Nghe An and Thanh Hoa achieved 100% of the target on electronic gasoline invoices.

Electronic invoices for each sale of petroleum are required. In Nghe An and Thanh Hoa, this target has reached 100%.

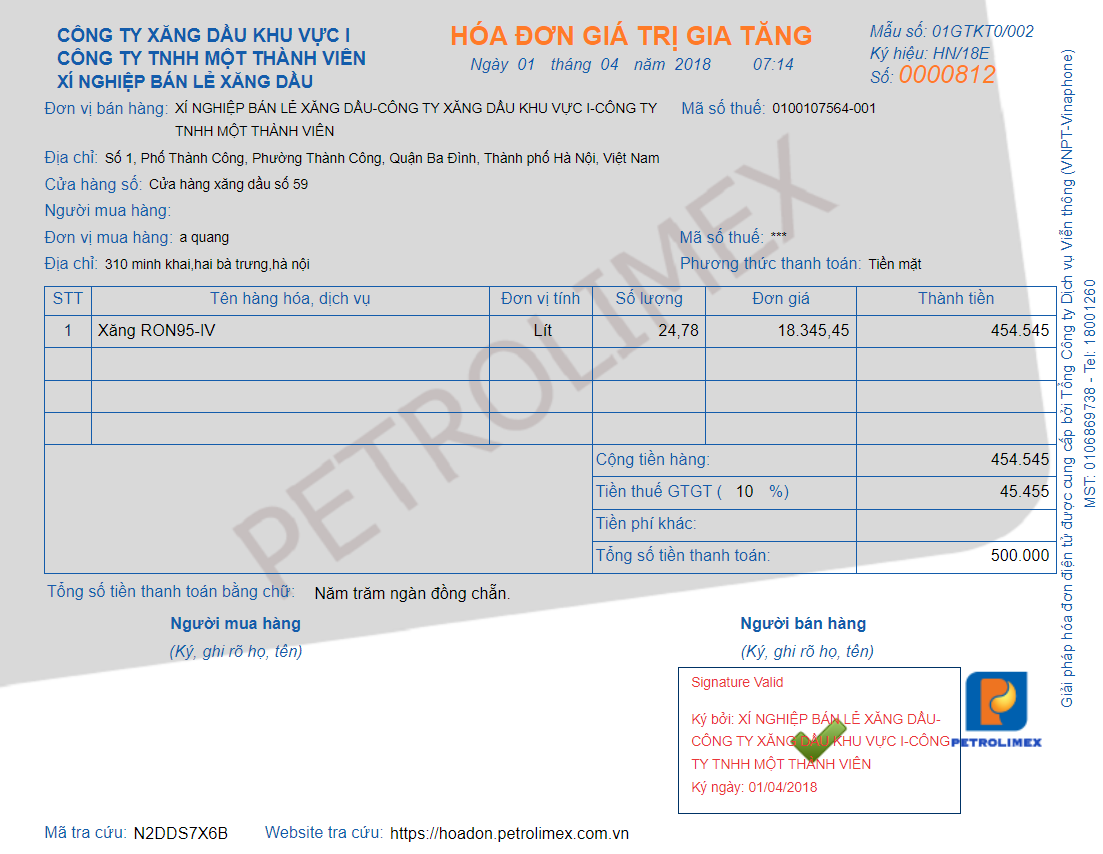

Automatic connection is a solution to automatically record data and information for each sale, transmit from the petrol meter to a computer connected to the Internet to issue electronic invoices (E-invoices) for each sale and transfer electronic invoice data to the tax authority regardless of whether the customer takes the invoice or not.

According to the report data, by the end of March 15, 2025, 100% of petrol stations operating in both Nghe An and Thanh Hoa provinces managed by Tax Department X have completed the target of applying automatic connection solutions to issue electronic invoices under the direction of the Government, Ministry of Finance, and Tax Department.

For example, it is known that Nghe An Petroleum Company (Petrolimex Nghe An) has 670 gas stations in Nghe An province. In 1 year, the company sells 831,000m3domestic gasoline, of which 315,000m3in Nghe An province, 447,000m3Thanh Hoa, Quang Binh, Ha Tinh provinces and 9,000m3to Laos. In 2024, Nghe An Petroleum Company paid 660 billion VND in taxes, and in the first 2 months of 2025, it paid about 125 billion VND in taxes.

Up to now, for Petrolimex, taking invoices from customers when buying gasoline is only a basis when sales data has been connected to the tax authority. However, for other gasoline stores, not taking invoices from customers still affects the budget collection results.

According to Point i, Clause 4, Article 9 of Decree No. 123/2020 of the Government, the time to issue electronic invoices for gasoline at retail stores for customers is the time to end the sale of gasoline for each sale.

Along with that, sellers must ensure that they fully store electronic invoices for the sale of gasoline to customers who are non-business individuals and business individuals, and ensure that they can be looked up when requested by competent authorities. According to regulations of the Ministry of Finance, after March 31, 2024, if gasoline stores do not implement this, the authorities will have sanctions to handle it.