Lesson 1: Improving service efficiency for people and businesses

In order to complete the State budget revenue estimate, at the same time, promote modernization, provide electronic tax services to serve people and businesses, in 2024, Nghe An Tax Department focused on leading and directing the promotion of digital transformation. Thereby, helping to increase publicity, transparency, prevent and combat fraud and negativity, create a favorable business environment for people and businesses, in line with international trends.

In order to complete the State budget revenue estimate, at the same time, promote modernization, provide electronic tax services to serve people and businesses, in 2024, Nghe An Tax Department focused on leading and directing the promotion of digital transformation. Thereby, helping to increase publicity, transparency, prevent and combat fraud and negativity, create a favorable business environment for people and businesses, in line with international trends.

With the motto of taking people and businesses as the center of service, Nghe An Tax Department has been implementing many projects and tasks of applying information technology in tax management and comprehensive digital transformation. In 2024 alone, the Tax Department issued a Decision to establish a Steering Committee for Digital Transformation headed by the Director.

For effective implementation, the Tax Department has developed and issued the 2024 Digital Transformation Plan, which sets out tasks and solutions for implementation, with clear assignments for each department and each relevant Tax Branch. The unit also implements the National Digital Transformation Day (October 10, 2024) according to the plan of the General Department of Taxation and the People's Committee of Nghe An province; regularly trains on digital transformation, organizes training courses on basic knowledge and basic skills on digital transformation for civil servants who are leaders of departments, Tax Branches, leaders of Tax Teams...

Mr. Phan Tuan Nghia - Head of Information Technology Department, Nghe An Tax Department, said: In recent times, Nghe An Tax Department has pioneered in deploying information technology applications to serve taxpayers' tax declaration, payment, and tax refund, as well as applications to serve tax management, ensuring the most favorable conditions for people and businesses, meeting the needs of digitalization and digital transformation of the Finance sector, towards national digital transformation.

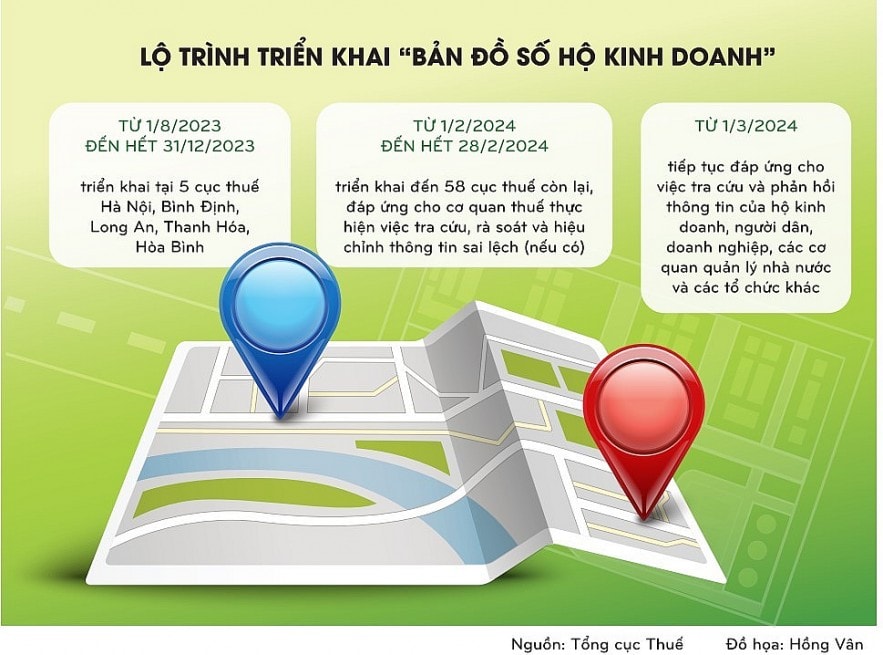

The Department has also focused on promoting digital transformation such as applying Big Data and Artificial Intelligence (AI) to serve tax management and invoice management, contributing to controlling and quickly detecting taxpayers who commit invoice fraud. At the same time, deploying the construction of digital map data for business households and mineral mines in the province; promoting tax management for e-commerce activities and business activities on digital platforms.

Electronic tax services have always maintained the rate of taxpayers declaring and paying taxes electronically at over 99% and 100% of tax refund dossiers in electronic form; 100% of enterprises and business households paying taxes by declaration method have applied electronic invoices in purchasing, selling and providing services.

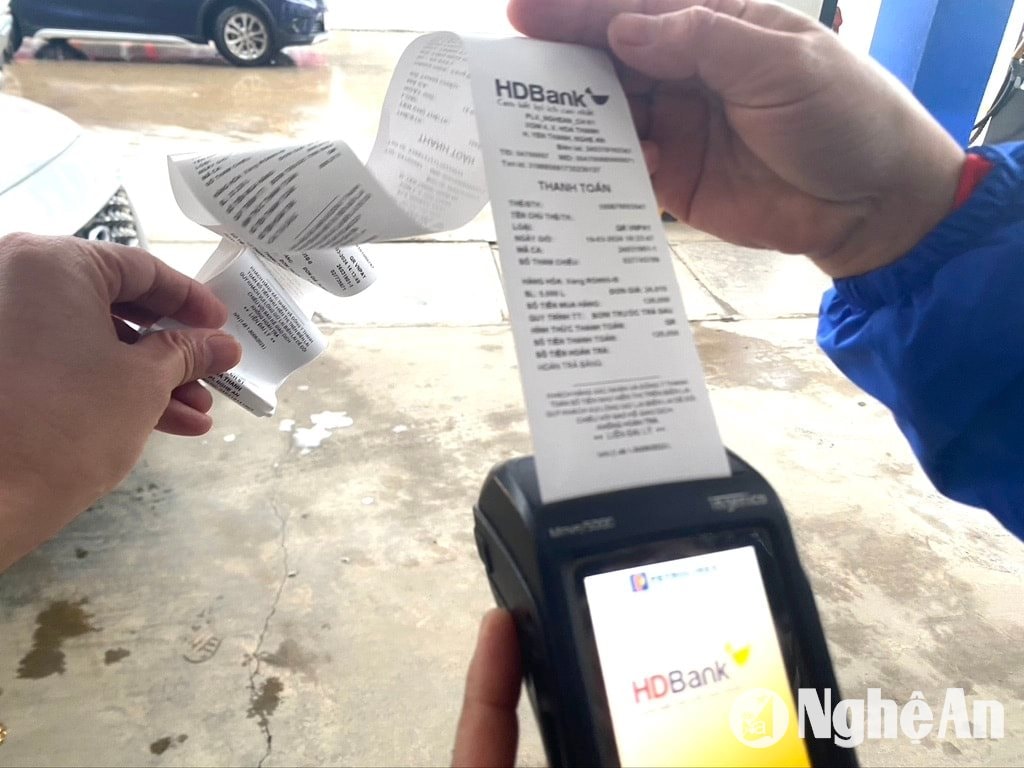

In addition, the effective implementation of electronic invoices generated from cash registers, the total number of registered taxpayers exceeds the number of taxpayers registered for implementation according to Official Dispatch No. 1432/TCT-DNNCN dated April 20, 2023 of the General Department of Taxation; 100% of taxpayers trading in gasoline and oil have applied electronic invoices according to the plan of the General Department of Taxation.

The industry continues to maintain the implementation of electronic tax applications on mobile devices (eTax Mobile) in the province, 100% of civil servants, public employees and employees working in State agencies; 100% of business households paying taxes by declaration method and 70% of business households paying lump-sum taxes have installed eTax Mobile to support taxpayers in looking up tax obligations, paying taxes, notifications, records, looking up car and motorbike registration fee price list, looking up information of taxpayers, business households, dependents, tax settlement, tax authority addresses to facilitate the performance of obligations to the State budget.

Deploying the review and standardization of personal tax codes according to Official Dispatch No. 846/TCT-DNNCN dated March 21, 2023 of the General Department of Taxation on reviewing and standardizing personal tax code data. Nghe An Tax Department is always in the TOP 10 Tax Departments nationwide with the highest number of correct reviews. The Department has coordinated with the Nghe An Provincial Public Service Portal to successfully implement the payment of financial obligations on land for enterprises on the National Public Service Portal under the direction of the Prime Minister.

Deploy and effectively use the application of electronic information exchange on land between the Tax Department and the branch of the Land Registration Office of Vinh City, districts and towns in the province.

Since April 2023, 21/21 districts, towns and Vinh City and 100% of records have had cadastral information transferred to determine financial obligations electronically. Thereby, administrative procedure reform has been promoted, creating maximum convenience for people when carrying out administrative procedures on land.

In addition, the industry has implemented non-cash payment of non-agricultural land use tax through bank accounts of the People's Committees of communes, wards and towns to meet the digital transformation requirements of the Ministry of Finance, the General Department of Taxation and Plan No. 216/KH-UBND dated March 31, 2022 of the People's Committee of Nghe An province on implementing the Project on developing non-cash payments in Nghe An for the period 2021-2025.

As a result, since August 2024, the implementation has been organized in the whole province. Up to now, 100% of the People's Committees of cities, districts and towns in the province have issued official dispatches directing the People's Committees of communes, wards and towns to open authorized collection accounts at BIDV to collect non-cash non-agricultural land use tax. By October 15, 2024, 9/10 Tax Departments have collected non-cash non-agricultural land use tax. Notably, in Vinh City, there have been 55,144 taxpayers, with a tax amount of more than 17,360,000,000 VND collected non-agricultural land use tax in 2024 in this form.

The Tax Department also always strengthens the management of electronic invoices based on the results of risk analysis. The risk management application of the invoice management subsystem supports risk analysis according to the set of assessment criteria, identifying taxpayers with signs of risk in the management and use of invoices issued with Decision No. 78/2023/QD-TCT dated February 2, 2023. The application automatically evaluates and calculates scores on the 25th of each month, thereby determining high, medium and low risk levels. The result of the assessment is a list of taxpayers with signs of risk to be included in the list of inspections, audits or notifications of change in invoice usage.

In addition, based on the situation and actual management requirements of the Tax Department, under the direct guidance of the Director, officers and employees of the IT Department have built and deployed a risk monitoring tool to proactively prevent risks through the development of risk criteria for regular taxpayer management and initial risk assessment for businesses registering to use electronic invoices; at the same time, enhancing the responsibility of units and individuals in taxpayer management.

In Official Dispatch No. 1284 of the Prime Minister dated December 1, 2023 on strengthening the management and use of electronic invoices for business and retail activities of gasoline and oil, the Prime Minister requested Ministers; Heads of ministerial-level agencies, Government agencies and Chairmen of People's Committees of provinces and centrally run cities: Complete the information technology system for electronic invoices, ensure the smooth and convenient reception and connection of electronic invoice information of tax authorities, contributing to improving the efficiency of tax management; to be completed no later than the first quarter of 2024.

Implementing the Prime Minister's direction, by the end of March 2024, 100% of gas stations in Nghe An had completed issuing electronic invoices as required by the Prime Minister.

According to Mr. Nguyen Xuan Hue - Head of Phu Quy I Tax Department, the unit manages 78 petrol and oil stores in Quy Hop, Quy Chau and Que Phong districts: Implementing the direction of Nghe An Tax Department, the unit has coordinated with the districts to establish an interdisciplinary inspection team to deploy electronic invoices for each petrol and oil sale. Along with that, strengthen the management, inspection and supervision of petrol and oil retail business activities, check the issuance of electronic invoices for each sale, and connect with tax authorities.

Vinh City Tax Department manages 26 petrol and oil businesses, with 145 stores. A representative of Vinh City Tax Department said that 100% of petrol and oil stores in Vinh City have issued electronic invoices after each sale since March 20.

At the request of the General Department of Taxation, Nghe An Tax Department has updated the progress of issuing electronic invoices for each gasoline sale of gasoline and oil stores across the province. By March 31, 2024, all stores have completed the investment in machinery and equipment associated with issuing electronic invoices for each gasoline sale; the Tax Department's departments and all tax branches in the area issue invoices for each sale with a total of 1,622 gas stations of 527 stores.

Implementing the National Digital Transformation Program to 2025, with a vision to 2030 approved by the Government, identifying digital transformation as not only a tool but also an adaptive solution, good management, putting into the framework many tax management areas, creating synchronization in storage, input and management, control, and operation, in recent years, Nghe An Tax sector has always strived to reform, modernize management, research and apply many advanced and useful software, from perfecting the legal environment to developing technology infrastructure.

In addition, propaganda should be strengthened for taxpayers to understand how to implement and prevent malware. Nghe An Tax Department has well implemented the modernization strategy of the superiors, providing electronic services and support tools for people and businesses, thereby contributing to improving the efficiency of budget collection.