USD exchange rate today December 26, 2024: Maintaining the upward momentum

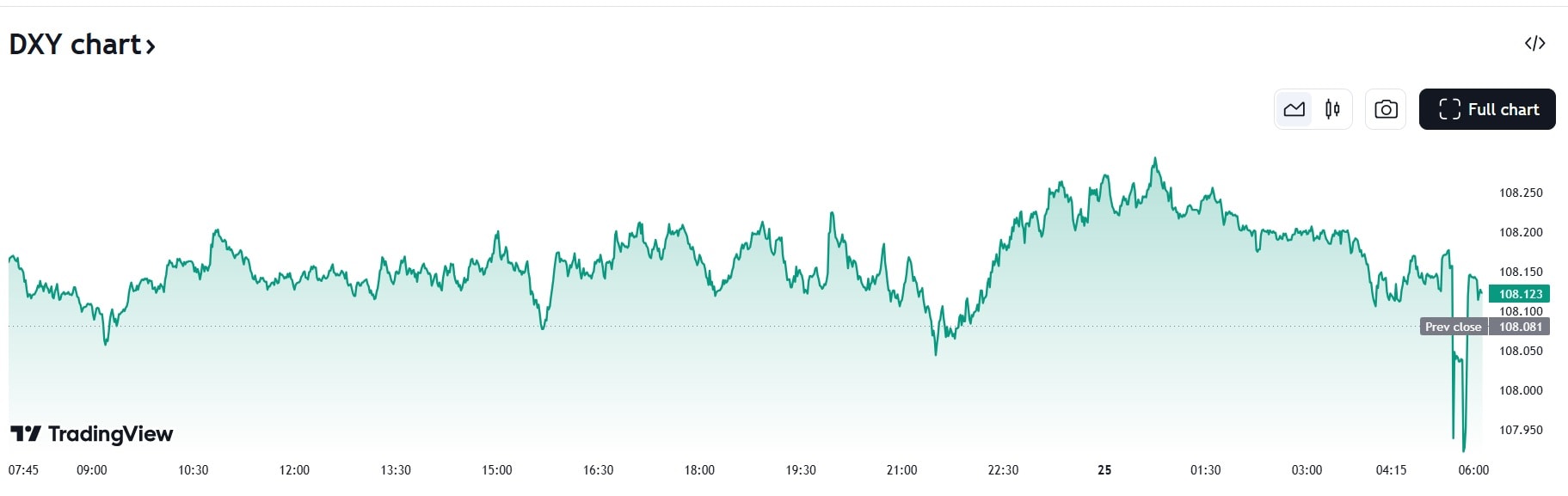

USD exchange rate today December 26, 2024: Maintaining the upward momentum before the new year with the US Dollar Index (DXY) up 0.09%, currently at 108.12.

USD exchange rate today in the world

Meanwhile, in the US market, the US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) increased by 0.09%, currently at 108.12.

The US dollar continued to grow strongly, supported by expectations that the US Federal Reserve (Fed) will delay cutting interest rates. The market also expected US economic growth, contributing to the dollar's gain of more than 7% since September. Inflation and the Fed's forecast of a slower pace of easing interest rate policy next year have strengthened the greenback's position.

The yield on the 10-year US Treasury note hit a seven-month high of 4.629%, reflecting the contrast between the Fed’s dovish stance and global growth forecasts. The widening interest rate differential between the US and other economies has fueled a stronger dollar.

With the market focused on interest rates, trading volumes are expected to remain low heading into the new year 2024. The DXY index is holding at $108.12, up slightly by 0.09%. Staying above 107.9 suggests a short-term bullish bias. A break above the resistance level of 108.54 could see the DXY move towards the next resistance level of 108.9.

Conversely, the DXY index's main support level is at 107.60, with the next support level around 107.18. To maintain the uptrend, the index needs to stay above these levels.

The yield on the US 10-year Treasury note recently rose sharply to 4.62%, breaking through a resistance level, showing investors' confidence in the strength of the US economy and expectations that the Fed will cut interest rates more slowly. The rise in yields reflects increased demand for higher returns amid global economic uncertainty.

High 10-year yields typically support the dollar, as higher yields attract foreign investment. When yields break above 4.58%, this could push the dollar higher and put pressure on commodities and dollar-denominated assets, including gold and silver.

Elsewhere, the EUR/USD pair is currently trading at $1.03912. The EUR is down slightly by 0.13% against the USD. The key support level is $1.04465, which will determine the next move for the EUR. A break above this level could see the EUR/USD pair target the resistance level of $1.05324, followed by $1.06288.

On the other hand, the support level for the EUR is at $1.03426. If it falls below this level, the price could move towards the next support level at $1.02760.

USD exchange rate in the country today

The central exchange rate of the VND/USD currency pair announced by the State Bank applied in the session on December 26 increased to 24,320 VND, an increase of 12 VND compared to the previous level.

The reference USD exchange rate at the State Bank of Vietnam was listed at 23,400 - 25,450 VND/USD (buy - sell), unchanged from the previous session. Meanwhile, the free USD market in Hanoi this morning continued to record an increase compared to the previous session. At 6:39 am, the USD exchange rate (buy - sell) was at 25,699 - 25,799 VND/USD, down 37 VND/USD for both buying and selling compared to the previous session.

On December 26, commercial banks increased the buying and selling prices of USD compared to the previous session. At Vietcombank, the USD exchange rate was listed at 25,206 - 25,536 VND/USD, up 13 VND/USD in both buying and selling prices. BIDV listed the USD buying and selling prices at 25,236 - 25,536 VND/USD, up 8 VND/USD in buying prices and up 13 VND/USD in selling prices compared to the previous session. At Vietinbank, the USD exchange rate was listed at 25,125 - 25,530 VND/USD, unchanged from the previous session. Eximbank listed the USD exchange rate at 25,200 - 25,536 VND/USD, down 20 VND in buying prices and up 13 VND in selling prices compared to the previous session.