between the technology platform provider and the investor is unclear.

Regardless of the form of P2P lending in Vietnam or in the US, the common point is that most customers borrowing under this model are subprime, not meeting the lending standards at commercial banks or financial companies" - Mr. Luc emphasized.

|

| The peer-to-peer lending model will continue to develop without a legal basis, which will be risky for both borrowers and lenders, but investors will face more risks. |

Legal framework needed soon

According to many experts, the biggest challenge is that Vietnam still does not have a legal basis to manage the peer-to-peer lending sector. With the peer-to-peer lending model continuing to develop without a legal basis, it will be risky for both borrowers and lenders, but investors will face more risks.

Because of the fear of taking on more risks, many investors who have borrowed money through P2P always want to use every means to collect debts, including gangster-style debt collection.

So in the coming time, how operators need to manage and develop it is an issue that is receiving a lot of attention from society.

|

Dr. Can Van Luc said: Peer-to-peer lending is essentially a civil relationship, meaning that legally it already has a legal form somewhere. However, this form of lending associated with technology is a new challenge.

Currently in the US, they manage peer-to-peer lending very scientifically. First, they assign the US Securities and Exchange Commission to be the focal point, second, they strictly manage the technology platform provider and it must be a company licensed as an investment management company, and the employees must be licensed to practice.

At the same time, the US also issued regulations to manage the interests of investors (lenders), which is to set limits, not allowing intermediary companies to mobilize too much capital, and limit the investment level of investors.

For example, investors are only allowed to borrow an amount equivalent to their income. If they earn 20 million a month, they are only allowed to invest an amount equivalent to their income, but cannot invest many times their income. These are very good experiences that Vietnam can refer to.

According to Mr. Luc, given the rapid development of the peer-to-peer lending model, it is recommended that the State Bank issue a legal basis as soon as possible, but it certainly cannot be banned just because it is difficult to manage.

Because this is the development trend of technology and in the world, this model has also developed strongly. If there is no legal framework soon and this model is allowed to operate outside the law and then collapse, the consequences and risks for society will be extremely large.