For customer safety, banks tighten electronic transactions

Faced with the recent surge of sophisticated e-banking scams, banks have introduced many measures to enhance the safety of e-banking transactions.

|

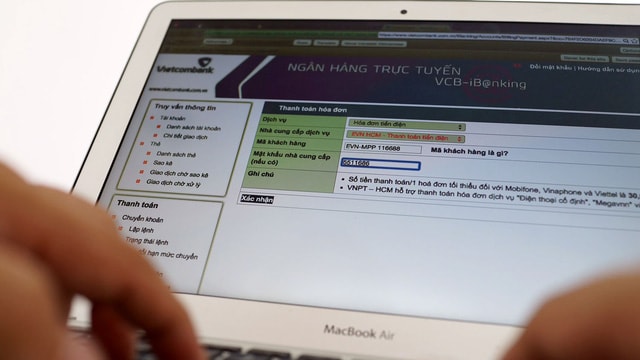

| When using Vietcombank online banking, customers are required to change their password to increase security. |

Changes to enhance online banking security have caused some customers to feel annoyed, but banks say this is necessary to reduce risks.

On November 2, when logging into his online banking account (Internet Banking), Mr. Nguyen Tien Giang (Tra Vinh), a Vietcombank customer, received a notification that he had to change his password to be able to log in. "If I don't change my password, the bank won't let me use the service. Meanwhile, I can't remember my old password, so it's a bit annoying," said Mr. Giang.

To do business selling hand-carried goods online to Vietnam, Ms. Huong (living in Australia) had to open an account in Vietnam under her father's name for convenience in money transfer activities. Only when customers transfer money into the account, Ms. Huong will go to buy goods, so she has to monitor her Internet Banking account regularly. However, for the past two days, she has not been able to log in to her account because the bank required her to change her password.

"After changing the password, the bank sent an OTP code to my father's phone in Vietnam. Because the validity period of the OTP code is very short, when my father read and informed me of this code, it expired. Therefore, I could not log in to the system to check my account, causing the business to stagnate" - Ms. Huong said.

Vietcombank said that from November 1, the bank will apply a series of new regulations, changing the structure of access passwords to increase the security of online banking services. Accordingly, access passwords must be 7-20 characters long, including numbers, uppercase letters, lowercase letters or numbers, letters and special characters. The cases that are required to change passwords are due to not meeting the above regulations.

After accessing the online banking service, if no transaction is made within 5 minutes, the bank will automatically terminate the transaction session. The validity period of the one-time transaction authentication code (OTP) is shortened to 5 minutes for receiving OTP via SMS and 2 minutes for receiving OTP via EMV - OTP card and eToken device.

If there is any change or reset of the device when using online banking services via phone or iPad..., customers must go to the counter to re-register to get a new username and password, instead of being able to register online as before.

In addition, this bank also posted on its website a video clip instructing customers on how to keep their security "keys" when transacting over the Internet, as well as simulated images of common tricks used by criminals today to keep customers alert.

According to TTO

| RELATED NEWS |

|---|