Nghe An focuses on lending for economic and social recovery and development according to Resolution 11

(Baonghean.vn) - Implementing the Plan of the Vietnam Bank for Social Policies on implementing Resolution No. 11 dated January 30, 2022 of the Government on the Socio-Economic Recovery and Development Program, Nghe An has actively implemented and achieved a number of important results.

Loan disbursement progress reached over 78%

Yen Thanh is a district with a large policy target, with a policy credit scale of more than 750 billion VND, a land with a tradition of studiousness, with tens of thousands of students studying in the whole district. Implementing Resolution No. 11 dated January 30, 2022 of the Government on the Programeconomic and social recovery and development, many students, educational institutions in the area are able to borrow capital for teaching and learning.

In 2021, student Thai Van Luc - son of Mr. Thai Van Chin in Hamlet 3, Ly Thanh Commune, is studying at Hanoi University of Industry. Mr. Thai Van Chin's family is poor, in difficult circumstances, both husband and wife are farmers and often sick, so it is difficult to provide financial support for their children's education. In addition to being able to borrow 12.5 million VND to cover their children's education costs, the family is supported to borrow 10 million VND with an interest rate of 1.2%/year, loan term of 36 months.

Mr. Thai Van Chin said that the loan capital supported by Resolution 11 has helped him buy computer equipment for his children's studies, reducing difficulties for his family.

|

| Yen Thanh District Social Policy Bank disburses loan to Mr. Thai Van Chin in Hamlet 3, Ly Thanh Commune, whose son is studying at Hanoi University of Industry. Photo: Thu Huyen |

According to Mr. Phan Huu Trang - Director of the Transaction Office of the Social Policy Bank of Yen Thanh District, in recent times, many major policies and guidelines of the Government for the goal of poverty reduction and social security have been widely implemented throughout the district. With the role of implementing the recovery goals of the Government during and after the Covid-19 pandemic, capitalpolicy creditAccompanying businesses and preschools, there are more resources to recover and reproduce, students who cannot go to school due to the pandemic can borrow capital to buy computers and online learning equipment...

|

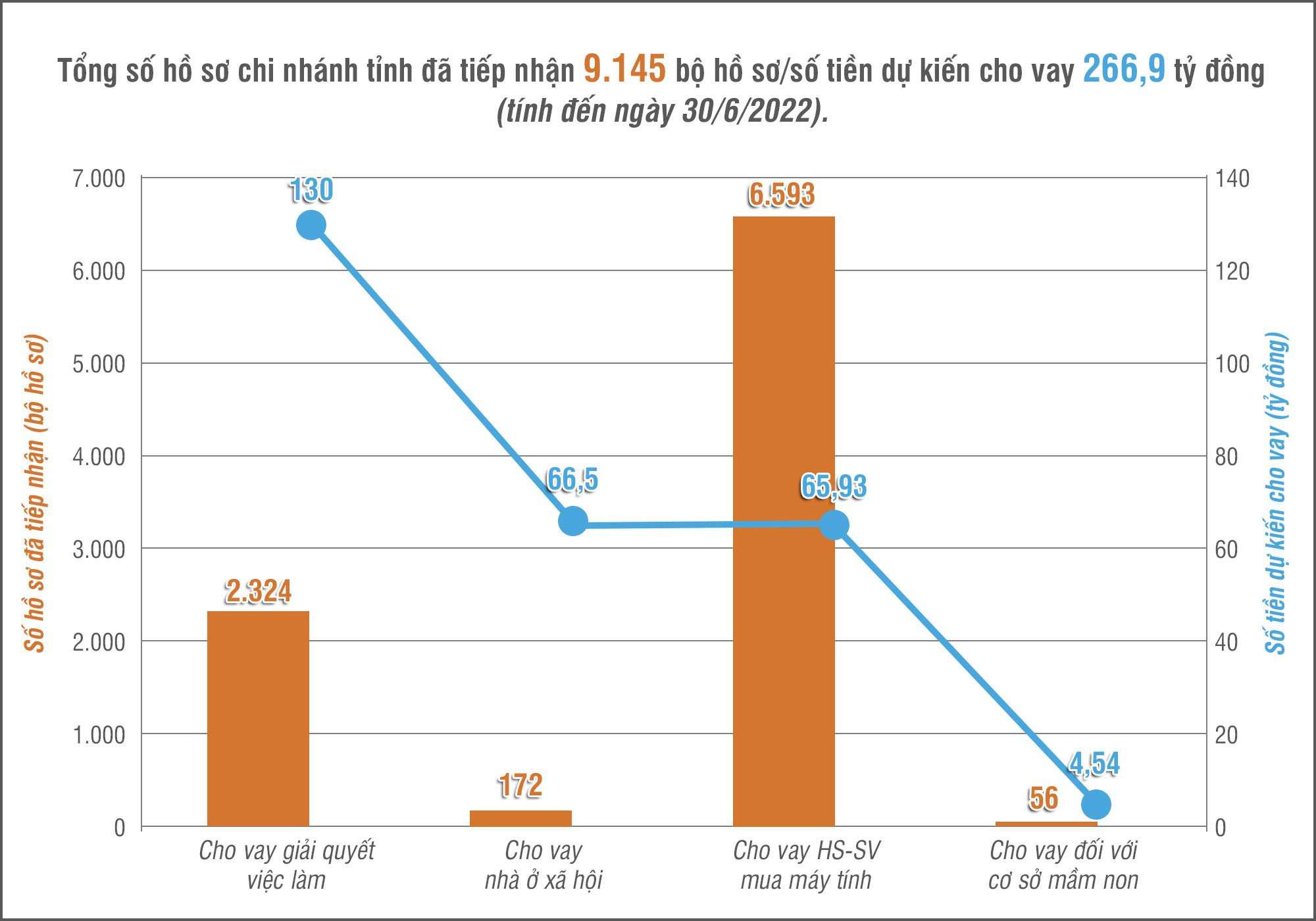

| Results of implementing Resolution 11 until July 30, 2022 in Nghe An. Graphics: Huu Quan |

Recently, implementing Resolution No. 11, the Nghe An branch of the Vietnam Bank for Social Policies has coordinated with relevant agencies to synthesize the capital needs of policy credit programs for the period 2022-2023 in the area. Based on the synthesis and review, the total demand for 5 credit programs is 2,177 billion VND, of which: 1,069 billion VND in 2022; 1,108 billion VND in 2023. By June 30, 2022, the branch has been allocated capital in 2 phases with a total target of 469 billion VND for 5 credit programs. Immediately after receiving the capital allocation decision from the General Director, the branch advised the Board of Directors to assign to districts, towns and cities for implementation.

As of June 30, 2022, the provincial branch has received a total of 9,145 sets of documents/expected loan amount of VND 266.9 billion. From the end of April to now, the branch has disbursed capital (4/5 authorized credit programs) to 8,913 customers, amounting to over VND 250.2 billion, completing 78.4% (not including VND 150 billion in loans for ethnic minorities and mountainous areas).

|

| Tan Ky District Social Policy Bank guides people to borrow capital to solve employment problems according to Resolution 11 for beneficiaries. Photo: Thu Huyen |

In addition, the branch also provides interest rate support for loans at the Social Policy Bank according to Decree No. 36/2022/ND-CP. According to the results of the synthesis of the interest rate support plan from district-level transaction offices: The average outstanding balance with interest rate support in 2022 is 1,665 billion VND, the demand for interest rate support in 2022 is 33.4 billion VND.

Timely and appropriate lending

However, the implementation processResolution No. 11The Government's Resolution dated January 30, 2022 on the Socio-Economic Recovery and Development Program still faces some difficulties and obstacles. According to the leader of the Provincial Social Policy Bank, the capital source for the job creation program allocated by the Central Government to the branch is still modest compared to the actual needs in the area, currently only reaching 130/730 billion VND of the demand (equal to 17.8%), not meeting the actual loan demand to create jobs and income for workers.

Regarding the lending program for ethnic minority and mountainous areas, some opinions said that, up to now, the Central Government has not issued a document guiding the lending, and localities have not announced the results of approving the list of beneficiaries of sub-projects related to loans from the Social Policy Bank under the National Target Program for Socio-Economic Development of Ethnic Minority and Mountainous Areas, therefore, the process of coordinating review and determining capital needs has encountered many difficulties, completing the disbursement plan of 150 billion VND of capital from this program in 2022 is really a challenge for the branch.

|

| The Transaction Office of the Social Policy Bank of Yen Thanh district signed a credit contract to support businesses in borrowing capital to restore production due to the epidemic. Photo: Thu Huyen |

Opinions from organizations such as the Provincial Veterans Association, Provincial Youth Union, etc. also said that the implementation of loan programs is difficult due to procedures, invoices, required documents, and high material prices, leading to difficulties in implementing loans for social housing construction.

We propose that the Vietnam Bank for Social Policies continue to pay attention and facilitate the allocation of capital to implement Resolution No. 11 of the Government in Nghe An province in 2022 to provide loans to meet the needs of the subjects (expected in the short term: Loans to create jobs of 300 billion VND; loans to support students to buy computers of 12.5 billion VND). Research to support the automatic warning function of outstanding debt according to the credit program and the debt status of customers for users when registering for loans on the Intellect system.

In addition, the Provincial and District People's Committees continue to pay attention to and balance additional local budgets entrusted through the Social Policy Bank to, together with the Central capital source, increase lending for credit programs.interest rate supportaccording to Resolution No. 11 of the Government. Direct relevant departments, branches, sectors, and district People's Committees to approve the list of beneficiaries of credit policies related to ethnic minorities and mountainous areas so that the Social Policy Bank can provide timely loans in 2022.

|

| Pu Mat Pharmaceutical Joint Stock Company was given a 0% interest loan to pay employees for 3 months of suspension. Photo: Thu Huyen |

Recently, at a meeting with the Board of Directors of the Vietnam Bank for Social Policies in Nghe An province on the implementation of Resolution No. 11 dated January 31, 2022 of the Government on the Program for socio-economic recovery and development, Mr. Nguyen Duc Hai - Deputy General Director of the Vietnam Bank for Social Policies acknowledged that Nghe An has closely followed the Central's instructions, assigned tasks for close implementation, so it has achieved good results, ensuring the requirements of the Central, reaching over 78% of the planned target.

Because the loan target according to the Resolution is quite broad, to increase the effectiveness of the program's benefits, as well as to avoid policy exploitation, the Deputy General Director noted that the Provincial Social Policy Bank should continue to proactively coordinate with entrusted organizations to accelerate the disbursement of loans for credit programs quickly, neatly, promptly, and to the right beneficiaries. Continue to review and determine capital needs for programs that have fully disbursed their targets and submit to superiors for additional capital sources, in order to meet actual needs...