In 9 months, more than 57 thousand poor households and policy beneficiaries in Nghe An received preferential loans.

(Baonghean.vn) - In the first 9 months of 2020, 57,674 poor households and other policy beneficiaries received preferential loans. Policy credit continues to make important contributions to the implementation of poverty reduction, social security, and new rural construction goals in localities in the province.

On the afternoon of October 19, the Board of Directors of Nghe An Social Policy Bank held the 65th regular meeting to evaluate the implementation of tasks in the first 9 months of the year and deploy tasks for the remaining months of 2020. Comrade Nguyen Thi Thu Thu - Director of the State Bank of Vietnam, Nghe An branch chaired. Attending were members of the Board of Directors of the Provincial Social Policy Bank.

12/19 programs have outstanding loan growth

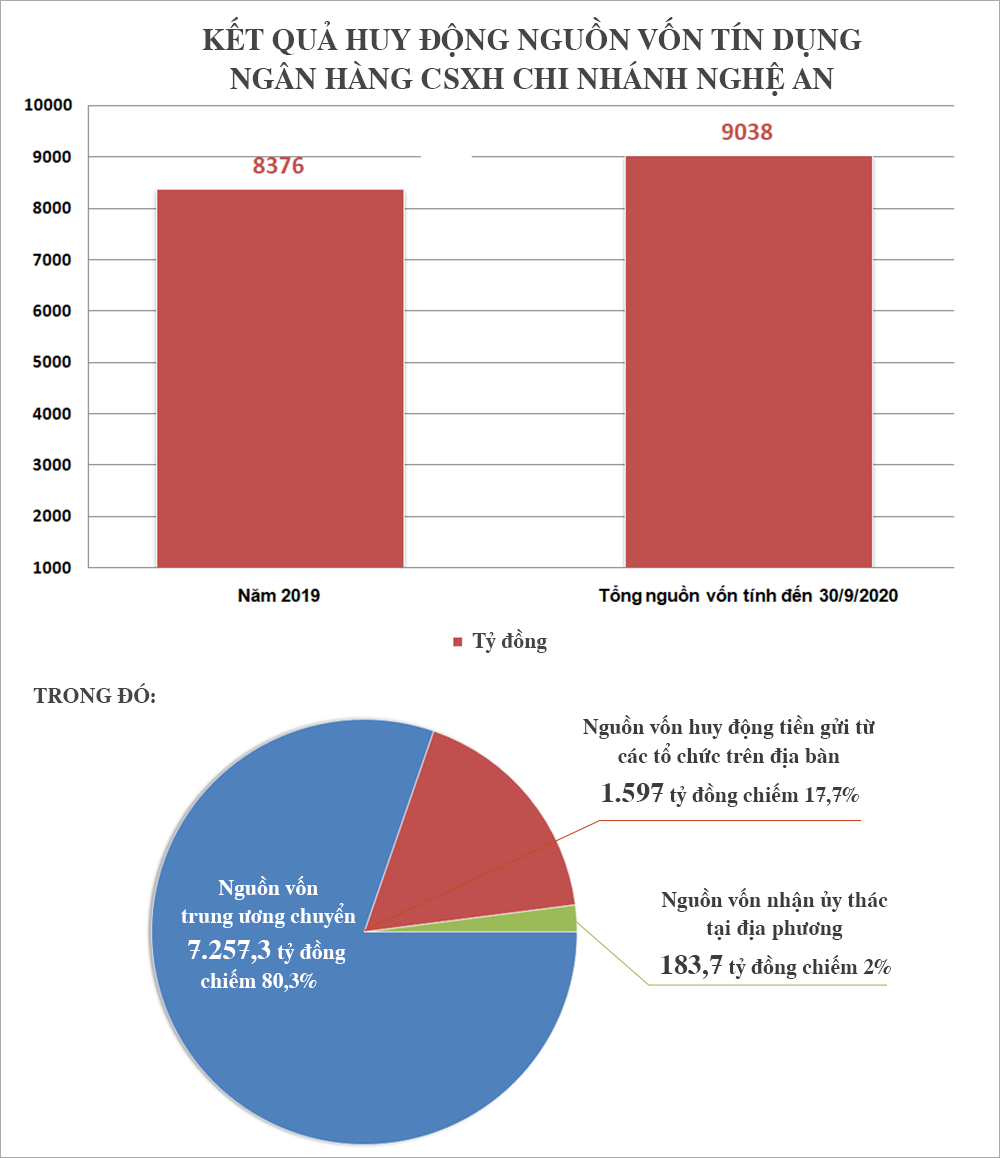

As of September 30, 2020, total capital reached VND 9,038 billion, an increase of VND 662 billion compared to 2019, achieving a growth rate of 7.9%. Loan turnover in 9 months reached VND 2,356.7 billion, an increase of 6.7% over the same period last year.

Programs with large disbursement turnover still focus on programs assigned to grow and have great demand such as: Loans for near-poor households with turnover reaching 730 billion VND; loans for newly escaped poverty households reaching 517 billion VND; loans for production and business households in difficult areas reaching 300 billion VND; loans for clean water and rural environmental sanitation reaching 290 billion VND; loans for job creation and job support reaching 99 billion VND; loans to support poor households with housing reaching 44.2 billion VND; loans for social housing reaching 38 billion VND.

There are 04 programs with lower sales compared to the same period last year (including: loans for poor households, loans for students, loans for ethnic minorities and loans to support capital for Vinh City Cooperatives). There are 4 programs whose loan term has expired, so there is no loan revenue, only debt collection when due.

|

| Director of the People's Credit Fund Nghe An branch reports on the results of policy credit activities in the first 9 months of the year. Photo: Thu Huyen |

Debt collection turnover reached 1,754 billion VND, accounting for 74.4% of loan turnover, contributing significantly to creating a stable and proactive revolving loan source at the local level, meeting the borrowing needs of poor households and policy beneficiaries in the context of difficulties in capital allocation from the central government.

As of September 30, 2020, the total outstanding debt reached nearly VND 8,961 billion. Of the 19 ongoing programs, 12/19 programs haveoutstanding loan growthCompared to the beginning of the year, some programs have increased significantly such as: Loans for near-poor households, households that have just escaped poverty; clean water and rural environmental sanitation; loans for production and business households in difficult areas, loans for job creation...Credit qualitycontinued to increase, overdue debt and bad debt continued to decrease compared to the previous quarter and decreased sharply compared to the beginning of the year.

|

| Graphics: Lam Tung |

In the first 9 months of 2020, 57,674 poor households and other policy beneficiaries received preferential loans. Policy credit continues to make important contributions to the implementation of poverty reduction, social security, and new rural construction goals in localities in the province.

Strengthening the Representative Board apparatus, improving the quality of credit activities

After listening to the opinions of the members of the Board of Directors of the Bank for Social Policies, concluding the meeting,Director of State Bank of Vietnam, Nghe An branchNguyen Thi Thu Thu highly appreciated the results achieved by the policy bank.In the first months of the year, despite being negatively affected by the epidemic, in the third quarter, the Branch took advantage of capital from the central government, accelerated disbursement of programs to meet capital needs for poor households and policy beneficiaries to restore production, creating conditions for people to soon stabilize their lives.

|

| Comrade Nguyen Thi Thu Thu - Director of the State Bank of Vietnam, Nghe An branch, delivered a concluding speech at the meeting. Photo: Thu Huyen |

To successfully complete the tasks of 2020, it is recommended that members of the Representative Board strictly maintain regular activities and promptly supplement and improve the apparatus of the Representative Board, especially after the Party Congresses at all levels. Members of the District Representative Board proactively arrange and allocate time to organize inspections according to the plan to ensure time and quality.

The Department of Labor, War Invalids and Social Affairs coordinates with the Provincial Bank for Social Policies to research and develop a loan project for workers from newly escaped-poverty households to work abroad using local budget capital to submit to the Provincial People's Committee for consideration and approval for implementation, in order to accelerate sustainable poverty reduction...

|

| Officers of the People's Credit Fund of Quy Hop district inspected the loan model for economic development of Mr. Chu Quoc Tru's family in My Dinh hamlet, Chau Dinh, Quy Hop. Photo: Thu Huyen |

For the Social Policy Bank, continue to closely follow and make the most of capital sources from the central to local levels to continue to boost credit growth of programs. Improve the quality of credit activities; strengthen thematic inspections and remote monitoring to promptly detect, prevent and correct existing problems and errors in the implementation process...

The Director of the State Bank of Vietnam, Nghe An branch, also requested that the entrusted socio-political organizations strengthen propaganda work, guide borrowers to use capital effectively, integrate with project programs, do a good job of consulting, guiding the construction and replication of typical production and business models, helping each other to escape poverty sustainably.