BAC A BANK launches new version of e-Banking application

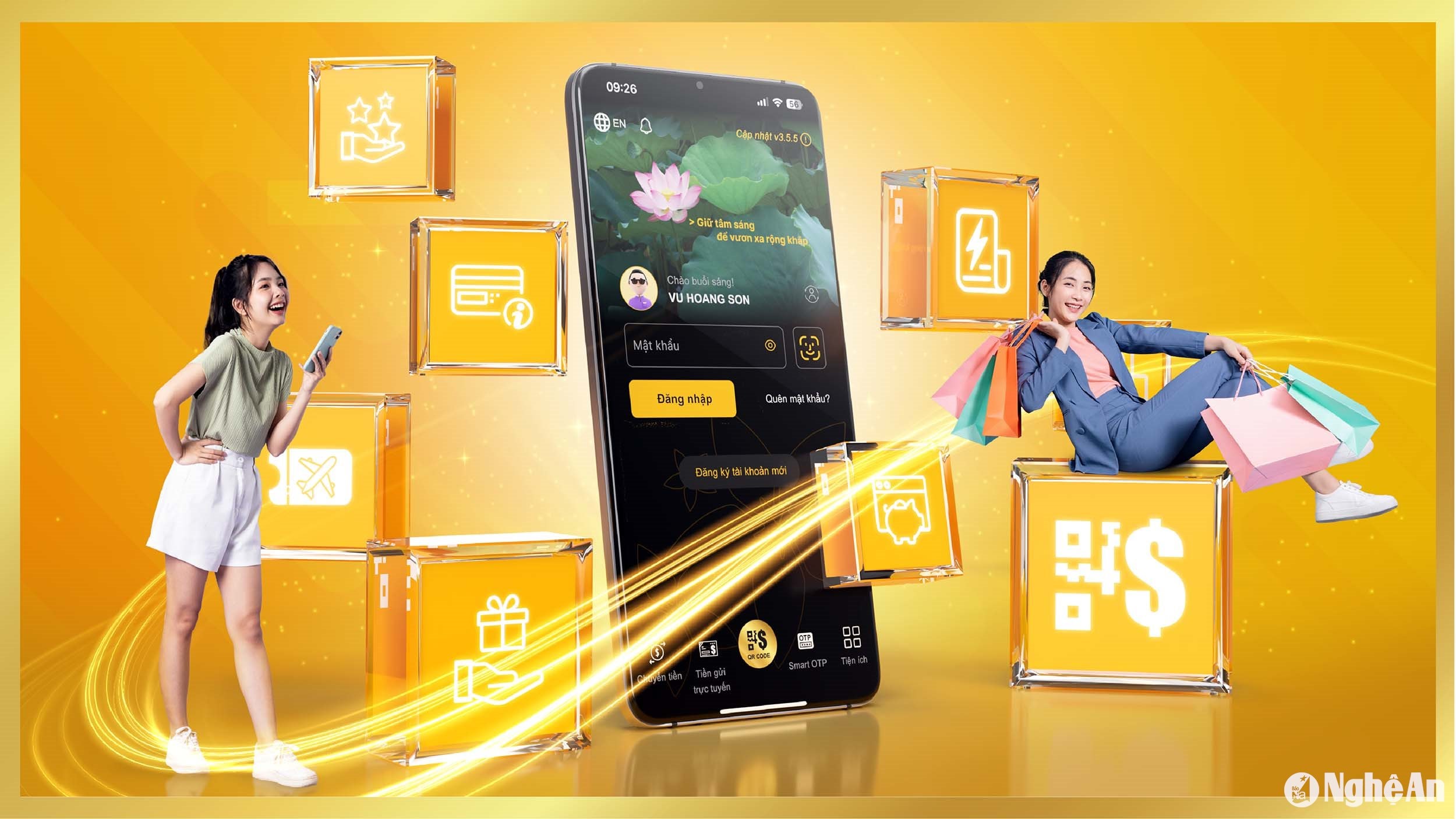

From December 16, 2024, with the aim of optimizing and enhancing customer experience, BAC A BANK officially launched the new version of Mobile Banking application with many improvements in interface and features, meeting the maximum needs of users.

Upgraded interface - Optimized experience

Not only is the modern interface a breakthrough, the layout of features is scientifically arranged and adjusted to suit the needs of users; but the new version is also absolutely safe with the most advanced authentication technology, helping customers feel completely secure when transacting, especially for financial transactions - a type of transaction where information security is always the top priority.

The special feature of this version of BAC A BANK Mobile Banking is the improvement in speed and stability in operation, ensuring that transactions always take place smoothly, seamlessly, and without interruption. The utility ecosystem is expanded, bringing customers a diverse and convenient experience on mobile devices.

In the journey of accompanying customers, BAC A BANK constantly researches, upgrades and improves products and services. The launch of new utilities and features on BAC A BANK Mobile Banking contributes to diversifying the product and service portfolio of BAC A BANK, while providing customers with a transaction channel in a digital environment that is extremely convenient, fast and safe.

A series of new utilities on BAC A BANK Mobile Banking

In addition to the existing payment and shopping features, the new version of BAC A BANK Mobile Banking has added and launched additional features: Buying airline tickets, booking hotel rooms, shopping at VNShop, paying Daiichi Life insurance premiums; to meet the diverse needs of users of all ages and regions.

“Another convenience for customers who frequently make money transfers is that the new version of the application allows users to proactively split money transfers 24/7 without exceeding the maximum limit/time and flexibly change the transfer limit,” said a representative of BAC A BANK.

In addition, account holders can also accumulate reward points when making transactions to convert into valuable, practical gifts such as annual fees for BAC A BANK international credit cards, shopping vouchers at TH truemart systems nationwide...

For customers who open online deposit accounts to enjoy attractive interest rate incentives, there will now be an additional option to settle at the transaction counter. In addition, customers can register for SMS Banking (balance change notification service via text message), query loan information with just a few simple steps right on the BAC A BANK Mobile Banking application.

To fully experience the new interface and features of BAC A BANK, existing customers only need to update the latest version of the application on Google Play or Apple Store. Meanwhile, new customers only need to spend a few minutes downloading the application, opening an account and registering for e-banking services - all operations are online thanks to electronic identification technology (eKYC).

For more information, please visit the website:www.baca-bank.vn, or contact Customer Care Center 1800 588 828 or BAC A BANK's nationwide Branch/Transaction Office system.