Lesson 3: Improving the efficiency of business household tax management

According to the overview of business household management in Nghe An in 2024, the total number of households managing the set is over 50,000, of which about 23,000 are contract households, more than 800 are registered households and more than 27,000 are low-income households. This department plays an important role in creating jobs, increasing income for workers, contributing to the development of the business sector and contributing to the supply chain of goods in Nghe An and the whole country in general.

.jpg)

According to the overview of business household management in Nghe An in 2024, the total number of households managing the set is over 50,000, of which about 23,000 are contract households, more than 800 are registered households and more than 27,000 are low-income households. This department plays an important role in creating jobs, increasing income for workers, contributing to the development of the business sector and contributing to the supply chain of goods in Nghe An and the whole country in general.

.jpg)

In recent years, the Nghe An Tax sector in general and the Nghe An Tax Department in particular have devoted significant resources to managing and collecting taxes on households with many measures. Especially since the promulgation of the new Tax Administration Law, the management of individual business households has been specified by Circular 40/2021/TT-BTC of the Ministry of Finance. The direction and management work has been strengthened with many forms and measures to ensure timely mobilization of revenue from individual business households for the state budget. In addition, attention has been paid to nurturing revenue sources and creating conditions for business households to become cooperatives and business owners.

In the context of digital technology, e-commerce is the main thing, in which every business requires tax work to be modified, adapted, comprehensive and monitored on digital platforms. Preventing tax loss while facilitating people to trade.

In 2024, Nghe An Provincial Tax Department issued many documents directing the tax management of business households. These included Official Dispatch No. 5858/CT-HKDTK directing the work of preparing tax records in 2024; Official Dispatch No. 821/CT-HKDTK dated February 1, 2024 of Nghe An Tax Department on rectifying the work of preparing tax records for households and individuals in 2024 after the results of checking tax stability data of the Provincial Tax Department; documents directing the management of business households according to the digital map function; on management against tax loss in the transportation sector; directing the review of management of seasonal activities...

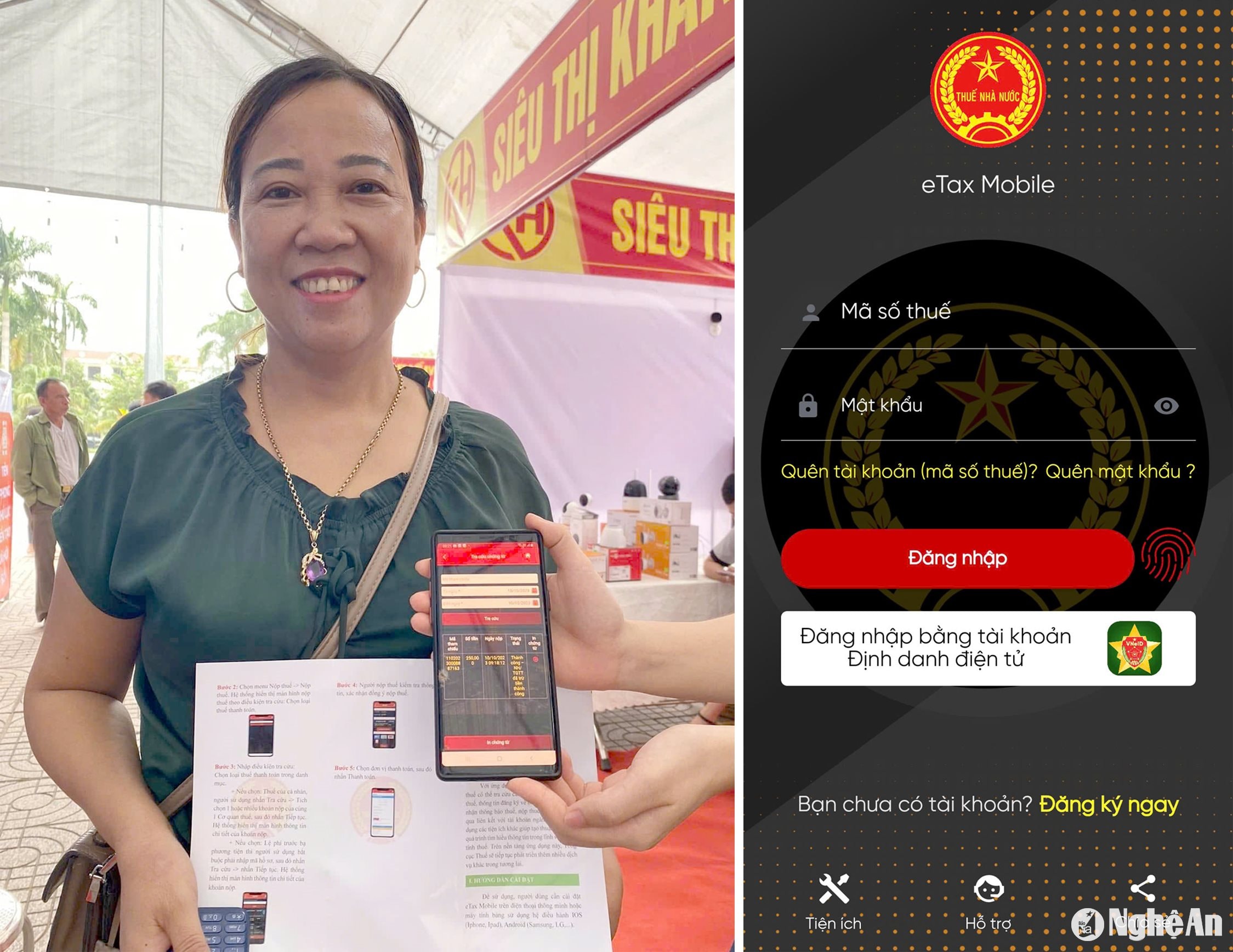

Nghe An Provincial Tax Department has deployed many tax management software. In particular, related to the management of business households, there is software to digitize the function of managing business households according to digital maps; software to manage transport business households; software to manage declaration households and software to pay taxes via mobile devices (Etax Mobile). In particular, the deployment of Etax Mobile software has been actively participated by business households due to the practicality and effectiveness of the application. To date, there have been 63,966 accounts registered for Etax Mobile in the province. The total amount of successful tax payments via Etax Mobile is more than 43 billion VND, accumulated in 2024 the amount of tax paid via Etax Mobile is more than 205 billion VND.

Song Lam II Regional Tax Department is one of the units that effectively implements solutions for tax management of business households. According to statistics, the total number of tax-managed households in the two districts of Nam Dan and Hung Nguyen is 4,928, of which 1,502 cases have established tax management units, 3,380 low-income households and 78 households pay taxes by declaration method. In 2023, the tax revenue of business households in the two districts of Hung Nguyen and Nam Dan is 11.8 billion VND, reaching 199% of the estimate; in the first 10 months of 2024, the revenue is 14.8 billion VND, reaching 192% of the estimate.

Mr. Ngo Tien Hung - Deputy Head of Song Lam II Tax Department said: In the digital age, tax authorities are currently applying applications, software, and solutions to collect taxes for business households more effectively, such as: TMS centralized tax management application, invoice management application, electronic invoice warning application, electronic tax declaration software, and Etax Mobile electronic tax payment application.

.jpg)

Every year, the Department has many initiatives and solutions that are effectively applied in the management of business household taxes and are recognized by the Nghe An Tax Department's Initiative Council. In 2024, the initiative "Preventing tax losses in accommodation service business activities" was effectively implemented and recognized by the Nghe An Tax Department in Decision No. 4934/QD-CT. The results in more than 4 months of implementing the initiative have prevented nearly 300 million VND in revenue loss and the initiative will continue to be strongly implemented in the coming time.

Currently, individual business households have been developing in a diverse way, contributing to creating jobs for workers, reducing poverty and increasing revenue for the state budget. However, the business situation of this sector is quite complicated. In the age of technology, business activities have become more diverse in methods, payment exchanges in many forms make it difficult for tax authorities to determine information, easily missing revenue causing budget loss.

Regarding the work of preventing revenue loss related to individual business households, in 2024, Nghe An Tax Department has carried out many topics and brought positive results. Specifically, regarding the program of reviewing individual business households with seasonal business activities, the Tax Department has directed the review and management of seasonal business subjects according to Official Dispatch No. 3535. As a result, the Tax Branches have put 622 more households under management. The tax amount increased by over 1 billion VND/month.

Regarding the program to prevent loss of revenue for households trading in imported agricultural products according to Official Dispatch No. 3970/CT-TTKT1, the Tax Departments have reviewed, processed, and collected taxes from households trading in imported agricultural products in the area. The amount of tax collected and paid to the state budget by 20 households trading in imported agricultural products increased by over 22 billion VND.

To improve the effectiveness of tax management for business households in the coming time, Nghe An Tax Department has directed Tax Branches to focus on building complete records of procedures for managing individual households according to regulations, reviewing and compiling statistics to put 100% of business households in the area under management, ensuring increased revenue according to regulations of the Ministry of Finance. Actively coordinate well with People's Committees of communes and towns to manage business households' taxes closely and accurately according to the tax revenue of business households. Regularly check and supervise the issuance of electronic invoices of households declaring on the electronic invoice management application; Strengthen management of accommodation service business activities, business households on e-commerce platforms and on digital platforms...

.jpg)

The "Lucky Invoice" program was implemented by Nghe An Tax Department to encourage buyers to get invoices when purchasing goods and services to manage business revenue, avoid tax loss, and at the same time, encourage sellers of goods and services to use electronic invoices with tax authority codes. This is one of the solutions to help strengthen tax management for business households, avoid loss of state budget revenue, contribute to improving the modernization and digitalization of tax management of the Tax sector... Up to now, Nghe An Provincial Tax Department has organized 6 lucky invoice draws and awarded prizes to lucky winning customers.

Mr. Nguyen Duc Canh, one of the winners of the lucky bill program in Nghe An in 2024, said: I am very happy because I did not expect that getting a bill when buying goods would bring me many benefits. Besides winning big prizes, getting and keeping electricity bills also helps buyers like us to be protected by law in commercial transactions.

With an attractive prize structure, the program has created positive changes for both buyers and sellers. Accordingly, for buyers, the program's prizes will be a motivation to encourage buyers to get invoices when purchasing goods and services; helping buyers change and create civilized consumption habits - that is, buying goods must have invoices, legal documents and contribute to protecting the maximum interests of consumers. For sellers, the program will attract individual customers to buy goods, helping sellers increase sales revenue.

The “Lucky Invoice” program is an initiative to change people’s habit of not taking invoices when making purchases, thereby creating transparency, maximizing consumer rights protection and improving the efficiency of tax management, contributing to increasing State budget revenue, especially in the field of business household tax.

With the trend of integration and closer monitoring online, Nghe An Tax Department has also been flexible and coordinated with sectors and levels to collect better taxes on gold and silver, food and beverage businesses, restaurants, hotels, housing construction, taxis, and transportation. These are mostly business households that declare taxes.