5 rules to limit risks with online banking

The development of technology brings convenience in online transactions but also poses many security risks.

|

Online payment is convenient but requires users to have a high awareness of security. |

Beware of scam messages

This is an old-fashioned method that is still used by scammers. Users may receive a message from someone pretending to be a bank representative with a warning message about security vulnerabilities and request to call a toll-free support number. They will then ask for an account and PIN number to confirm.

Robert Vamosi, risk and fraud analyst at the companyJavelin Strategy & Research in California, USA, said this practice still occurs in less developed places where users do not have the conditions to update information fully. He also warned never to call the numbers in the text messages and always consider it as unreliable information.

A bank's customer service number is always prominently displayed on their official website and appears in their statements. Additionally, for verification purposes, the bank may ask for card number, name, date of birth but not confidential information such as PIN.

|

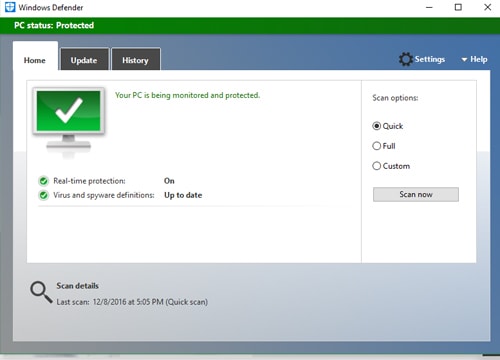

Always make sure your computer is not infected with spyware. |

Protect your computer from spyware

Malicious software can infiltrate and steal confidential information without the user's consent. As online payments have become more popular, so has the proliferation of such software. Computers can be infected with this type of software in a variety of ways, such as clicking on a link on the Internet and downloading it or following an email as an attachment.

With computers infected with this type of software, all user actions are recorded and sent to hackers. This includes a series of names and passwords to log into important accounts.

To avoid falling into these situations, users should not access unknown websites, do not listen to invitations to click on strange links. Computers need to be regularly scanned for viruses with the latest updates.

Do not use public computers or Wi-Fi networks

Never log in and use online transactions on public computers. In addition to the risk of spyware being installed on these computers, hackers can exploit information from another computer on the same network.

In addition, using public Wi-Fi networks also has many potential risks, especially networks without passwords. According to himRobert Vamosi, Wi-Fi connections require more secure passwords and if staying in a hotel, it is advisable to choose a wired connection.

Set password with multiple character types

Many users are reluctant to remember passwords, so they choose simple, easy-to-guess character strings. Security experts say that passwords should be composed of different combinations of letters, numbers, characters, uppercase and lowercase letters. It is best to set them without specific rules and with little personal relevance. Many banks now also require security codes that are much more complex than in the past.

|

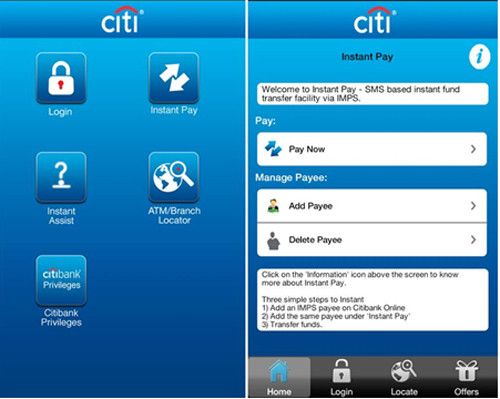

Citibank has advised users to upgrade their software immediately to avoid security vulnerabilities being exploited by hackers. |

Be careful when downloading and using banking applications.

Most banks have their own applications to help customers make transactions more easily on smartphones and tablets. However, there have been cases of fraudsters creating "fake" applications to deceive and steal customer information.

In addition, even if you have downloaded the correct "official" application, users still need to regularly download upgrades. Citibank once warned that their smartphone application had security holes, so they recommended users download updates immediately to avoid being exploited by hackers.

According to VNE

| RELATED NEWS |

|---|