Global volatility causes Nissan to incur losses, Toyota proposes a new solution.

Amidst the volatile global automotive industry, companies like Nissan and Toyota will have to propose unprecedented business strategies.

Nissan suffers huge losses, shareholders criticize new CEO.

At the recent annual shareholders' meeting, Ivan Espinosa, Nissan's new CEO, faced a barrage of sharp questions from shareholders dissatisfied with the company's poor financial results.

Specifically, Nissan reported a loss of 671 trillion yen (equivalent to $4.6 billion) in fiscal year 2024-2025 and forecasts a further loss of 200 trillion yen in the first quarter of 2025-2026.

Shareholders also reacted strongly when they learned that the former management, including former CEO Makoto Uchida, received severance pay totaling 646 million yen ($4.3 million), despite dismal business results.

Some shareholders also opposed Espinosa's proposed "Re:Nissan" restructuring plan, which included cutting 20,000 jobs and closing seven factories. However, the new CEO calmly pledged to bring the company back to profitability by fiscal year 2026-2027 and asserted that Nissan still had 2.1 trillion yen (nearly $14.5 billion) of unused credit.

Toyota wants Japanese dealerships to sell American cars.

Faced with the impact of high import taxes, Toyota unexpectedly proposed supporting American automakers like Ford in distributing their products in Japan through Toyota's own dealer network.

This solution was proposed by Hiroki Nakajima, Toyota's Chief Technology Officer, during a meeting with the company's President, Akio Toyoda, and Japanese Prime Minister Shigeru Ishiba in May 2025.

Toyota hopes this move will help reduce the trade deficit between the US and Japan, and may also persuade the Trump administration to lift or ease the tariffs that are driving up car prices. Another proposed solution is for Japanese manufacturers to produce cars in the US and then export them back to Japan.

Similarly, Ola Källenius, CEO of Mercedes, also floated the idea of allowing the US and the European Union (EU) to import cars with "mutual tax exemptions" to balance trade.

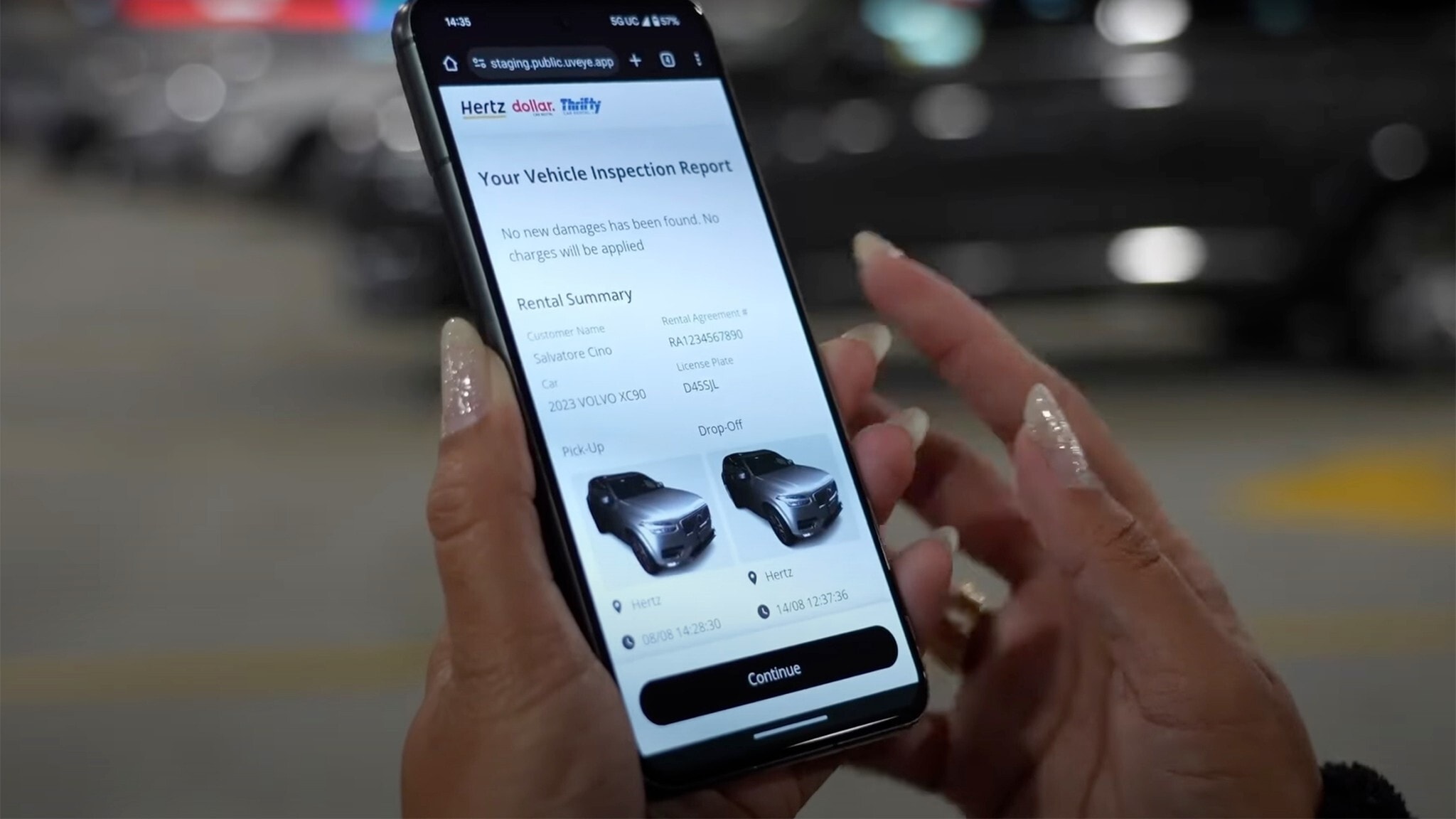

Hertz uses AI to scan vehicles, raising customer concerns about transparency.

Hertz, a car rental company, is currently implementing AI-powered vehicle inspection technology in collaboration with the Israeli company UVeye. The system scans vehicles upon pickup and return, detecting issues such as paint scratches and tire wear without the need for manual inspection by staff.

However, not all customers are satisfied. In one case at Atlanta Airport (USA), a customer was charged up to $440 for a small scratch on a wheel. This fee included administrative costs and damage repair expenses.

This customer also encountered difficulties contacting Hertz's support center because the chatbot did not allow direct conversations with staff. This raises concerns about transparency, the right to respond, and fairness when applying AI technology to property appraisal processes.