Final article: Innovation in non-agricultural tax collection and "cashless" solutions

Implementing the goals of the "National Digital Transformation Program to 2025, with a vision to 2030" and the "Project for developing non-cash payments in Nghe An for the period 2021-2025", in order to facilitate people in fulfilling their non-agricultural tax obligations, Nghe An Provincial Tax Department has researched and innovated non-agricultural tax collection methods.

.jpg)

Implementing the goals of the "National Digital Transformation Program to 2025, with a vision to 2030" and the "Project for developing non-cash payments in Nghe An for the period 2021-2025", in order to facilitate people in fulfilling their non-agricultural tax obligations, Nghe An Provincial Tax Department has researched and innovated non-agricultural tax collection methods.

.jpg)

In recent years, taxpayers have paid non-agricultural land use tax mainly through the following forms: Cash payment at block and hamlet headquarters; Payment via eTax Mobile application; Direct payment at commercial bank counters.

The above mentioned forms of tax payment all have different disadvantages leading to difficulties in tax payment for taxpayers as well as difficulties in accounting for documents at tax authorities; specifically: For the form of cash collection at the headquarters of the block, hamlet, the authorized collection officer of the ward/commune can write incorrect taxpayer information, incorrect tax code, incorrect sub-item, the receipt does not record the tax code, does not separate each sub-item of the actual taxpayer but combines them into one sub-item, the dates on the copies of the receipt do not match, leading to late payment or incorrect tax obligations of taxpayers, causing frustration for the people.

An officer of Nghe An Tax Department said: In reality, there is a situation where authorized tax collectors do not sum up the correct amount on the receipt, leading to excess or shortage of tax paid to the state budget; paying money to the state budget in different sub-items. The process of processing tax collection data is manual and cumbersome. Authorized tax collectors of wards/communes transfer paper receipts to the tax authority after paying money to the state budget, the tax authority performs the marking of the set and records the documents into the centralized tax management system TMS, these tasks are all done manually.

Regarding the form of using the eTax Mobile application, in 2023, the amount of non-agricultural tax paid via eTax Mobile is very small, because the operations on eTax Mobile are still quite complicated, causing difficulties for taxpayers when using the application. Linking to a bank account to pay taxes is very difficult, synchronizing the account with the bank is slow. Some commercial banks charge very high fees for each payment transaction. It is not convenient to pay on behalf of others, people who want to pay on behalf of others must know the account number, decision number or payment ID number; many banks have not yet deployed tax payment services on behalf of others on eTax Mobile.

.jpg)

Vinh Tan Ward, Vinh City is a large locality with a population of over 22,000 and a household size of over 5,000. Over the years, the implementation of non-agricultural land tax collection in cash has had many shortcomings, inconsistent with reality, leading to incorrect information about taxpayers, tax collection being difficult, time-consuming, and easily causing budget loss. In particular, the management of budget collection for this source of revenue is not convenient and transparent.

Mr. Nguyen Dinh Thanh - Chairman of Vinh Tan Ward People's Committee said: When we learned that Nghe An Tax Department was piloting cashless collection of non-agricultural land tax, we realized that this is a good model, which will contribute significantly to the state management of non-agricultural land tax collection, so the ward would like to register to be the first pilot.

With a clear understanding of this important issue, Vinh Tan Ward People's Committee started to build a specific and detailed plan with the participation of the entire political system. Before implementing the collection, a conference was held to disseminate to the Party Committee, Executive Committee, Head of the Front Committee and organizations to know, understand, grasp firmly, deploy propaganda on radio systems, prepare instructions on how to do it and send them to the Facebook and Zalo pages of each residential group, then deploy forces to each household... Unexpected results: after 2 days Saturday and Sunday, 80% of the plan was completed, after that, people grasped the information, how to do it and fulfilled their obligations in a convenient and extremely excited way. In 2024, with the new way of doing things, Vinh Tan Ward completed the tax collection with 150% compared to the collection in 2023, reaching 80% of the plan.

Mr. Nguyen Dinh Thanh also added: Through the success of the pilot project of collecting non-cash non-agricultural land tax, we have drawn clear results. This is in line with the current trend in the context that the Government is promoting the national digital transformation. People's Committees at all levels are continuing to promote administrative reform, digital transformation and building a modern administration, contributing to innovation, rapid and sustainable development. People pay taxes anywhere, anytime...

For example, Mr. Nguyen Van Quyet in Tan Phuong block, Vinh Tan ward, has been in Poland for many years. By 2024, thanks to his participation in the Zalo group in the block, he paid taxes himself while in Poland. In fact, in Vinh Tan ward, there are many people who, even though they are not at home, on business trips..., thanks to the form of non-cash tax collection, still participate in fully and conveniently paying non-agricultural taxes.

“However, the Tax Department needs to study the transfer documents, issue new land use right certificates, and attach the declaration of non-agricultural land tax; attach to the documents adjusting taxpayer information if transferring, thereby cutting off the old user's obligations and adding the new user's obligations,” the Chairman of Vinh Tan Ward People's Committee suggested.

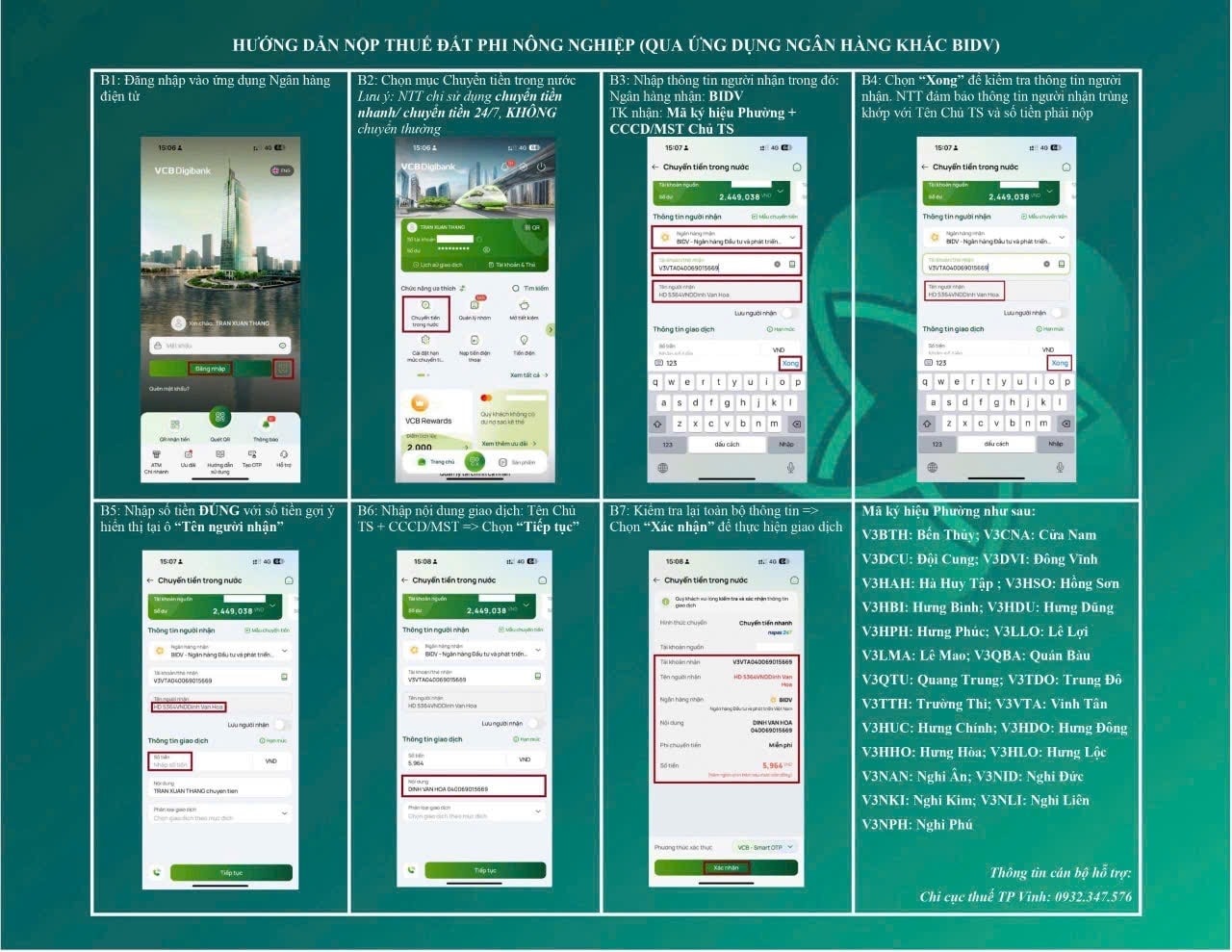

The new form of tax collection is bringing convenience to taxpayers in paying non-agricultural land use tax by transferring money to the tax collection account of the ward/commune People's Committee according to the identification number which is the CCCD number or tax code of the taxpayer. Taxpayers can pay tax anywhere and at any time of the day. Taxpayers can use any bank account to pay non-agricultural tax. Non-agricultural tax can be paid on behalf of another taxpayer easily, just need information about the tax code or CCCD of the taxpayer who needs to pay. Non-agricultural tax payment is free at all banks. Overcoming the limitations of the above forms of non-agricultural land use tax payment.

Support officers authorized to collect non-agricultural taxes at wards/communes in tax collection, officers authorized to collect do not have to write paper receipts. At the same time, it also supports tax officials in accounting for documents on collection and payment of non-agricultural land use tax into the tax management application system, tax payment documents of taxpayers are automatically transmitted and accounted for from banks and the State Treasury into the centralized tax management application system of the tax authority. This also strengthens digital transformation in the tax sector, promoting non-cash payments in Nghe An province.

In June 2024, Nghe An Tax Department piloted the tax collection solution in the form of authorizing collection to the People's Committees of communes/wards/towns in Vinh Tan Ward, Vinh City. By early August 2024, all 21/21 People's Committees of districts, towns and Vinh City issued official dispatches directing all People's Committees of wards, communes and towns in the area to coordinate with BIDV Bank to open accounts to collect PNN land use tax by bank transfer.

Implementation results in recent times: Nghe An Provincial Tax Department has directed Vinh City Tax Department and regional Tax Departments to coordinate with People's Committees of wards, communes and towns to carry out propaganda to all blocks and hamlets in the area so that people know the convenience of this form of tax payment.

As of November 2024, in the province, there were about 100,000 taxpayers paying taxes through this form, with a total tax paid of more than 25 billion VND.

Nghe An Tax Department said: 2024 is the first year that Nghe An Provincial Tax Department organizes the implementation of a solution to collect non-cash non-agricultural taxes through bank transfers. The amount of tax collected through this method is expected to reach about 60% of the estimate (because many taxpayers have paid non-agricultural taxes along with fees since the first months of the year, before implementing this solution). It is expected that in the coming years, with this method, the efficiency of collecting non-cash non-agricultural taxes will be even higher, moving towards 100% non-cash non-agricultural land use tax collection.

With extremely simple, safe and secure operations, taxpayers can pay non-agricultural taxes anytime, anywhere, at any location with an Internet connection; and can easily pay on behalf of other taxpayers, only needing information about the tax code or citizen identification, paying quickly, the correct amount of tax that needs to be paid without having to pay fees at all banks.

Nghe An is the largest province in the country with 20 districts, cities and towns. Tax collection management over a large area is quite difficult and complicated. Since the concept of digital transformation was new, Nghe An Tax Department has always been a pioneer in applying advanced software and programming and researching new applications. The Department has early applied software such as: Individual household tax management system (QCT), stamp management system (QLAC), debt management software, internal document management software (QLVB), personal income tax management software, real estate tax management software (QND). Business household diagram management application, other applications such as: accounting application, asset management, tax stamp management application, tax code registration application...

In recent years, Nghe An Tax Department has strongly implemented administrative reforms. In 2023, Nghe An Tax Department implemented initiatives on online tax collection, anti-transfer pricing, and developed a Regulation on coordination of tax management for mineral resource exploitation activities, which specifically stipulates the tasks of the Tax Department, departments, branches, and People's Committees at all levels to implement tax management contents... In addition, the application of Electronic Alcohol Stamp Management and Electronic Tobacco Stamp Management aims to serve the management work in printing, issuing to organizations and individuals for use, transmitting electronic stamp data from organizations and individuals using electronic stamps to the electronic stamp management system...

Nghe An Tax Department has continuously promoted the application of IT in propaganda work to support taxpayers, in order to improve the interaction between the Tax authority and taxpayers, meeting the trend of accessing electronic information of people and businesses. Propaganda through social networking platforms; online support through 479 Q&A information channels of the Tax sector; Taxpayers using PNN land look up information on payment obligations via the website tracuuPNN.vn...; build instructional clips and post them on the Tax Department's website.

The industry focuses on promoting digital transformation such as applying Big Data and Artificial Intelligence (AI) to serve tax management and invoice management, contributing to controlling and quickly detecting taxpayers committing invoice fraud. At the same time, deploying the construction of digital map data for business households and mineral mines in the province; promoting tax management for e-commerce activities and business activities on digital platforms.

Electronic tax services have always maintained the rate of taxpayers declaring and paying taxes electronically at over 99% and 100% of tax refund dossiers in electronic form; 100% of enterprises and business households paying taxes by declaration method have applied electronic invoices in purchasing, selling and providing services.

In the coming time, the Nghe An Tax Department will continue to promote digital transformation, contributing to the construction of a modern and integrated Finance sector. The Department also hopes to continue to deploy forms of disseminating knowledge to leaders, civil servants, and employees about digital transformation, digital government, digital economy and digital society in accordance with the guidance of the Government, the Ministry of Finance, the General Department of Taxation and the actual situation at the Nghe An Provincial Tax Department through conferences, meetings, posting documents on the website...

With the guidance of the Ministry of Finance, the General Department of Taxation, the close leadership and direction of the Provincial Party Committee, the Provincial People's Committee, the participation of the entire political system; especially the proactive role and sense of responsibility of the collective of cadres, civil servants and employees of the Nghe An Tax sector, the budget revenue of Nghe An province has excellently completed its tasks every year. In 2024, the budget revenue of Nghe An province reached over 25,000 billion VND, 16.7% of the same period in 2023, reaching 157.8% of the estimate assigned by the Provincial People's Council, creating momentum for the completion of the budget collection plan in the following years.