Coffee price today November 19, 2025: Sharp increase due to prolonged rain

Coffee prices today November 19, 2025: Central Highlands coffee prices increased sharply from 3,200 to 4,100 VND/kg due to prolonged rains. Coffee harvesting was forced to stop.

Update domestic coffee prices

Coffee prices today, November 19, 2025, in the Central Highlands region are trading in the range of 112,600 - 113,800 VND/kg, a sharp increase of 3,200 to 4,100 VND/kg compared to yesterday.

| Market | Medium | Change from yesterday |

| Dak Lak | 113,700 | +3200 |

| Lam Dong | 112,600 | +4100 |

| Gia Lai | 113,000 | +3200 |

| Dak Nong | 113,800 | +3300 |

Specifically, in Lam Dong province, Di Linh, Bao Loc and Lam Ha areas increased sharply by 4,100 VND/kg compared to yesterday, trading at the same level of 112,600 VND/kg.

In Dak Lak province, Cu M'gar area is purchasing coffee at 113,700 VND/kg today, an increase of 3,200 VND/kg compared to yesterday. Meanwhile, Ea H'leo and Buon Ho areas are trading at 113,600 VND/kg.

In Dak Nong (Lam Dong province), traders in Gia Nghia and Dak R'lap increased prices by VND3,300/kg compared to yesterday, trading at VND113,800 and VND113,700/kg, respectively.

In Gia Lai province, Chu Prong area is trading at 113,000 VND/kg, while Pleiku and La Grai are at 112,900 VND/kg, an increase of 3,200 VND/kg compared to yesterday.

In Lam Dong, the coffee harvest season should be bustling, but the rain that lasted from morning to afternoon made the atmosphere quiet. The wet weather prevented many households from harvesting on time, causing the whole region to fall into a state of slow progress.

In the fields, the coffee has ripened, but heavy rains have caused many fruits to fall from the ground. Some gardens are in the peak ripening season, but workers cannot harvest them, with up to 20% of the coffee falling. Coffee growers can only watch as their year’s work is severely affected when the harvest is delayed.

Coffee is the main source of income for many families in the Central Highlands, so the damage is even more worrying. The fruit falls with the rain, especially in steep areas, and is almost impossible to collect. For the people, this is a great loss during the time considered as the "Tet" of the coffee growing profession.

However, many households still tried to harvest in the rain, patiently picking up every remaining fruit. For the farmers, each coffee fruit is the result of a year's work, so no matter how difficult it is, they still try to limit the damage.

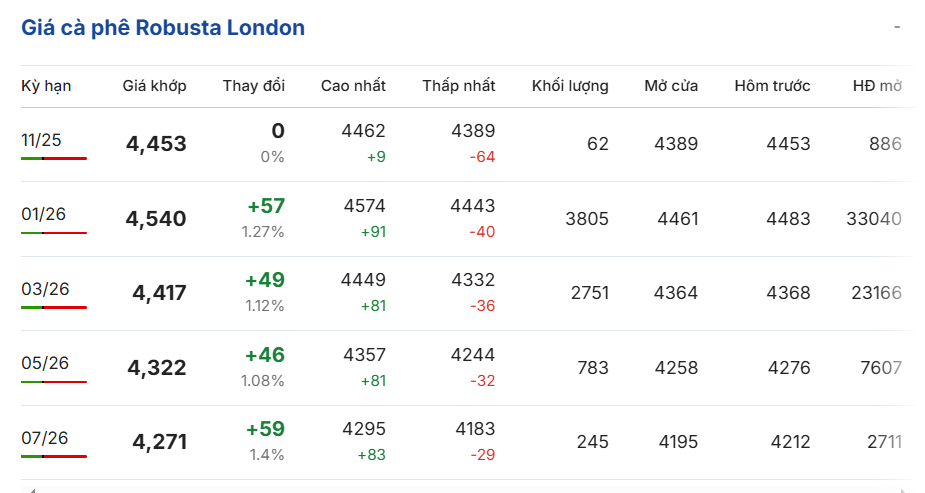

Update world coffee prices

On the London Stock Exchange, the online price of Robusta coffee futures for January 2026 delivery closed on November 15 at $4,540 per ton, up 1.27% ($57 per ton) from yesterday. The March 2026 futures contract increased 1.12% ($49 per ton) to $4,540 per ton.

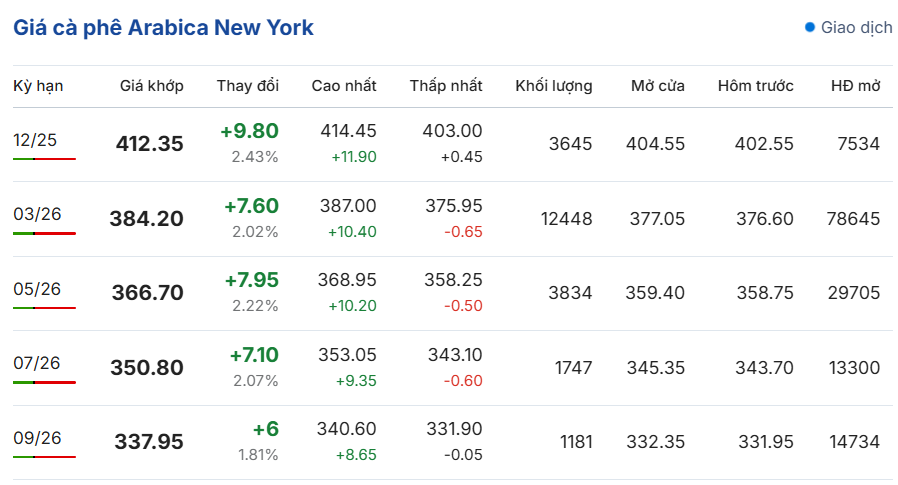

Similarly, the price of Arabica coffee for delivery in December 2025 on the New York Stock Exchange increased by 2.43% (9.8 US cents/pound) yesterday to 412.35 US cents/pound. The contract for delivery in March 2026 increased by 2.02% (7.6 US cents/pound) to 384.2 US cents/pound.

According to Reuters, the decision by the Trump administration to eliminate tariffs on most imported coffee beans benefits roasters and importers in the US. However, Brazil is at a disadvantage as its coffee still faces higher tariffs than many other markets.

The new policy exempted coffee beans from most producing countries from tax, but for Brazil, the US only removed the 10% reciprocal tax, while the 40% tax remained. This made Brazilian coffee less competitive in the world's largest consumer market.

Experts say the tariff changes will cause the US to increase coffee purchases from Asia and Latin America, while reducing imports from Brazil. Judith Ganes, president of J. Ganes Consulting, said price will be the factor that guides trade flows in the future.

She also said robusta is benefiting from tariff exemptions for most Asian producers, allowing U.S. roasters to increase the proportion of robusta in blends to lower the higher costs of arabica.