Apple beats fourth-quarter revenue forecast, faces $1.1 billion tariff cost

Apple just announced a current-quarter revenue forecast that far exceeded Wall Street expectations, sending its stock up 3% after-hours trading, despite warnings about $1.1 billion in tariff costs.

Third-quarter revenue far exceeds expectations

Apple just announced revenue guidance for the current quarter (ending in September) that was significantly higher than Wall Street estimates, the news helped boost the company's stock, even though CEO Tim Cook warned that US tariffs would add $1.1 billion to its costs during the period.

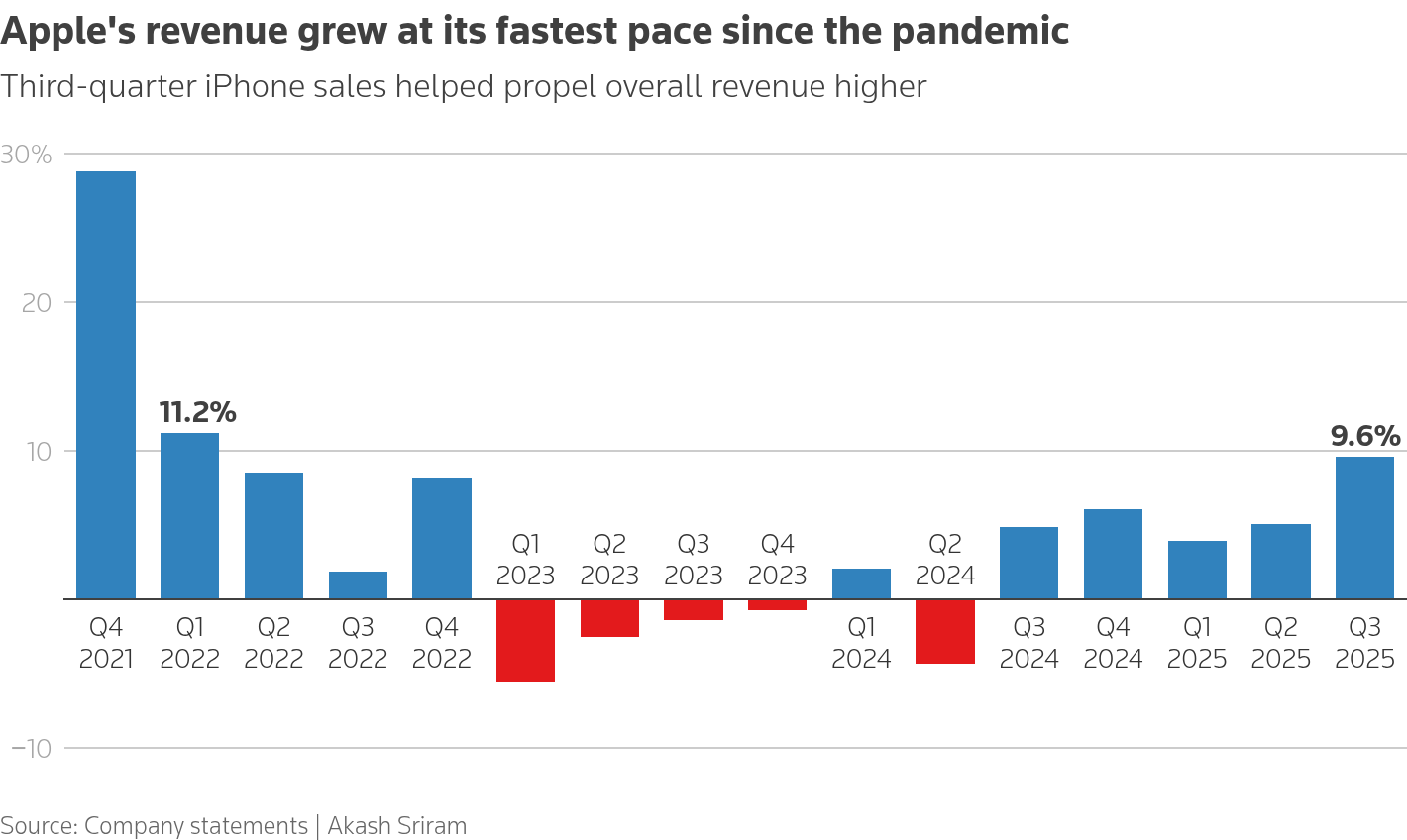

Apple reported revenue of $94.04 billion for the third quarter (ended June 28, 2025), up nearly 10% year-over-year, beating analysts' estimates of $89.54 billion. Earnings per share were $1.57, beating estimates of $1.43.

Sales of the flagship iPhone rose 13.5% to $44.58 billion, beating the $40.22 billion forecast. Part of the growth came from customers buying iPhones early to avoid new tariffs.

Chief Financial Officer Kevan Parekh said Apple expects fourth-quarter revenue growth in the “mid- to high single digits,” beating analysts’ forecasts of 3.27%, or $98.04 billion.

Despite facing a $1.1 billion tariff bill due to President Donald Trump’s trade policies, Apple remains optimistic about growth. Last quarter, tariffs cost the company $800 million.

In the U.S. and the Americas, revenue rose 9.3% to $41.2 billion, despite the impact of tariffs. In China, sales reached $15.37 billion, up from a year earlier and beating expectations of $15.12 billion, thanks to a smartphone subsidy program there. CEO Tim Cook said the program boosted sales throughout the third quarter. The number of iPhone users reached a record in every region.

Services revenue, which includes the App Store, music and cloud storage, hit $27.42 billion, beating expectations of $26.8 billion. Mac sales hit $8.05 billion, beating the $7.26 billion forecast.

However, iPad only reached 6.58 billion USD, lower than the expectation of 7.24 billion USD, and wearable devices such as AirPods, Apple Watch reached 7.4 billion USD, below the forecast of 7.82 billion USD. Gross profit margin in Q3 reached 46.5%, exceeding the expectation of 45.9%, and is expected to maintain 46-47% in Q4.

The Challenge of Tariffs and AI

Apple is shifting iPhone production to India and products like the Mac and Apple Watch to Vietnam to reduce the impact of US tariffs. However, the final tariff rate is still unclear, and some products are currently exempt. Trump has said India could face a 25% tariff from August 1, but analysts say India still has a long-term cost advantage.

Apple also faces competition from Samsung in the high-end smartphone market and Alphabet in integrating AI into the Android operating system.

Apple is delaying the launch of an AI-enhanced version of Siri in China due to a lengthy approval process. However, Tim Cook said the company is making progress with personalized Siri and is investing heavily in AI. Apple's philosophy is to bring advanced technology to everyone in an easy-to-use way. Although it doesn't spend as much as Microsoft or Nvidia, Apple is confident in its AI strategy.

Apple faces European rulings that could impact its App Store business model, a key source of revenue. But its services business is still growing strongly, helping to offset the challenges from tariffs and competition.

With positive forecasts and impressive Q3 revenue, Apple continues to assert its position, but needs to overcome many obstacles to maintain growth momentum.

Remarkable information leaked about Apple's first foldable iPhone