Customers struggle with biometric authentication for banking transactions

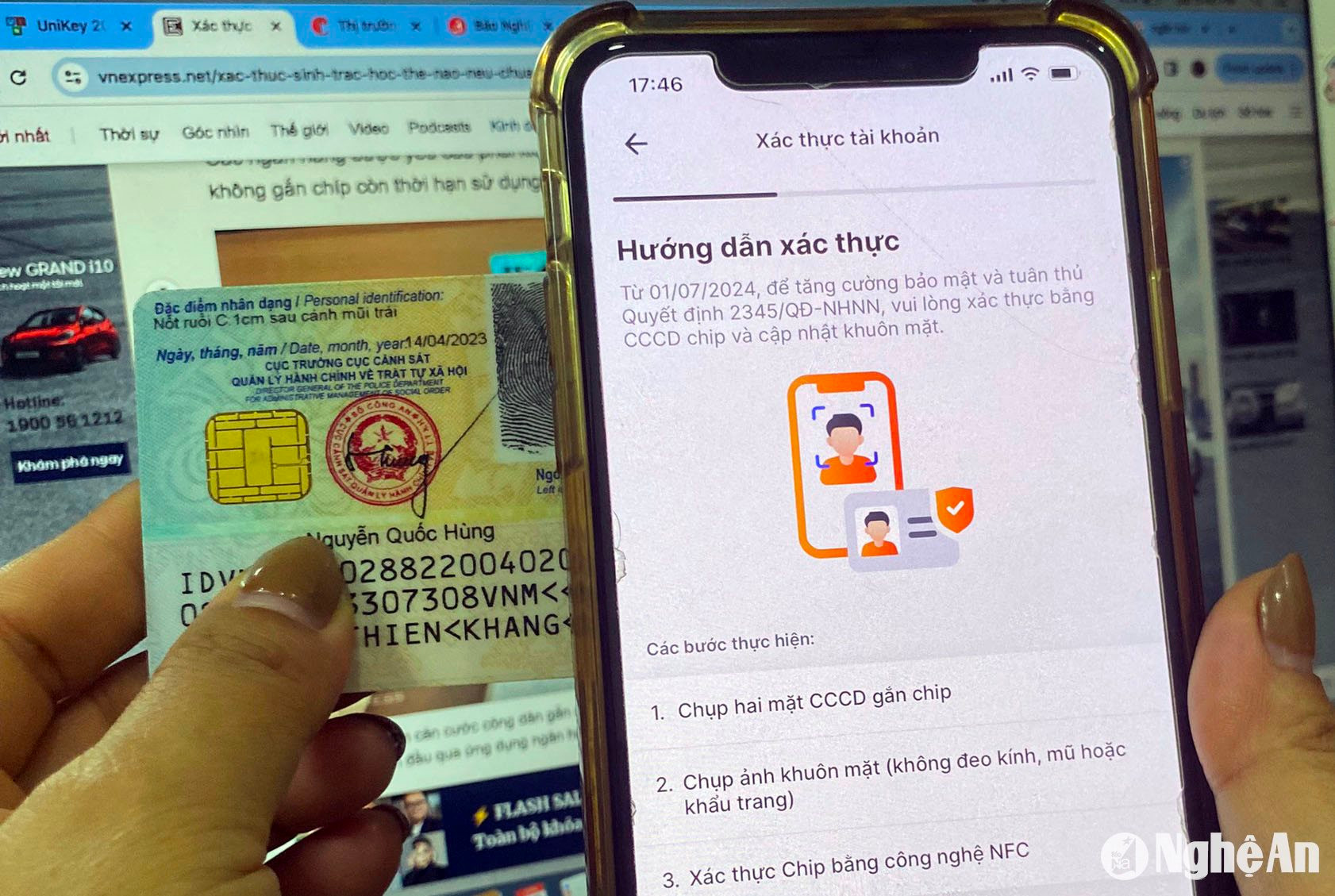

From July 1, online banking transactions will apply bio-authentication according to Decision 2345 of the State Bank.

Banks proactively intervene

Thus, customers who want to transfer money from 10 million VND/time and 20 million VND/day; customers who deposit money into e-wallets from 10 million VND or make inter-bank transactions abroad... must perform biometric authentication.

Previously, in June, many banks began to pilot the biometric authentication and urgently supported customers to complete it. Up to now, many banks have implemented it early and quickly with a large number of customers registering for biometric identification, such as: VietinBank, Vietcombank, BIDV, Agribank, VIB...

Ms. Le Thi Mong Ly - Deputy Director of BIDV Bank Nghe An branch said that BIDV has proactively guided customers to do this for many months now. Particularly in the last days of June, the branch has increased working hours and worked overtime to serve customers.

"In the past few days, the number of customers coming to the headquarters has increased sharply because many people cannot do it themselves, so they come to the bank for instructions. The specific instructions are easy to follow. However, today the traffic has increased so the network is sometimes congested, customers can do it in the next few days."

Ms. Le Thi Mong Ly - Deputy Director of BIDV Bank, Nghe An branch

Currently, some banks have added chip-based ID card reading and verification devices; and are urgently collecting customers' biometric data to deploy biometric authentication for some transactions from July 1.

The implementation process shows that banks are racing to update their applications, enhance customer facial recognition features, and update information to match the population database. Meanwhile, many customers are struggling to update, some can do it right away, others are still struggling.

At a joint stock bank in Vinh city, a customer said: "Because I do a lot of business transactions and large amounts of money, when I heard about this policy, I immediately implemented it. I followed the steps correctly according to the bank's instructions, but when it came to scanning my ID, I couldn't do it. I had to go to the bank to ask for instructions. However, the bank staff couldn't do it either."

A representative of the State Bank of Vietnam, Nghe An branch, said: This is a mandatory condition when transferring money over 10 million VND each time or over 20 million VND per day, or transacting goods and services over 100 million VND. Using biometric measures is an additional layer of security, preventing risks for customers. To have time and a roadmap for implementation, banks have gradually applied it. The industry's viewpoint is to ensure safety for customers but not make it difficult for customers in transactions, in the spirit of the goal of the cashless project that banks and agencies have been implementing very well for a long time.

"It will start to be implemented from July 1st, but not all banks can apply it, it depends on the technology of each bank," said a representative of the State Bank of Vietnam, Nghe An branch.

According to Decision 2345, the two lowest authentication levels, A and B, do not require biometric authentication. For example, with type A transactions, customers only need to log in with their username, password or PIN and are not required to authenticate at the transaction step if they have logged in before. This form applies to transactions to look up information; transfer money within the same bank, same account holder or payment under 5 million VND.

Type B authentication using OTP, biometric identification attached to handheld devices, or electronic signatures to transfer money to others, deposit and withdraw money with e-wallets. However, the transaction size is only under VND 10 million per transaction and under VND 20 million per day.

According to the State Bank, biometric identification of customers for transactions of type C and D (the two highest levels) is done by matching the biometric data stored in the collected and verified customer biometric database. In case of not having a chip-embedded ID card, people must go to the bank branch to update and verify the data.

Biometric authentication as decided by the State Bank is based on comparing the user's biometric characteristics with the information registered in the national population database provided by the Ministry of Public Security or via VNeID - which is being piloted. Therefore, users need to distinguish between device biometrics and biometrics based on national population database.

If the biometric authentication does not match the data on the chip-embedded ID card or the customer biometric database, people will only be allowed to transact under VND 10 million per transaction, or under VND 20 million per day.

Biometric authentication can still be performed without a chip-embedded ID card

One of the most important steps when creating biometric data on banking apps is to take a photo of both sides of the chip-embedded citizen ID card. So what should customers do if they are still using their ID card; or do not have a chip-embedded citizen ID card?

To resolve arising problems, on June 25, the Governor of the State Bank of Vietnam issued Document No. 5262/NHNN-CNTT on guiding a number of contents to implement Decision 2345/QD-NHNN.

According to the guidance of the State Bank, in case a customer does not have an ID card, a chip-embedded CCCD, only has an ID card or a non-chip-embedded CCCD (but must still be valid according to the law), if they need to make online transactions of over VND 10 million or total daily transactions of over VND 20 million, they must register biometric information directly at the transaction counter. Credit institutions need to support customers to authenticate by matching the biometric data stored in the collected and verified customer biometric database.

For customers with chip-embedded ID cards but using phones that do not support NFC (Near-Field Communication wireless connection standard), the authentication measure using the customer's biometric identification mark for type C and D transactions specified in Article 1 of Decision 2345 is implemented: Through authentication of the customer's electronic identification account created by the electronic identification and authentication system (units need to integrate Internet Banking and Mobile Banking applications with the electronic identification and authentication system to provide this service).

The second measure is to match the biometric data stored in the collected and verified customer biometric database, in which the verification is performed as follows: Matching the customer's biometric identification data with the biometric data in the chip of the customer's CCCD card issued by the police agency by performing at the transaction counter, through the unit's chip-mounted CCCD reader device/phone; Or matching the customer's biometric identification data through authentication of the customer's electronic identification account created by the electronic identification and authentication system.

To prepare for the implementation of Decision 2345 from July 1, 2024, the State Bank of Vietnam requires banks to strengthen communication and guidance to all customers on the implementation of transaction authentication measures corresponding to the prescribed transaction limits. Credit institutions prepare plans, hotline channels and arrange staff on duty 24/7 to promptly guide and support customers in registering and using biometric authentication information. Proactively coordinate with the National Population Data Center - Department of Administrative Police for Social Order - Ministry of Public Security and other relevant organizations to prepare plans to handle difficulties and problems in the process of registering and using biometric authentication services. Credit institutions deploy technical solutions to ensure information and customer data security and safety, comply with legal regulations on personal data protection and legal regulations on ensuring information system security and safety.

To avoid transaction congestion and provide timely support to customers, the State Bank encourages units to complete the implementation and provide services to customers soon. The Bank recommends that customers do not update biometrics via any other website or application to avoid the risk of fraud.